The best investors buy stocks before they get popular. As the vast majority of market participants talk about the hottest investing topics of the day, such as artificial intelligence (AI), contrarians are searching for the next big thing hidden in plain sight. They are more likely to have bought Nvidia five years ago instead of today.

What are the underfollowed growth trends an investor can buy right now? My money is on digital remittances -- otherwise known as international money transfers -- and Remitly Global (RELY +0.11%). This financial technology (fintech) stock with a market cap of just $3.9 billion is one that investors will regret not adding to their portfolios in 2025. Here's why.

NASDAQ: RELY

Key Data Points

Betting on digital cross-border money transfers

Remitly has taken the remittance world by storm with its easy-to-use mobile application and transfer fees that are much lower than legacy solutions. It has targeted popular North America payment corridors such as India, the Philippines, and Mexico, with marketing tailored for those specific cultures, allowing the company to gain rapid market share gains. For receiving money, it has partnered with hundreds of thousands of different payout options to make it easier for both the sender and recipient to get money easily to family and friends across the globe.

Last quarter, Remitly's total payment volume grew at a blistering 40% year over year to $18.5 billion. It keeps taking market share within digital payments, but is still a small player in the overall remittance market, giving it a long runway to grow.

Revenue was up 34% last quarter and grew slower than payment volume, which shows that Remitly's fees are getting reduced the more it scales up operations. The company generated only a small net profit, but it has a gross profit margin of close to 60% that should lead to strong underlying profitability once management decides to stop pouring so much money into new product development and marketing.

Image source: Getty Images.

Diving into new product opportunities

Speaking of product development, 2025 is the biggest year in Remitly's history when it comes to expanding beyond cross-border money transfer services. It has built new products specifically for small business money transfers, a huge market that has over $10 trillion in annual payment volume.

For individuals, Remitly is expanding beyond sending money with the Remitly Wallet, where a customer can store funds in a variety of different currencies including stablecoins. There will be new services for Wallet members such as a product called "send now, pay later" to help bridge liquidity gaps as well as cash back deals. The company is also beginning to utilize stablecoins as a way to on-ramp and off-ramp to the Remitly platform and on its own balance sheet to help with money transfer costs.

Overall, Remitly is far from resting on its laurels. All these new services plus the general market share gains in remittances should help Remitly keep growing its revenue at a high rate for many years.

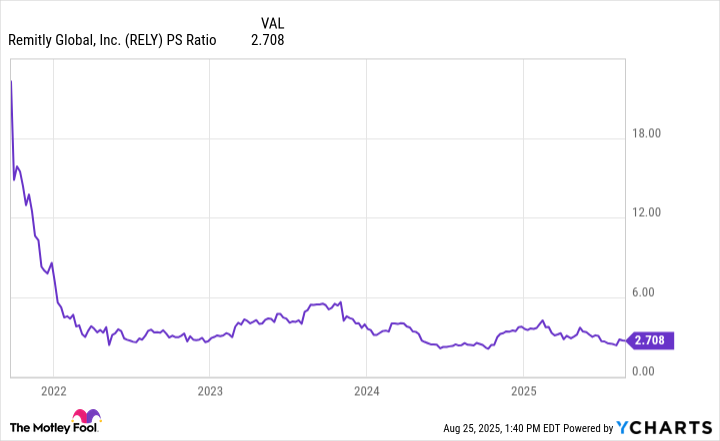

RELY PS Ratio data by YCharts

Remitly stock is cheap today

Despite Remitly's huge growth prospects, this stock does not trade at an ultra-premium valuation, a rare occurrence in this market environment. At a market cap of $3.9 billion, Remitly has a price-to-sales ratio (P/S) of just 2.7, which is cheap compared to its unit economics and underlying profit potential.

Let's use some estimates to illustrate why. Remitly's revenue is projected to be around $1.6 billion this year. At its current growth rate, it can reach $3 billion in revenue -- under a double from 2025 -- within three to five years. At a 60% gross profit margin, Remitly can achieve bottom-line net income margin of 20%, which is $600 million in net earnings on $3 billion in revenue.

That is a forward price-to-earnings ratio (P/E) of just 6.5, which is ultra-cheap for a fast-growing company. Buy Remitly stock and watch the gains roll in the coming years. You won't regret it.