Artificial intelligence (AI) software design company Figma (FIG +0.16%) is arguably the hottest initial public offering (IPO) stock of the year so far. The stock was able to capitalize on the ongoing AI boom, increasing 250% on its debut, but it has since experienced a sharp decline.

Figma's recent stock price struggles aren't necessarily reflective of its business performance, but it does raise the question of whether or not it's an obvious buy right now. There are mixed signals coming from Wall Street, but there's one way in particular that I'm leaning.

Image source: Getty Images.

So, what exactly does Figma do?

Figma is an AI-first company that creates tools for digital product design. Think about it like this: With a simple (or not so simple) prompt, its tools can create user interface (UI)/user experience (UX) flows, wireframes, and working prototypes.

Plenty of Wall Street analysts have praised the company's software. JPMorgan analyst Mark Murphy called the company a "trailblazing technological innovator," and William Blair analyst Arjun Bhatia's stance was that Figma has "no second-place competitor that is even close to [its] ubiquity, market share, or feature functionality."

When you look at Figma's client list, it seems this praise is warranted. The list includes Microsoft, Netflix, Dropbox, Airbnb, and Zoom Communications. Figma notes that 1,560 companies in the Fortune 2000 use its tools, and 76% of customers use at least two products.

NYSE: FIG

Key Data Points

The positives from Figma's business performance so far

When Figma announces its second-quarter (Q2) results on Sept. 3, it will be its first earnings report as a public company. However, we can dive into its S1 filing -- which companies file before going public to disclose financials, risks, and growth opportunities -- to get an idea of how the business has been performing so far.

In its fiscal 2024, Figma's revenue grew 48% to $749 million over the prior year, and in this year's first quarter, revenue grew 46% year over year to $228.2 million. Net revenue retention in the first quarter was 132%, meaning that customers spent 32% more with the company than in the first quarter of 2024. Assuming this continues, its revenue should continue on an impressive path.

If Figma can keep its gross margin in the 90% range (it was 91% last quarter), it should leave it with a lot of financial flexibility to keep reinvesting its revenue for growth.

Why Figma isn't an obvious buy

When you're deciding if a stock is an obvious buy, being a good business isn't enough in itself. You also have to consider valuation because paying too much up front can limit upside. In Figma's case, its valuation is working against it.

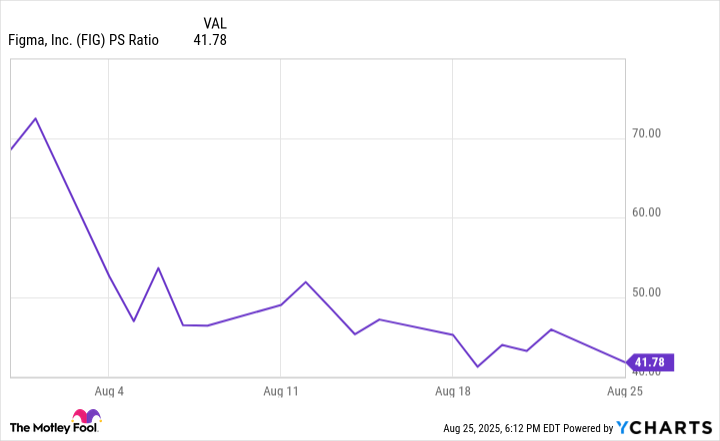

Since Figma isn't consistently profitable yet, and growth is the priority, it's helpful to look at its price-to-sales (P/S) ratio, which tells you how much you're paying per dollar of its revenue. Even after a 42% drop since Aug. 1, Figma's current P/S ratio is close to 42, which is considerably expensive, even for a high-growth tech company.

FIG PS Ratio data by YCharts

To justify Figma's current valuation, it would need to maintain around 40% annual revenue growth over the next few years. That's a tough ask, but not impossible by any means. The problem is that the stock has very high expectations priced into it, so anything short of meeting those could lead to sharp pullbacks. A recent example would be the nearly 9% decrease it experienced on Aug. 25.

Figma is still a promising company, but I wouldn't consider it an obvious buy until investors have a few more quarters of results to look at and review.