There's no doubt that artificial intelligence (AI) has become a topic that's been virtually impossible to avoid over the past couple of years. Although it's not a new technology, the popularity of AI tools like ChatGPT has brought it to the mainstream.

Many companies dealing with AI have seen their stock prices surge due to investors rushing to take advantage of new growth opportunities. However, that has made many of these stocks inflated and overvalued.

However, one stock that has shown promising AI growth, consistent profits, and a relatively low valuation is Alphabet (GOOG 0.26%)(GOOGL 0.20%). It's seemingly one of the best deals you can get from an AI stock right now.

Image source: Getty Images.

Alphabet is one of the most important AI companies

Although the focus on AI seems relatively new, Alphabet has been at the forefront of AI innovation for a while. It's responsible for many of the breakthroughs that have led to AI being what it is today. Alphabet is a full-stack AI company, meaning it operates in the three main phases of the pipeline.

Alphabet's subsidiary, DeepMind, is purely focused on AI research and development; its cloud platform, Google Cloud, allows it to provide scalable AI infrastructure for itself and other companies; and it has consumer-facing applications like its generative AI tool, Gemini.

Google Cloud will be a key part of Alphabet's AI growth in the near future. It's still third in market share behind Amazon Web Services (AWS) and Microsoft Azure, but it has been experiencing impressive growth. Google Cloud has also landed a six-year, $10 billion deal with Meta, making it the go-to platform to power Meta's AI ambitions.

NASDAQ: GOOGL

Key Data Points

Alphabet continues to be a cash cow

Making money has never been a major problem for Alphabet, and its recent earnings show that's still the case. In the second quarter, Alphabet's revenue increased 14% year over year to $96.4 billion. Unsurprisingly, much of that came from its Google Services segment, which includes businesses like Google Search, YouTube ads, and Google subscriptions. Google Services revenue increased 12% year over year to $82.5 billion.

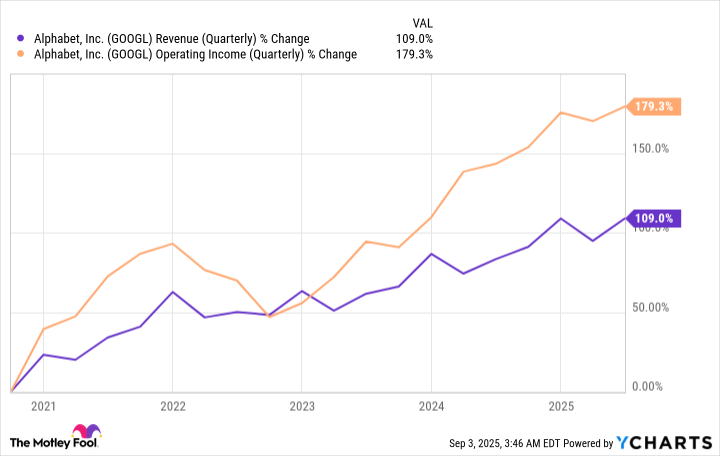

Alphabet's operating income (profit from core operations) also came in impressively, growing from $27.4 billion in the second quarter last year to $31.3 billion in this year's second quarter. Over the past five years, Alphabet's revenue and operating income have more than doubled.

GOOGL Revenue (Quarterly) data by YCharts

The most impressive growth -- and what most investors had their eyes on -- came from Google Cloud. Its revenue increased 32% year over year to $13.6 billion and was Alphabet's fastest-growing segment. Google Cloud is a business that should continue to be high-growth, as many companies flock to the platform for AI infrastructure.

You can't beat Alphabet at its current price

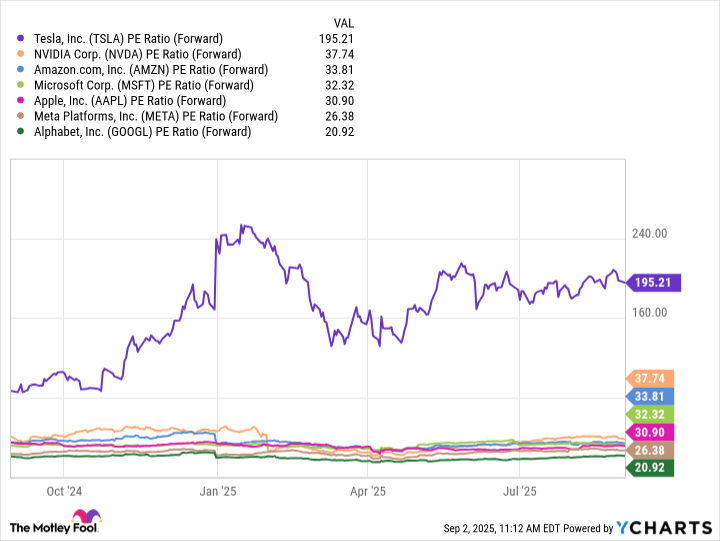

A stock's price by itself won't tell you whether or not it's valued low; instead, you should compare metrics to similar companies. In Alphabet's case, it's helpful to compare its price-to-earnings (P/E) ratio to other "Magnificent Seven" stocks.

When looking at Alphabet's forward P/E ratio -- which tells you how much you're paying per dollar of a company's expected earnings over the next 12 months -- it seems to be fairly low valued. Its forward P/E ratio is around 20.9 at the time of writing.

TSLA PE Ratio (Forward) data by YCharts

Given Alphabet's market position (especially Google), its profits, and growth prospects, its current valuation seems like a steal for long-term investors. There's also the company's dividend, which it first began paying last year, that can help hedge against some of the volatility that we've seen from growth and tech stocks in recent times.

Alphabet's current dividend yield is only around 0.40%, but Alphabet has the cash flow to make increasing the annual dividend a priority -- and that's what I expect to happen. It's not a foolproof investment, but the upside far outweighs the downside.