Meta Platforms (META +1.08%) is set to release its latest earnings report on Oct. 29. So, is the company's stock a buy heading into this report? Let's break it down.

Image source: Getty Images.

The current state of Meta Platforms

To get a sense of whether Meta's stock is a buy, let's examine how the company is performing. In its most recent earnings report (for the three months ended on June 30), Meta reported fantastic numbers, highlighted by the following:

- $47.5 billion in revenue

- $18.3 billion in net income

- 43% operating margin

- 3.5 billion daily average users (DAUs)

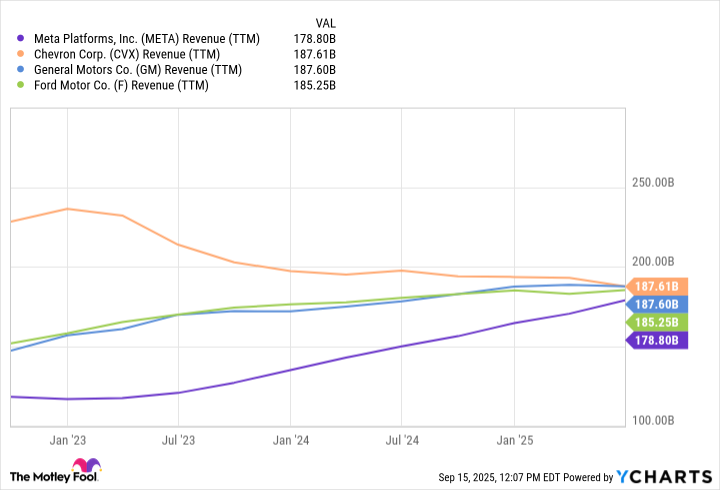

In short, the company knocked it out of the park. Over the last 12 months, Meta has generated $178 billion in revenue, which ranks 19th among all American public companies. Moreover, it's growing revenue much faster than most companies of its size. Meta's revenue growth in its most recent quarter was 22%. Given this incredible growth rate, Meta's annual revenue will likely surpass similarly giant, but slower-growing, companies like Chevron, General Motors, and Ford Motor Company by the end of 2025.

META Revenue (TTM) data by YCharts.

How Meta is positioned for the future

Clearly, Meta is a healthy company that is firing on all cylinders right now. But what about its future? Is the company making the right moves today that will prepare it for five years or 10 years down the road?

I would say it is, and here's why. Meta is making monumental investments in state-of-the-art technologies like artificial intelligence (AI). A significant amount of the investment comes in the form of AI hardware. Think AI chips and data centers that will give Meta a leg up in the race to develop its AI models. However, the company is also investing in people. Reports have surfaced that Meta is paying astounding signing bonuses to lure key AI researchers from rivals like OpenAI, the company behind ChatGPT.

While all this spending might seem like a negative, we must remember that Meta isn't just spending money -- it's investing for its future. No one knows precisely how AI will shape the future, but one thing is clear: AI models will play an increasingly important role in how people live, work, and play.

By investing heavily into AI hardware, data centers, and talented researchers, Meta is stocking up on the resources needed to compete against other big tech players that also have ambitions to develop and leverage the next great advancements in AI technology.

NASDAQ: META

Key Data Points

Meta is already a financial juggernaut. Its massive reach enables it to produce staggering sums of revenue, net income, and free cash flow. The company is diverting some, but not all, of these resources into building out its AI infrastructure. Some of Meta's AI projects are already bearing fruit, such as its push into AI-generated advertising on its platforms, or its AI-enabled glasses.

However, many more projects will be coming down the pipeline. That should help bolster Meta's revenue growth and keep its momentum strong as it pushes further up the leaderboard of largest American companies by annual revenue. In short, Meta could eventually become the great AI company of the future.

Therefore, investors may want to consider owning shares ahead of its next earnings report on Oct. 29.