Invesco QQQ Trust (QQQ +0.08%) has been attracting a lot of attention from investors, noting that it has a huge $360 billion in net assets. It is easily one of the largest exchange-traded funds (ETFs) an investor can buy into, and, clearly, investors are happily buying shares in it. There are two big reasons for that, but one of those reasons is also a potential warning sign. Here's what you need to know.

What does Invesco QQQ Trust do?

As an index-tracking exchange-traded fund, Invesco QQQ Trust basically just mirrors the performance and characteristics of whatever index it follows. The index in this situation is the Nasdaq-100. It's a fairly straightforward index to understand, given that it tracks the 100 largest nonfinancial companies that trade on the Nasdaq exchange. The holdings are market-cap weighted, as is the index.

Image source: Getty Images.

The expense ratio for Invesco QQQ Trust is a bit high for an ETF at 0.2%. That's a potential problem, given that the ETF industry is largely focused on offering low fees. For example, some S&P 500 (^GSPC +0.16%) tracking ETFs have expense ratios as low as 0.03%.

However, given the strong recent performance (more on this in a second), some investors might be willing to overlook the higher costs here. The holdings are rebalanced quarterly, and the portfolio is reconstituted annually.

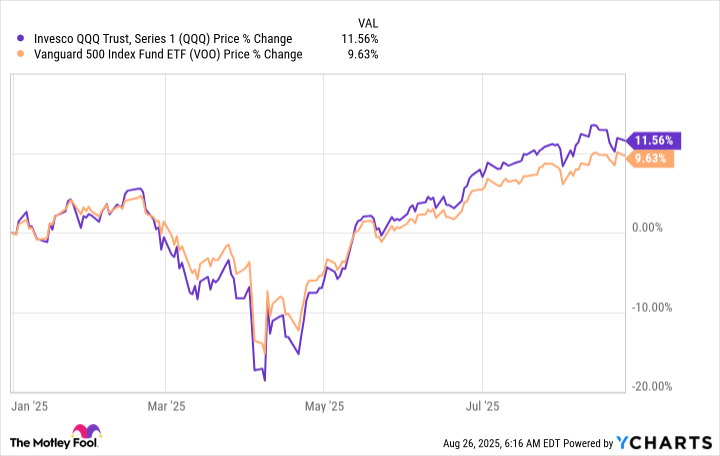

Data by YCharts.

Why is Invesco QQQ Trust so interesting right now?

The first big attraction to Invesco QQQ Trust in 2025 is its performance. That's a big one for investors, who as a group tend to flock to strongly performing investment ideas. The lemming-like approach on Wall Street can, at times, lead to investments advancing well beyond what would be reasonable, given the underlying facts of the investment.

To be fair, Invesco QQQ Trust's outperformance versus the broader S&P 500 index isn't huge on an absolute basis. As the chart highlights, the ETF is up around 11.5% so far in 2025 compared to an advance of 9.6% for Vanguard S&P 500 ETF (VOO +0.16%), one of the most popular S&P trackers.

That's "only" 1.9 percentage points. But on a percentage basis, that's nearly 20% outperformance. That's a huge difference on Wall Street, and it is the type of thing that will garner investor attention.

NASDAQ: QQQ

Key Data Points

This brings up the second big issue, which is Invesco QQQ Trust's heavy concentration in technology stocks. This one sector makes up over 60% of the ETF's portfolio. The top 10 holdings, which are all either technology stocks or tech-related, account for 52% of the ETF's portfolio.

The market has been driven by a few large technology companies, and those stocks just so happen to have the largest impact on Invesco QQQ Trust's performance. So strong performance and hot stocks have, not surprisingly, drawn investors into this ETF.

Be careful how concentrated you make your portfolio

There's nothing inherently wrong with Invesco QQQ Trust. But it is hard to suggest that this ETF is diversified today, given its heavy exposure to technology stocks. Add in the fact that 50% of the portfolio is in just 10 stocks, all of which are tech-related, and you start to see the risk of following the crowd into this ETF.

That's not to suggest that you shouldn't buy it, but you should do so with caution and an understanding of how concentrated a bet this ETF is on just a few market-leading stocks. When, not if, the market hits a downdraft, Invesco QQQ Trust's outperformance could easily switch to underperformance. If you decide to buy this ETF, perhaps make it a part of a more broadly diversified portfolio.