Artificial intelligence (AI) stocks have had a notable run so far in 2025, and some may be approaching points where it would be wise not to buy more. However, there's one in particular that I think investors should continue to load up on: Alphabet (GOOG -0.63%) (GOOGL -0.65%).

It has several characteristics of a stock that's poised to soar, and buying shares now could prove to have been a genius move a few years down the road.

Image source: Getty Images.

Alphabet has multiple business units providing strong growth

Alphabet is the parent company of Google, among many other notable brands. While this has historically been an excellent business, investors are worried that Google Search could be losing market share to generative AI. This thesis was far more reasonable a year or so ago; it no longer appears as promising.

Google has integrated generative AI search overviews into the Google Search experience. This improvement should keep Google relevant over the next few years, which really hurts the bear case against the stock.

Despite claims that Google Search is on its way out, it's still growing at a solid pace for its maturity, as revenue rose 12% year over year to $54.2 billion in Q2. With the primary bearish argument against Alphabet diminished, investors are free to focus on other parts of its business.

An exciting unit for investors to note at Alphabet is Google Cloud, its cloud computing business. Cloud computing is experiencing a significant surge in demand from AI-related workloads, as few companies have the resources to build and maintain a massive data center dedicated to AI. As a result, these companies outsource some or all of the computing workload to cloud computing providers like Google Cloud.

Google Cloud has become a top destination for migrating workloads, as evidenced by recent choices from OpenAI, the creator of ChatGPT, and Meta Platforms, both of which have selected Google Cloud as their provider in the past few months. That's significant because they could have gone to any of the other major cloud computing companies, but chose to go with Google Cloud.

This success is showing up in its growth, as Google Cloud's revenue rose an impressive 32% year over year to $13.6 billion in Q2. Additionally, its operating margin profile is improving substantially as it reaches scale. Its operating margin rose from 11% to 21% over the year, and it still has considerable room to expand when compared to other competitors in the space.

Outside of Google Cloud, Waymo, its self-driving car division, is also experiencing significant growth, although management has not yet broken out the revenue it's generating from that venture.

Overall, Alphabet's revenue increased by 14% in Q2, with diluted earnings per share (EPS) rising 22%. That's impressive for any company, let alone Alphabet, which was supposed to be displaced by AI. Despite this, Alphabet's stock still trades at a pretty hefty discount to its peers.

Alphabet's stock is cheap compared to its peers

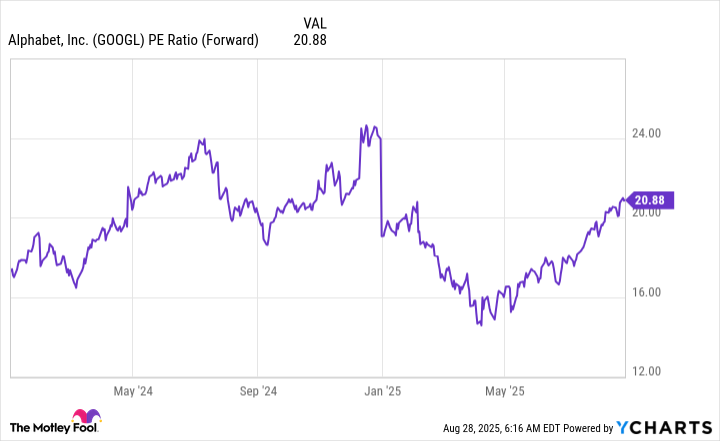

Many of the tech giants are trading at a forward price-to-earnings ratio ranging from the high 20s to the low 30s. However, Alphabet can be scooped up for less than 21 times forward earnings.

GOOGL PE Ratio (Forward) data by YCharts

That's also cheaper than the S&P 500 (^GSPC -0.69%), which trades for 23.7 times forward earnings.

Alphabet's profits are growing faster than those of some of its peers, yet it trades at a significant discount due to concerns about being disrupted by AI. Alphabet is faring quite well in this competition and shows no signs of weakness. With Alphabet's discount to its peers and the market, it's a no-brainer to buy this stock right now.