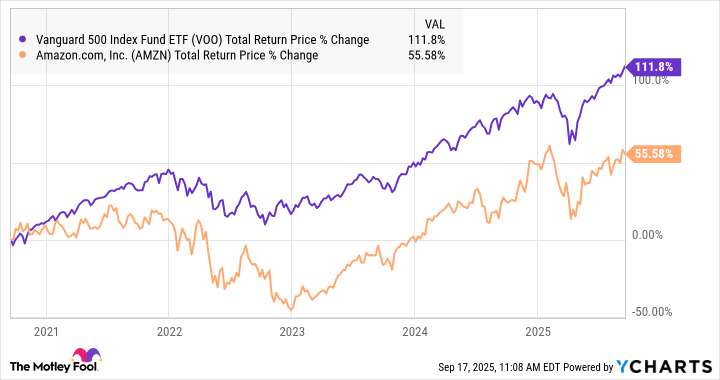

I won't sugarcoat it: Amazon (AMZN 0.17%) hasn't exactly been the best-performing stock over the past five years, with a gain of about 56% during that time period. In other words, a $1,000 investment in Amazon five years ago -- on Sept. 17, 2020 -- would be worth $1,560 today.

That is significantly less than the S&P 500 (^GSPC +0.04%), which has delivered a 112% total return over the past five years. So, why did Amazon produce less than half of the gains as a simple S&P 500 index fund?

Image source: Getty Images.

Why did Amazon underperform?

Let's be clear: It isn't that Amazon is performing poorly. And before you judge the last five years of performance, it's important to put that time frame into context.

VOO Total Return Price data by YCharts

Specifically, five years ago, in mid-September 2020, the world was essentially still locked down due to the COVID-19 pandemic. As a result, e-commerce demand was incredibly strong. In fact, from the start of 2020 through mid-September, Amazon had already risen by 63% versus just a 5% total return from the S&P 500. In other words, when looking at the past five years, Amazon was already starting from a place of strong performance.

NASDAQ: AMZN

Key Data Points

As a matter of fact, if we look at Amazon versus the S&P 500 from the beginning of 2020 through today, Amazon is actually ahead by about 26 percentage points.