The U.S. stock market has been on a bull run since early 2023, with much of it being propped up by the artificial intelligence (AI) hype and boom. On one hand, this is great for investors who have been along for the ride. On the other hand, it has made the current stock market expensive and overvalued by many metrics.

One particular metric that has brought cause for concern is the S&P 500's Shiller price-to-earnings (P/E) ratio, which measures stock prices against inflation-adjusted average earnings over the past 10 years. The index's current Shiller P/E ratio is around 39.5, the highest it has been since October 2000, in the thick of the dot-com bubble.

Unfortunately, anytime this index has reached those levels, sharp pullbacks in the market have followed. That doesn't mean that will always be the case, but it should make investors cautious about the stock market's current environment. To help hedge against that possibility, investors should consider investing in the Vanguard Value ETF (VTV +0.34%).

Image source: Getty Images.

Why seeking value may be a good option right now

Growth stocks have been the go-to for many investors in recent years because of their high return potential. However, growth stocks often come with more risk and volatility because the stocks have future growth priced into them, and anything short of meeting investors' expectations can cause huge sell-offs.

Value stocks are typically more stable (though not exempt from volatility), trade at lower valuations, and are known for their consistent cash flows. The value focus of VTV means it's much less tech-heavy than the S&P 500 and growth ETFs. The top five sectors in the ETF are financials (22.8% of the ETF), industrials (16.5%), healthcare (13.5%), consumer discretionary (9.1%), and consumer staples (9%).

For perspective, tech stocks make up 34% of the S&P 500; Nvidia, Microsoft, and Apple alone account for over 21%; and the top 10 holdings are close to 38% of the index.

NYSEMKT: VTV

Key Data Points

What you're getting by investing in VTV

This ETF tracks the CRSP US Large Cap Value Index. To be included, a stock must be a large-cap company and meet certain metric requirements dealing with price-to-book, P/E, price-to-dividends, and price-to-sales metrics. These requirements ensure investors are getting exposure to companies that truly fit the value narrative. Below are VTV's top 10 holdings:

| Company | Percentage of the ETF |

|---|---|

| JPMorgan Chase | 3.61% |

| Berkshire Hathaway (Class B) | 3.27% |

| ExxonMobil | 2.18% |

| Walmart | 1.95% |

| Oracle | 1.93% |

| Johnson & Johnson | 1.79% |

| Home Depot | 1.66% |

| Procter & Gamble | 1.60% |

| AbbVie | 1.51% |

| Bank of America | 1.35% |

Data source: Vanguard. Percentages as of July 31.

These companies are leaders in their respective industries, have stood the test of time, generate consistent cash flow, and pay an attractive dividend (except for Berkshire Hathaway). The ETF has averaged a dividend yield close to 2.5% over the past decade, outpacing the S&P 500's 1.5% average in that time.

Don't expect outsize gains from VTV

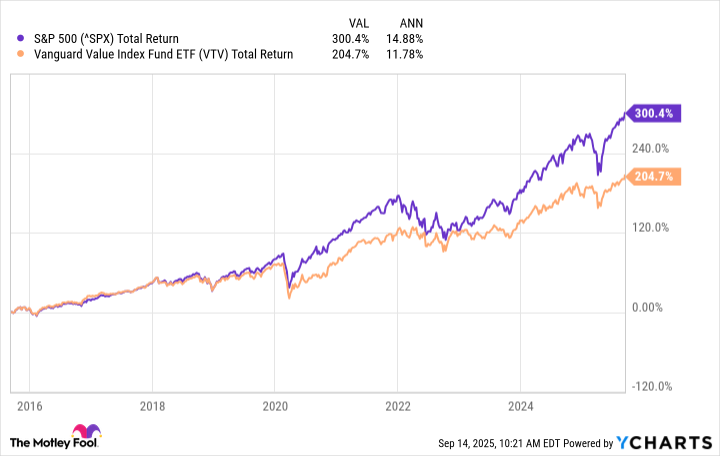

Over the past decade, VTV has averaged around 11.7% total returns, which is great by most standards. However, the S&P 500 has averaged 14.8% total returns over that time.

I wouldn't invest in VTV expecting consistent, market-beating returns. Instead, I would invest to hedge against the high valuation of the current market and the high tech concentration of the S&P 500. It has worked out in the S&P 500's favor in recent years, but the same factors that have lifted it can also be the same ones that drag it down.

A good example would be in 2022, when the S&P 500 declined by over 19%. VTV also finished the year in the red, but "only" 4.5%. It's a good investment to have in your portfolio when the market is down, and with only a 0.04% expense ratio, it's a cheap addition.