Quantum computing is slated to become the next big tech investment trend following artificial intelligence (AI). We're still in the early innings of this exciting technology, but most companies agree that 2030 will be a turning point in this space. However, waiting until 2030 to start investing in this field after the winners are established is a mistake. Many of these companies will likely have dramatically increased in value by then, causing investors to lose out on massive returns.

By investing today, it's possible to pick some of the winners in this space before they've become too large to provide substantial returns. I've identified four options that appear to be excellent investments in quantum computing, ranging from startups to established big tech players. By staying balanced in this opportunity, investors can capitalize on the trend while ensuring positive returns.

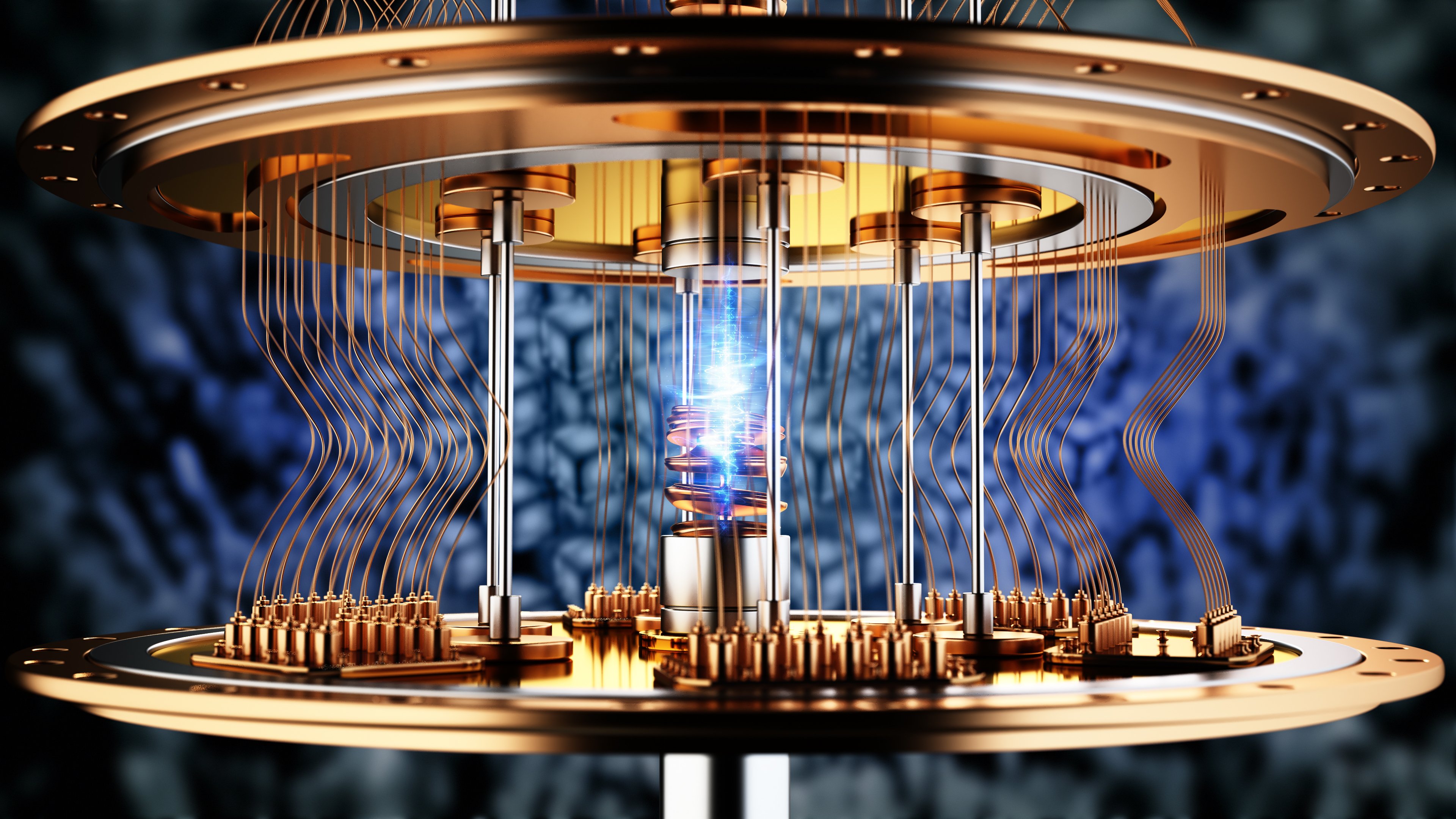

Image source: Getty Images.

Pure plays: IonQ and D-Wave Quantum

The stocks that most investors consider in reference to the quantum computing arms race are pure-play investments, such as IonQ (IONQ 5.59%) and D-Wave Quantum (QBTS 7.01%). These companies are startups that have no other goal besides developing commercially viable quantum computing technologies, and their upside could be immense if they achieve their goals.

IonQ and D-Wave only have market caps of $16.5 billion and $6.1 billion, respectively. This makes them relatively small companies in general, although they could grow to be monsters if their technology becomes widespread.

The primary reason I prefer these two over many of the other quantum computing pure plays is their approach to quantum computing. The most popular quantum computing technique is superconducting, which involves cooling a particle to near absolute zero to utilize its quantum mechanics to perform calculations. This is an incredibly cost-intensive process, and may be cost-prohibitive in deploying quantum computing at scale, especially in the early years.

NYSE: IONQ

Key Data Points

IonQ doesn't use this approach; its quantum computing technology is known as trapped ion. This provides several key advantages, namely cost (because it doesn't require cooling a particle to absolute zero, it can be done at room temperature) and accuracy. IonQ holds world records in quantum computing accuracy and with the largest concern surrounding quantum computing being how accurate it is, I think IonQ's technology could be a popular pick.

D-Wave isn't taking the same approach as many companies. Instead of creating a general-purpose quantum computer, it's developing a quantum annealing platform. This approach cannot be applied to every quantum computing application, but it excels at optimization problems, which can be solved by finding the lowest energy state in a system. D-Wave's technology will be useful in determining logistics networks and statistical models, which represent a large chunk of quantum computing use cases. D-Wave doesn't have to capture the entire market; it just needs to secure enough business to make it viable.

NYSE: QBTS

Key Data Points

Both of these two stocks are high-risk, high-reward investments, and balancing them out with more established players is a smart idea.

Legacy tech companies: Microsoft and Alphabet

Both Microsoft (MSFT 10.23%) and Alphabet (GOOG +0.71%) (GOOGL +0.71%) are developing quantum computing technologies in-house for their cloud computing divisions. Currently, Alphabet and Microsoft are paying a substantial premium to their current primary computing hardware supplier, Nvidia (NVDA +0.63%). If they can develop a viable quantum computing option for these platforms in-house and not have to purchase them from a third party like IonQ or D-Wave, they will save a ton of money and become more profitable.

NASDAQ: GOOGL

Key Data Points

This makes quantum computing a highly lucrative field to invest in, and both companies have already announced significant breakthroughs in the realm of quantum computing. Furthermore, these two companies have nearly unlimited resources to deploy compared to IonQ and D-Wave, and it may become too cost-intensive for them to compete against Microsoft and Alphabet in the long run.

NASDAQ: MSFT

Key Data Points

However, David versus Goliath stories exist for a reason, and IonQ and D-Wave may ultimately prevail against their larger competitors, but there's no way to know that right now.

By purchasing all four of these stocks, investors are taking a balanced approach to the quantum computing investment trend. This gives them the upside of pure plays like IonQ and D-Wave, while also investing in established players like Microsoft and Alphabet, which continue to benefit from the ongoing AI arms race. I believe this cohort has a great chance to outperform the market, and if IonQ or D-Wave achieves significant success, this group could crush the broader market.