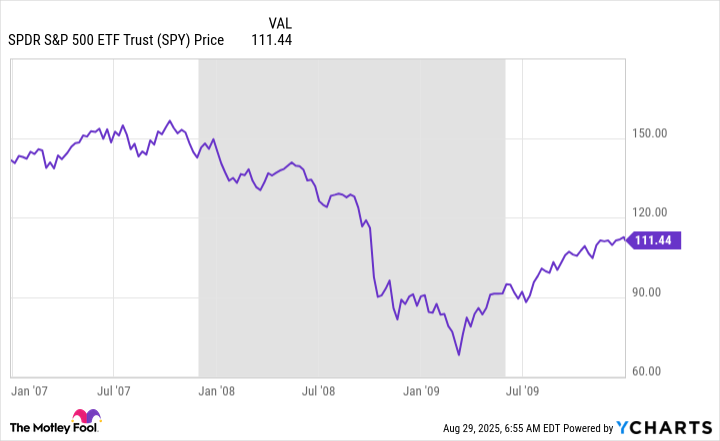

The S&P 500 index is trading near all-time highs, which is good news. Or is it? On Wall Street, the market swings between bull and bear cycles. Given the lofty valuation of the market, investors need to be worried about a bear.

What does a normal market cycle look like?

Investing is an inherently emotional affair, with the excitement of making money juxtaposed against the fear of losing it. When investors are excited about making money, the market often rises to lofty levels in what are known as bull markets. When fear is gripping Wall Street, stocks fall, often slipping into what is known as a bear market. If you have been investing for even a short time, you probably know this already.

Image source: Getty Images.

History suggests you can't have one without the other. The reason is that emotions usually drive investors to extremes. So when bull markets are running, investors price in too much good news, stretching the valuations of stocks. There are usually good reasons to be excited, but investors just get too excited to justify the prices being paid. That's when a bear market comes in, with a drop in stock prices returning valuations to more normal levels. But then investor pessimism normally goes too far, pushing stocks lower still.

And then the cycle starts again, as investors jump back into the market. This is the big pendulum swing that Howard Marks, the co-founder of OakTree Capital Management, talks about in his books. If you don't know Marks, he is famous for having called the economic and market downturn that eventually became known as the Great Recession. Not only did he call that recession, he and his clients also profited from it.

Where are we in the cycle?

Before you get the wrong impression, Marks is not a market timer. Market timing, or trying to buy at the bottom and sell at the top, is pretty much impossible to do consistently. Marks isn't trying to be perfect; he's just trying to figure out generally where the pendulum may be at any given time and then adjust to that information. He recognizes that he can be out of step with the market for years before he is correct. And, in fact, that is what happened leading up to the Great Recession. And he lost clients because of his cautious investment stance.

That said, the pendulum concept can be very useful for investors as they look at the market today. With stocks at all-time highs, Vanguard S&P 500 ETF (VOO 0.04%) has an average price-to-earnings ratio of 27.6. The average price-to-book value ratio is 5. Both figures are toward the high end of historical ranges for these metrics.

In other words, the market as tracked by the S&P 500 index, and any exchange-traded fund that tracks it, looks expensive right now. That doesn't mean the stock market is about to crash. But it does mean that investors should probably tread with caution. At some unknowable point in the future, likely sooner rather than later, the pendulum will swing back in the other direction, and a bear market will start.

Knowing where you are is important

If this were a baseball game, it would likely be closer to the end than the start. That's actually one very important thing to know and understand about the market today. It could stop you from taking on excessive risks in the hope that the bull market will continue indefinitely.

History suggests that a bear market is coming at some point and, given the lofty valuation of the market, now might be a good time to start preparing yourself. That could simply mean an emotional steeling or it could be more functional, like taking some risk out of your portfolio.