Nvidia's (NVDA -2.78%) sustained dominance of the artificial intelligence (AI) chip market helped it become the largest company in the world. It has a market cap of just over $4.1 trillion following a remarkable increase in its share price in the past three years thanks to the AI boom.

The AI craze took over the world nearly three years ago with the launch of OpenAI's ChatGPT in November 2022. Nvidia provided the building blocks for the chatbot in the form of its A100 data center graphics processing units (GPUs). There has been no looking back for Nvidia since then. A $1,000 investment made in the stock three years ago is now worth more than $12,000.

But investors may now be wondering if it would be a good idea to buy $1,000 worth of Nvidia stock now in anticipation of more gains over the next three years. Let's take a closer look at the company's prospects and try to answer that question.

Image source: Getty Images.

Growing data center power capacity is going to be a tailwind for Nvidia

When Nvidia released its fiscal 2026 second-quarter results (for the three months ending July 27), the company beat expectations once again despite facing headwinds in China. The chip giant's revenue soared 56% year over year to $46.7 billion, while the spike in its adjusted earnings was also identical.

Nvidia was able to register such impressive growth without any sales to Chinese customers. Moreover, the company's revenue guidance of $54 billion for the current quarter (which points toward a 54% year-over-year increase) doesn't take any potential revenue from China into account. Of course, China isn't a lost market for Nvidia yet since the company has reportedly agreed a deal with the U.S. government to share 15% of its revenue from sales of AI chips to that market.

This probably explains why CEO Jensen Huang points out that Nvidia could start selling its flagship Blackwell processors in China instead of the H20, which isn't as powerful as the company's top chips. Huang points out that it sees a $50 billion potential revenue opportunity in China this year, which could grow at an annual rate of 50% in the future.

So, if the company manages to gain access to this market once again, it will have a solid catalyst that will enable it to sustain impressive growth levels. The good part is that Nvidia's business outside China continues to grow at an incredible pace, which is the reason why it reported solid growth once again last quarter.

Huang remarked on the latest earnings conference call:

As you know, the capex of just the top four hyperscalers has doubled in two years. As the AI revolution went into full steam, as the AI race is now on, the capex spend has doubled to $600 billion per year. There's five years between now and the end of the decade, and $600 billion only represents the top four hyperscalers.

Importantly, Nvidia says that for a typical gigawatt data center that costs $50 billion to build, its revenue opportunity stands at a whopping $35 billion. McKinsey estimates that global data center power capacity could grow from 55 gigawatts (GW) in 2023 to 171 GW in 2030 in a base case scenario. The higher end of McKinsey's forecast predicts that 298 GW of data center capacity could be needed by the end of the decade.

As a result, hyperscalers and governments across the globe could continue to invest more money into building data centers. McKinsey estimates that a whopping $6.7 trillion is likely to be spent on data center infrastructure in the next five years. Of that, $5.2 trillion will be directed toward AI data centers. McKinsey adds that 60% of the AI data center spending will go toward "technology developers and designers, which produce chips and computing hardware for data centers."

So, it can be concluded that Nvidia is sitting on a addressable market worth of $3 trillion through 2030.

Here's how much upside investors can expect

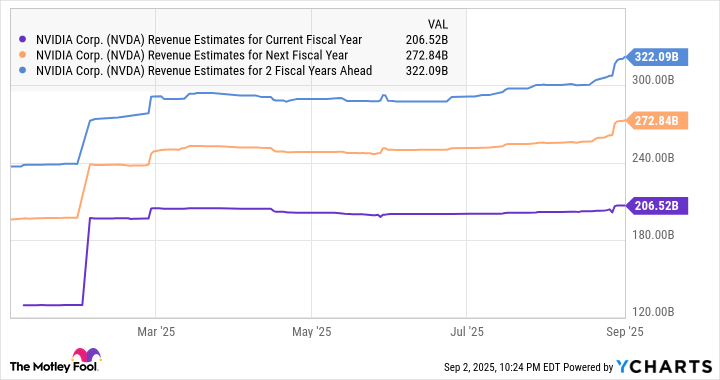

The lucrative opportunity in the AI data center market and Nvidia's estimated 80% share of this market explain why analysts have been raising their revenue growth expectations from the company, even though it has a high revenue base.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

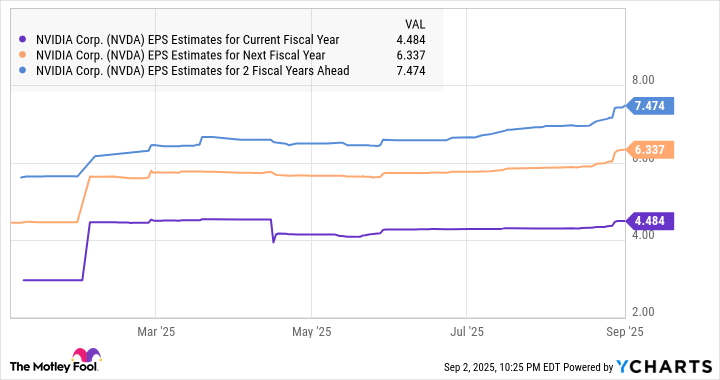

It won't be surprising to see Nvidia's revenue exceeding consensus revenue expectations after three years, considering the pace at which data center development is set to take place. Not surprisingly, Nvidia's earnings expectations also headed higher.

NVDA EPS Estimates for Current Fiscal Year data by YCharts

Assuming Nvidia can bring in $7.50 per share in earnings in fiscal 2028 and trades at 33 times earnings at that time (in line with the tech-laden Nasdaq-100 index), its stock price could increase to $248. That would be a 46% jump from current levels.

This AI stock is now trading at 38 times forward earnings. Don't be surprised to see it maintain such a premium after three years because of the reasons discussed above, which could lead to stronger upside for investors.