Dutch Bros (BROS 4.09%) stock is finally getting some market love. It's more than doubled in value over the past year, and it trades at a P/E ratio of 193. That's expensive by almost any standard, but it's not the only valuation ratio worth a look. The valuation could also be justified given the company's growth prospects.

Here's a deeper look.

Image source: Dutch Bros.

High growth, high profits for Dutch Bros

With performance as good as Dutch Bros' has been posting since it went public in 2021, it's surprising that it's taken the market this long to take notice. It reliably reports high sales growth, and profits continue to rise. In the 2025 second quarter, revenue increased 28% year over year, while net income rose from $22.2 million last year to $38.4 million this year.

NYSE: BROS

Key Data Points

However, there were reasons the market was concerned until recently. It didn't report its first annual profit until 2023. In addition, investors were worried about its chances when same-store sales growth was low, even in negative territory for a short time, and most of the increase was coming from price hikes.

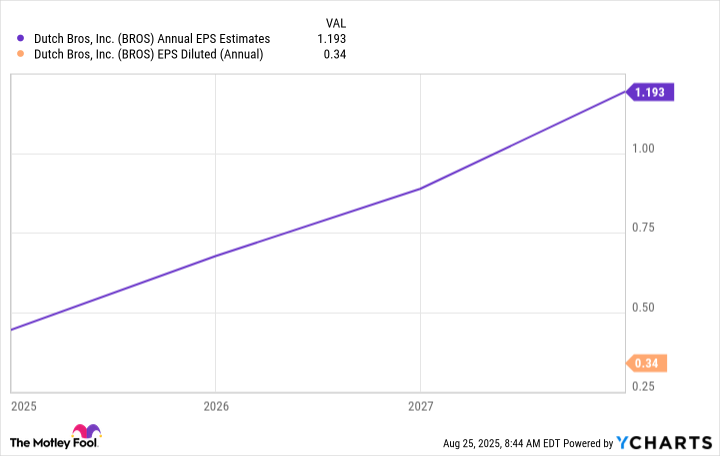

Dutch Bros has moved way past that now. Earnings per share (EPS) increased from $0.03 to $0.34 in 2024, and from $0.12 to $0.20 in the 2025 second quarter year over year. Same-store sales were up 6.1% in the quarter, with a 3.7% rise in transactions.

More importantly, analysts expect EPS to increase about 350% over the next three years.

Data by YCharts.

There's a lot of expectation here. Dutch Bros has a huge growth runway in opening new stores, and net income is following. While there's some growth built into Dutch Bros' current price, the opportunity is enormous, which is why it commands a premium valuation. As for other valuation methods, the forward one-year P/E ratio is a more reasonable 74, and the price-to-sales ratio is a very reasonable 5.