In the past three years, an artificial intelligence (AI) boom has consumed a lot of the tech world, with some even calling it the most transformational technology since the internet became mainstream. Generative AI apps like ChatGPT have become a regular part of millions of people's daily lives, and businesses scrambled to incorporate AI into their products and services.

With this boom has come an explosion in valuations for tech companies dealing with AI. Eight of the world's most valuable public companies are tech companies, each with a valuation of over $1 trillion as of market close on Aug. 21.

Despite the many companies whose stocks have skyrocketed over the past few years, none have quite seen the explosion of data analytics company Palantir Technologies (PLTR 2.65%). In the past three years, its stock is up over 1,110%, while the S&P 500 is up only around 56%.

Image source: Getty Images.

This latest run has made plenty of Palantir investors a lot of money, but it has also put Palantir's stock in a position that leaves virtually no room for error if the company wants to get anywhere close to justifying its valuation. That's not just my take, either. Plenty of Wall Street analysts and investors have the same thought.

Where does Palantir's valuation stand?

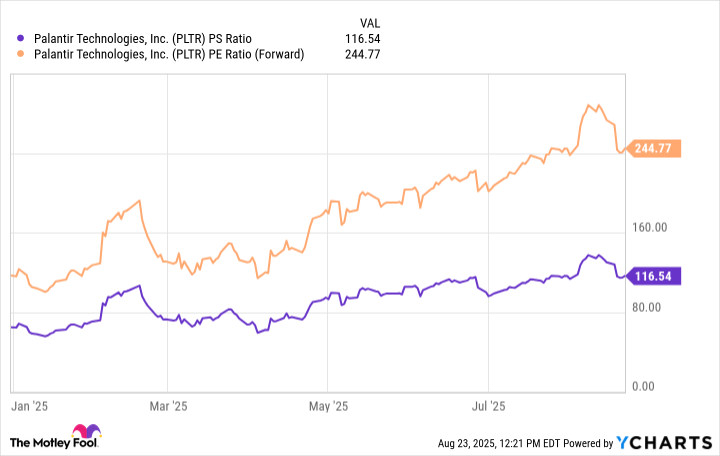

A stock price by itself doesn't tell you if a stock is overvalued or not: A $10 stock could very well be overvalued, while a $1,000 stock could be undervalued. Instead, it's helpful to check a company's price-to-earnings (P/E) ratio -- which tells you how much you're paying per dollar of profits -- or price-to-sales (P/S) ratio, which tells you how much you're paying per dollar of revenue.

As it stands, Palantir's forward P/E ratio (how much you're paying for estimated future profits) is around 244, and its forward P/S ratio is around 116. It's hard to overstate how expensive both of those are.

PLTR PS Ratio data by YCharts

What are Wall Street and financial experts saying about Palantir's stock?

Below are a few quotes from Wall Street analysts and finance writers who have commented on Palantir's extreme valuation:

- Known short-seller Andrew Left called the stock "detached from fundamentals and analysis."

- An Economist article noted that Palantir "might be the most overvalued firm of all time."

- Brent Thill from investment banking firm Jefferies said the stock's valuation is "disconnected from even optimistic growth scenarios."

- Fool contributor Sean Williams called Palantir "the most overvalued megacap stock" he's ever seen.

These are just a few quotes, but many on Wall Street seem to have the same thought. Financial information website MarketWatch has 18 analysts giving Palantir's stock a hold rating, while only four giving it a buy rating. And that's not because it's not a good company; it's just hard to justify buying the stock at current levels.

NASDAQ: PLTR

Key Data Points

How should investors approach Palantir's stock?

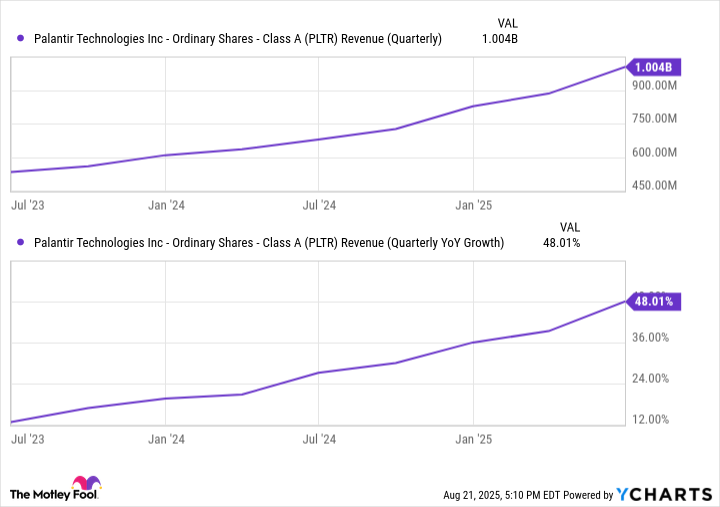

There's no doubt Palantir is a good company with a stronghold in its niche: complex data analysis and decision-making tools. Its business and revenue growth show Palantir's value in solving real-world problems, and it is being embraced by both government and corporate entities.

The second quarter was its first $1 billion quarter, with its U.S. government segment making $426 million while its U.S. commercial segment made $306 million. Just two years ago, in the second quarter of 2023, those segments made $226 million and $103 million, respectively.

PLTR Revenue (Quarterly) data by YCharts

My recommendation for approaching Palantir's stock would be to dollar-cost average your way into a stake. You don't want to sit on the sidelines anticipating a drop because there's no way to predict how the market will move.

By dollar-cost averaging -- investing a set amount at regular intervals regardless of stock price -- you protect yourself against investing a lump sum before a sharp decline. There's still a chance that your cost basis will end up higher than ideal if the stock slowly declines, but you'll avoid missing the train altogether.

But you should buy Palantir's stock only if you're in it for the long haul. Anything short of that is more speculative than an investing-focused approach.