C3.ai (AI 4.17%) was founded in 2009 by Thomas Siebel, and it was one of the world's first enterprise artificial intelligence (AI) companies at the time. It now offers over 130 ready-made applications to help businesses in 19 different industries accelerate their adoption of AI.

C3.ai stock was trading at around $29 on July 23, but it has since plummeted by more than 40%. On July 24, Thomas Siebel announced he plans to step down from his role as CEO for health reasons, and on Aug. 8, the company released a very disappointing set of preliminary financial results for its fiscal 2026 first quarter (which ended on July 31).

C3.ai is scheduled to release its complete Q1 results on Sept. 3, and management will probably use the accompanying conference call to try and ease some investor concerns. Should investors buy C3.ai stock ahead of the upcoming report, or steer clear until the company's future is more certain?

Image source: Getty Images.

C3.ai offers a great value proposition for its customers

Developing AI software from scratch requires significant financial and technical resources, which not every company can spare. C3.ai's readymade applications are a cost-effective alternative, especially because they can be customized to suit the needs of each individual business.

For manufacturers, the C3.ai Reliability application can predict when and how critical equipment might fail, so maintenance schedules can be adjusted as necessary. This reduces downtime by up to 50% and also increases efficiency. For banks, the C3.ai Anti-Money Laundering application improves the accuracy of suspicious activity identification by a whopping 200%, which significantly reduces compliance risks.

C3.ai's applications are accessible through leading cloud providers like Microsoft Azure and Amazon Web Services, so businesses can pair them with state-of-the-art computing capacity to achieve the necessary scale. Since businesses don't have to maintain their own data center infrastructure, this arrangement is extremely affordable.

C3.ai's Q1 revenue likely fell way short of expectations

According to management's guidance, C3.ai was expected to generate between $100 million and $109 million in revenue during the fiscal 2026 first quarter. Based on the company's preliminary results, it delivered just $70 million, representing a 19% decline from the year-ago period. If that number remains the same when the company releases its official Q1 results on Sept. 3 (which is likely), it would obviously be a major disappointment for investors.

Siebel called the result "unacceptable" and attributed it to two things: First, a total restructure of C3.ai's sales and services departments had a disruptive effect on deal closures during the quarter, and second, Siebel says he was personally less involved than usual in the sales process because of his health issues.

The restructure is now complete, so it should no longer be a headwind, but only time will tell whether Siebel's absence will continue to hurt sales.

NYSE: AI

Key Data Points

C3.ai's disappointing Q1 revenue had significant consequences for the bottom line. The company's preliminary results showed a generally accepted accounting principles (GAAP) net loss of almost $125 million, which is nearly double the amount it lost in the year-ago quarter. Management probably couldn't slash costs fast enough by the time it noticed the revenue shortfall, which created the blowout loss.

C3.ai still has over $700 million in cash and equivalents on its balance sheet, so it has some breathing room while it rights the ship, but the company will have to make some very hard decisions with respect to cost-cutting if its revenue doesn't return to growth. Ironically, reducing expenses will often lead to slower growth, especially if things like marketing are on the chopping block.

Should you buy C3.ai stock before Sept. 3?

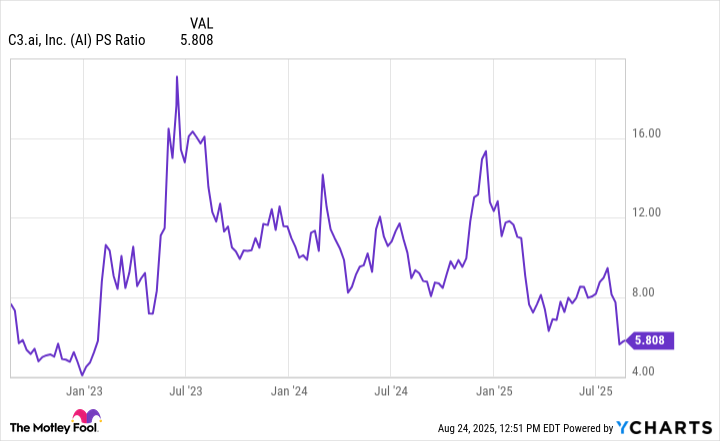

The 40% decline in C3.ai stock since July 24 has pushed its price-to-sales (P/S) ratio down to just 5.8, which is near the lowest level in three years. In other words, the stock is quite cheap relative to its history.

Data by YCharts.

However, an attractive valuation won't matter if C3.ai's revenue continues to decline. Shrinking businesses tend to destroy shareholder value over the long term, so investors typically avoid them. While it's possible the company will resolve its recent issues, I think investors should adopt a wait-and-see approach. Siebel's replacement hasn't even been selected yet, so there is still a significant amount of uncertainty on the horizon.

As a result, it might be best to avoid C3.ai stock ahead of Sept. 3, and perhaps until the company is firmly back on track with growing revenue and shrinking losses.