Nvidia (NVDA -2.78%) has been one of the top-performing stocks over the past decade. It transformed relatively small amounts into mini-fortunes, although investors have had to stomach a lot of large moves along the way.

There are numerous lessons that investors can learn from Nvidia's rise from a known computer equipment company to the world's largest business. Furthermore, there's still upside in the stock thanks to the massive artificial intelligence (AI) tailwind it currently enjoys. Nvidia is an excellent stock to study to help identify the next big thing, because if you can identify the next Nvidia, you'll be an incredibly successful investor.

Image source: Getty Images.

Nvidia's climb has been a roller-coaster ride

A decade ago, Nvidia was just an $11 billion company. So its rise from that relatively small starting point to a $4 trillion behemoth is nothing short of impressive.

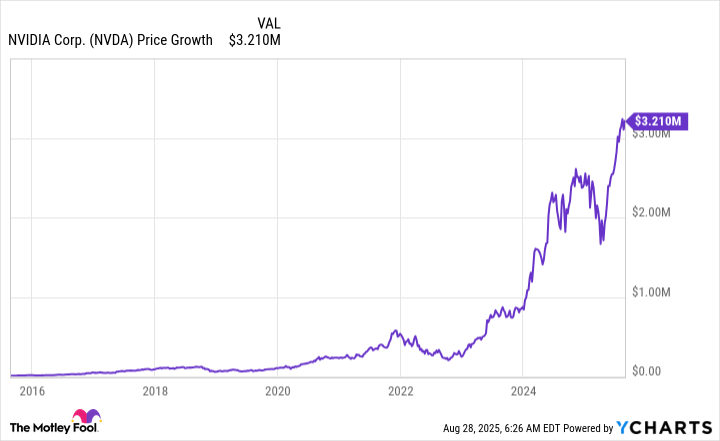

If you invested $10,000 in Nvidia a decade ago, that investment would now be worth around $3.2 million today.

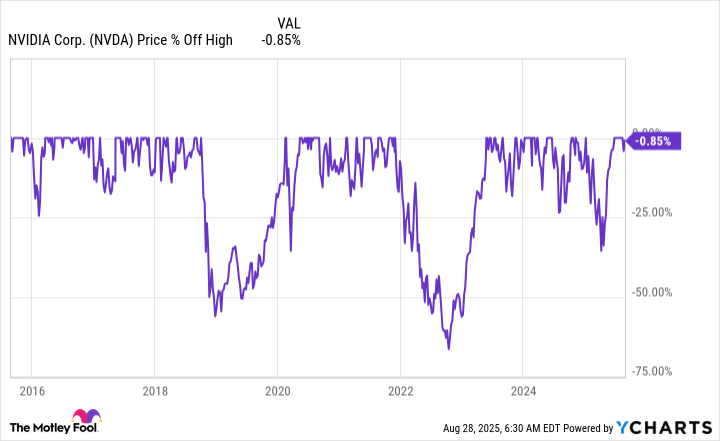

That's an incredible run, but to achieve those returns, you'd have to stomach some hefty drops due to the business that Nvidia is in.

Nvidia makes graphics processing units (GPUs). These devices were originally designed to process gaming workloads, although their use has expanded to areas such as drug discovery, engineering simulations, and cryptocurrency mining.

GPUs were the best general-purpose computing options available a decade ago to process arduous workloads, which should have been investors' first clue as to why Nvidia could be a massive growth machine. The company had a product that was specialized in one industry, but could easily be adapted to others. If you asked someone a decade ago if computing power needs would be greater in the future than they were then, the answer would have been an obvious "yes."

However, the rise wasn't all smooth. Nvidia's GPUs were widely deployed to take advantage of a booming cryptocurrency market in 2018 and 2021; however, when those markets crashed in the following years, it was a bad time to own Nvidia shares. The stock fell more than 50% on two occasions, which investors would have needed to hold through to capture all the gains.

However, if you held on through those tumultuous times, you would have been rewarded with an investment in a company at the center of the biggest computing need in human history: artificial intelligence. Computing demand for AI is unlike anything investors have ever seen, and with Nvidia's GPUs being the primary computing muscle behind this trend, its business benefited greatly.

This caused the final surge of Nvidia's stock to propel the $10,000 investment across the $1 million threshold, but it didn't stop there, as AI demand has been massive. It shows few signs of slowing down, as evidenced by Nvidia's latest results.

Data center demand is still impressive

Nvidia's GPUs are primarily being deployed in data centers, where many AI hyperscalers are still ramping up their spending on. This is a positive catalyst for Nvidia, and why the company is still growing its sales rapidly.

In Q2 FY 2026 (ending July 27), Nvidia's revenue rose 56% year over year, surpassing internal expectations of 50% growth. Most of that strength comes from its data center division, which accounted for $41.1 billion of Nvidia's total revenue of $46.7 billion in Q2.

Management remains bullish on the AI build-out and believes we're still in the early innings of this spending, which will continue to make Nvidia a strong stock pick. While the days of turning $10,000 invested into $1 million are over, I still think Nvidia is a worthy investment; it just isn't going to yield the same returns.

However, it can be a valuable stock for investors to study and learn from, potentially outperforming the market over the next five years. That's a great combination to invest in, which is why Nvidia remains at the top of my best stocks to buy now.