If you invested $1,000 in the Vanguard Total Stock Market ETF (VTI 0.06%) 10 years ago and had held your shares, you'd have an investment worth $3,870 today. This assumes that you had reinvested all of the dividends you received along the way.

To be sure, this is an excellent result. It is a 14.5% annual total return, which is excellent from a broad, passive investment vehicle like this one.

Image source: Getty Images.

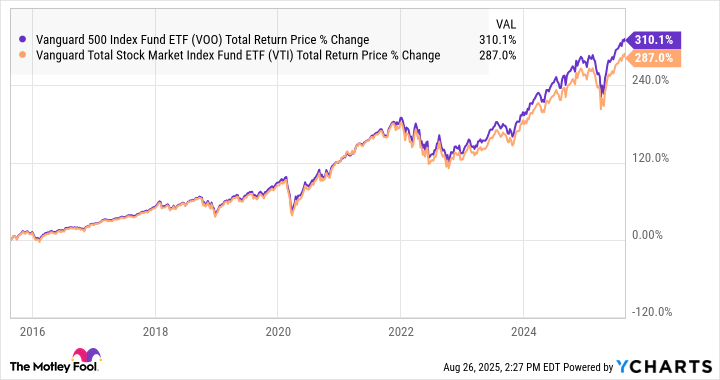

However, it actually underperformed the S&P 500 over the past decade. A $1,000 investment in the Vanguard S&P 500 ETF (VOO 0.08%) over the same period would have grown to $4,100. This is a 15.1% annualized return.

VOO Total Return Price data by YCharts

Why did the Vanguard Total Stock Market ETF underperform the S&P 500?

The short answer is that over the past decade, large-cap stocks have performed disproportionately well. Megacap technology stocks have driven much of the S&P 500's performance, and this is the primary reason why that benchmark index has done so well.

Now, there's a lot of overlap between the Vanguard Total Stock Market Index and the S&P 500. In fact, the S&P 500 accounts for roughly 80% of the total market capitalization of the U.S. stock market. However, it is the other 20% of the market -- mid-cap and small-cap stocks -- which are included in the Vanguard Total Stock Market ETF but are not in the S&P 500, that has caused the broader index to underperform.

In other words, because it includes smaller companies, it makes some of the best-performing large companies account for a smaller portion of the fund's assets. As an example, Nvidia (NVDA 0.29%) makes up 8.1% of the S&P 500, but accounts for only 6.8% of the Vanguard Total Stock Market ETF. This is the main reason why, although the Vanguard Total Stock Market ETF has delivered an excellent decade for investors, it wasn't quite as excellent as the returns of the S&P 500.