SoundHound AI (SOUN 2.08%) stock was in the doghouse last week, witnessing a significant pullback as investors pressed the panic button in the wake of a research report released by the Massachusetts Institute of Technology (MIT) about the productivity gains delivered by artificial intelligence (AI).

Shares of the conversational AI solutions provider dropped by more than 17% during the week as MIT pointed out that the artificial intelligence investments of 95% of the businesses surveyed by it are not profitable yet. This sent investors into panic mode, leading to a sell-off in richly valued AI stocks such as SoundHound.

However, the stock's recent pullback could be an opportunity for savvy investors to accumulate SoundHound AI. Let's see why that could be a smart thing to do.

Image source: Getty Images.

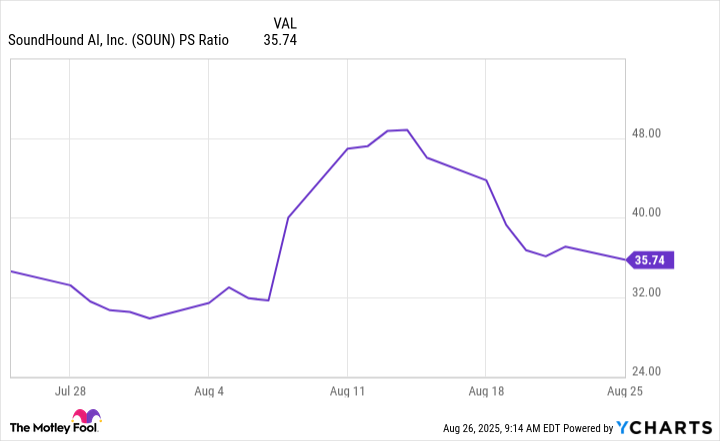

SoundHound AI is now available at a relatively cheaper valuation

SoundHound AI was trading at more than 48 times sales earlier this month. However, the recent sell-off has brought its price-to-sales ratio to just under 36.

SOUN PS Ratio data by YCharts

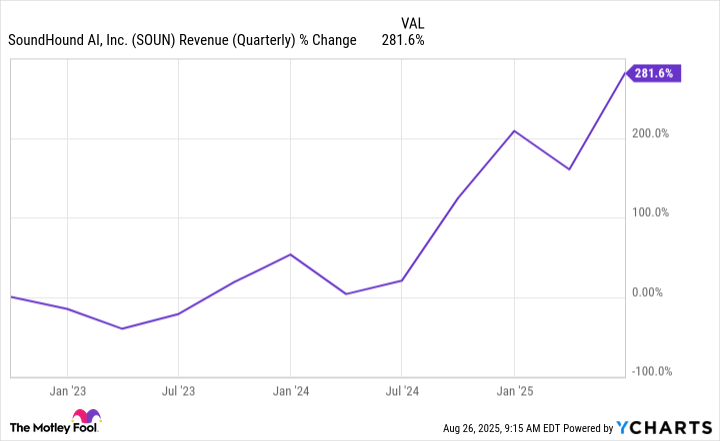

Of course, the stock is still on the expensive side considering that the U.S. technology sector has a price-to-sales ratio of 8.6. However, taking a look at SoundHound AI's stock sales multiple in isolation won't be correct. After all, the company is growing at a phenomenal pace thanks to the fast-improving adoption of its conversational AI solutions. This is evident from the following chart.

SOUN Revenue (Quarterly) data by YCharts

Another thing worth noting here is the projected improvement in SoundHound's bottom line. Though the company is still a loss-making one, analysts are projecting it to cut its losses by 34% in 2025 and 57% in 2026. For comparison, the average earnings growth of S&P 500 index companies is expected at 9% this year and 13.5% next year.

So, SoundHound AI isn't all that expensive considering its impressive pace of growth.

Investors shouldn't miss the bigger picture

Another reason to buy SoundHound following its recent dip is its ability to justify its valuation. SoundHound has a diversified customer base, a huge potential revenue pipeline, and an incredible addressable market opportunity that should ideally help it sustain its impressive growth for years to come.

NASDAQ: SOUN

Key Data Points

The company recently raised its 2025 revenue guidance to a range of $160 million to $178 million. It reported $85 million in revenue in 2024, a jump of 85% from the prior year. So, SoundHound's top-line growth is on track to accelerate this year. More importantly, it can sustain healthy growth levels in the future as well, considering that it has been winning new customers, is involved in several pilot projects, and has been witnessing an expansion in business with existing customers.

SoundHound has managed to build a strong customer portfolio already. Its portfolio includes popular automakers such as Honda, Stellantis, and Hyundai, restaurant chains such as Chipotle, Applebee's, and Red Lobster, and seven of the top 10 financial institutions across the globe. It has also expanded its presence in healthcare and retail, while its introduction of agentic voice AI solutions is set to unlock another major growth opportunity since this market is expected to clock an annual growth rate of 35% over the next decade.

In all, SoundHound AI estimates that it has a total addressable market (TAM) worth $140 billion. The company's product development moves, such as offering voice AI agents and entering emerging niches like voice commerce, can help it capitalize on the huge end-market opportunity outlined above. The good part is that the company is already on track to capture a nice chunk of the voice AI market, as evident from its $1.2 billion subscriptions and bookings backlog at the end of last year.

SoundHound AI will update this metric when it releases its results for the final quarter of 2025 next year, but the pace at which it is landing new contracts and expanding business with existing customers suggests that its backlog is likely to grow.

As such, investors looking for a growth stock may be interested in buying SoundHound AI in the wake of its recent dip, as the huge secular growth opportunity it is sitting on can help it regain its mojo and send its shares soaring in the long run.