Eli Lilly (LLY 0.83%) shares have been disappointing to own this year. As of the end of last week, they were down more than 4% since the start of the year. But this has still been a phenomenal growth stock to own in recent years, and its five-year gains are impressive, at around 400%. The hype and excitement around the stock seems to have faded, at least for now.

The good news is that despite its lackluster performance this year, there are plenty of reasons to remain bullish on Lilly over the long haul. Here's why it may be due for a rally in the not-too-distant future, and why you may want to consider loading up on the healthcare stock sooner rather than later.

Image source: Getty Images.

Approval of its weight loss pill could be coming -- soon

Eli Lilly has a robust portfolio of drugs, but there's no doubt that what moves the stock these days is anything related to its GLP-1 medications. Those are key to its long-term growth prospects, and they've generated billions of dollars in revenue already this year.

On Aug. 7, the stock dropped heavily after Lilly's weight loss pill, orforglipron, showed that it helped patients lose around 12% of their body weight when taking its highest dosage over a 72-week trial. This was considered bad news, because it was less than the 15% that analysts were expecting.

A few weeks later, on Aug. 26, however, the latest trial data showed that it helped people with diabetes lower their blood sugar levels. The weight loss percentage was slightly lower, at around 10.5% on the highest dose. But what's most important is that the overall results were favorable, the drug met all its key endpoints.

The company now says it has the data it needs to move forward to file for regulatory approval. Assuming that goes through smoothly, Lilly believes that it could be launching its pill in about a year from now.

A big growth opportunity for an already growing business

Obesity and diabetes are two serious health concerns, which is why a pill that can help patients on both fronts can be a significant growth catalyst for Eli Lilly. And by being first to market in this area, it can gain a significant advantage. If it's available sooner, patients will be more familiar with any side effects. Meanwhile, by setting a high bar at the start, orforglipron could make it difficult for new entrants to take a lot of market share later on.

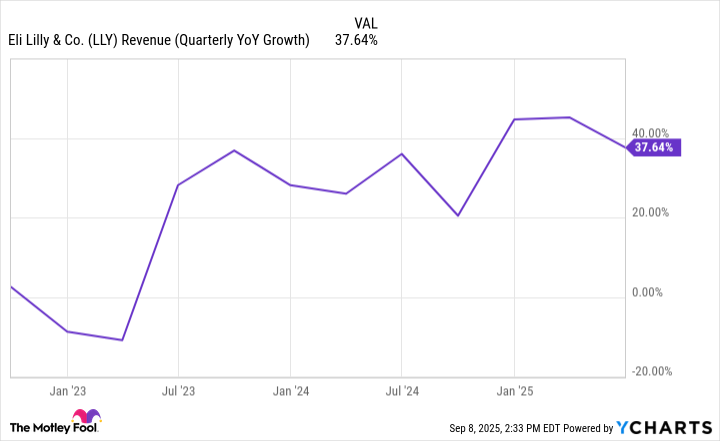

LLY Revenue (Quarterly YoY Growth) data by YCharts.

In recent years, Lilly's top line has been growing at a much faster pace thanks to its already approved GLP-1 injections, Zepbound (for weight loss) and Mounjaro (for diabetes). But a GLP-1 drug in pill form is likely to be more appealing to patients, which could mean an even greater growth opportunity down the road.

Eli Lilly's stock isn't cheap, but it's worth the premium

At a price-to-earnings multiple of nearly 50, Eli Lilly seems like a fairly expensive stock to own, but that's only if you aren't considering its long-term growth prospects. Its forward price-to-earnings multiple, which factors in analyst expectations, falls to just 24. And when you look at an even longer duration of five years, its price-to-earnings-growth (PEG) multiple is only 0.80 -- a PEG of 1.0 or lower is considered a cheap buy.

NYSE: LLY

Key Data Points

Investors haven't been as excited about healthcare stocks this year, likely due to concerns about tariffs and potential reform of drug prices in the sector. But I believe those issues are overblown, especially if you're a long-term investor who's buying and holding a terrific stock like Eli Lilly for several years. In that case, it's hard to go wrong with the stock given its amazing growth prospects. And it could just be a matter of time before it goes through another rally.