Despite strong revenue growth and raised guidance, shares of Walmart (WMT 1.49%) sank following the retailer's Q2 results, as the company's profits came in a bit light of expectations. While much of the talk was around tariffs, the real culprit for the earnings miss was an increase in the cost of workers' compensation claims, as the company self-insures. The stock is now up about 8% on the year, as of this writing.

Let's dive into retail giant's quarterly results and commentary to see if this dip is a buying opportunity.

Image source: Getty Images.

Solid results and tariff talk

Tariffs were a big part of the conversation when Walmart reported its Q2 results, but they had a relatively modest impact on its results. This could be seen in its gross margin, which actually edged up by 10 basis points year over year to 24.5%.

Walmart has been working to keep costs low. It absorbed some tariff costs for certain items, while passing them along to the consumer on others. However, it did say that costs would continue to creep up as it replenishes more inventory at post-tariff rates.

While the company saw some pressure on lower- and middle-income household spending, its overall sales remained strong. Revenue rose nearly 5% to $177.4 billion, topping the $176.16 billion consensus, as compiled by LSEG. Walmart U.S. store sales rose nearly 5% to $120.9 billion, while same-store sales jumped 4.6%. The number of transactions increased by 1.5%, while the average ticket climbed 2.1%. E-commerce sales, meanwhile, soared 26%.

Internationally, Walmart sales climbed 5.5% to $31.2 billion, are were up nearly 10.5% in constant currencies. The growth was led by China, Walmex (Mexico), and Flipkart (India e-commerce), with strength in both consumables and general merchandise. International e-commerce sales climbed 22%.

Sam's Club U.S., its warehouse store concept, saw sales (ex-fuel) increase by 6% to $21.2 billion. Same-store sales, excluding fuel, climbed 5.9%. Transactions rose 3.9%, while the average ticket rose 2%. E-commerce sales surged 26%, helped by club-fulfilled pickup & delivery. Membership rose nearly 8% year over year.

Adjusted EPS rose 1.5% to $0.68. That fell short of the $0.74 consensus. Without $450 million in additional general liability claims, it looks like the company's adjusted EPS would have met analyst expectations.

Looking ahead, Walmart forecasted Q3 sales to rise between 3.75% to 4.75%. For its full year, it upped its sales guidance, taking it from a prior forecast of 3% to 4% growth to between 3.75% to 4.75%. It is looking for full-year adjusted EPS to be between $2.52 to $2.62, up from a prior outlook of $2.50 to $2.60.

Should investors buy the dip?

While tariffs grabbed the headlines, Walmart appears to be managing them well, with no real falloff in consumer spending or impact to its gross margins. While the earnings miss sent shares lower, it was due to something that is not really core to the company's business.

Meanwhile, Walmart is starting to see some strong momentum in its e-commerce business. Growth was robust both in the U.S and abroad, with all segments seeing growth of 20% or more. Profitability in the segment is building, and it's also helping fuel its high-margin ad business, which grew revenue by 46% globally in the quarter.

Walmart is also investing in artificial intelligence (AI) to help improve inventory management and delivery speeds. Its AI investments don't stop there, though, as it's also developing several AI agents. The first to be launched will be Sparky, which will help improve customer interactions on its app. It is also developing ones to help associates, suppliers, and advertisers.

Higher-income households, meanwhile, continue to be the biggest driver behind Walmart's growth. With tariffs set to continue to lead to higher prices, this dynamic should be good for the company that is already the low-cost retail leader.

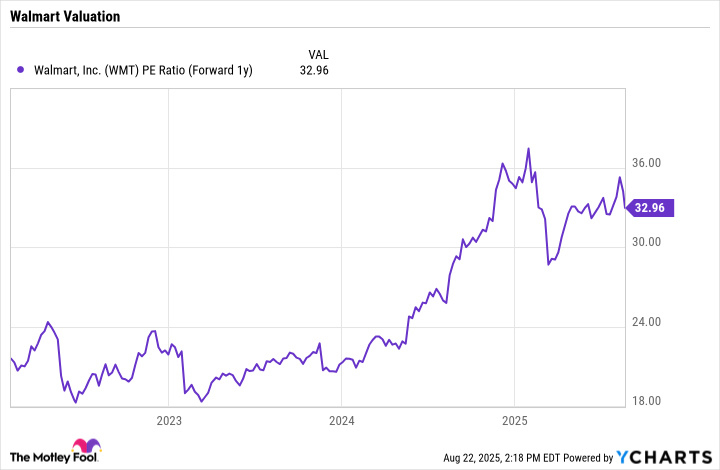

Turning to valuation, the stock trades at a forward price-to-earnings (P/E) ratio of about 33 times next year's analyst estimates. That's well above where the stock traded before the middle of 2024, when its valuation multiple started to expand.

WMT PE Ratio (Forward 1y) data by YCharts

Overall, I think Walmart is doing a lot of good things, and I like the direction it is headed. However, I think the stock's valuation has gotten a bit ahead of itself at the moment, and it still has a bit of balancing act in front of it with tariffs. As such, I would not be a new-money buyer at this time.