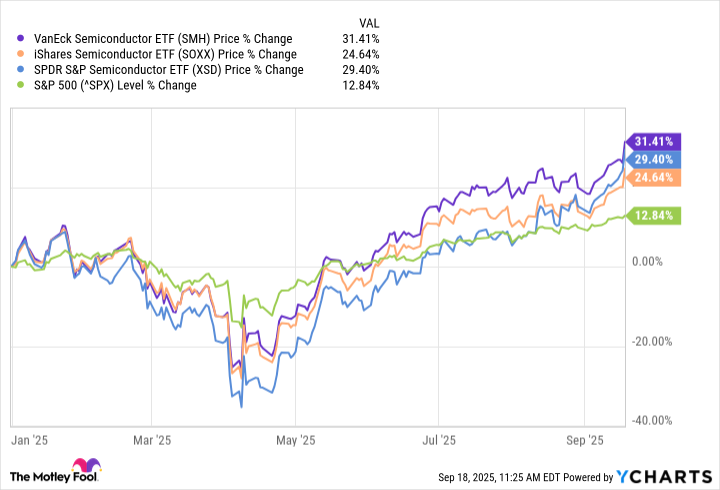

Semiconductor stocks and artificial intelligence (AI) are ruling the stock market this year. While the benchmark S&P 500 is up 12% so far in 2025, major semiconductor exchange-traded funds are by far outperforming the market.

And while companies like Nvidia, Advanced Micro Devices, and Broadcom are having solid years, they need a company to actually fabricate the semiconductors that they're designing. That's where Taiwan Semiconductor Manufacturing (TSM 4.20%) comes into play, and why it's one of the most consequential stocks on Wall Street right now.

Image source: TSMC.

About TSMC

Taiwan Semiconductor, also known as TSMC, is the world's largest independent semiconductor foundry. It makes advanced semiconductor chips for multiple companies, including Nvidia, Apple, Tesla, AMD, and others. The company says it used 288 different process technologies to produce nearly 12,000 products in 2024, proving its broad capabilities to literally any type of client.

According to research by The Motley Fool, 60% of the company's revenue comes from manufacturing its specialized 3 nanometer (nm) and 5nm chips. The transistor sizes are important -- a nanometer is 1 billionth of a meter, so the more transistors TSMC can squeeze into a semiconductor chip, the faster it can work.

Back in the second quarter of 2022 -- which is not that long ago -- TSMC earned 30% of its revenue from 7nm chips. But now it gets a full 36% of its revenue from 5nm chips and 24% from 3nm chips, according to The Motley Fool's research.

TSMC is one of four companies that make 3nm chips at scale, in addition to Samsung, Intel, and Xiaomi. TSMC and Samsung already have plans to mass-produce the 2nm process in 2025.

To say the chips are in high demand is an understatement. TSMC announced that its revenues in August were $11.13 billion, up 33% from a year ago and up nearly 4% on a sequential monthly basis.

The company is investing $165 billion into building new production facilities in Arizona to fabricate semiconductors domestically, which will help it get around any trade issues between Beijing and Washington.

Other ways that TSMC makes money

While the high-powered 5nm and 3nm chips make up the lion's share of TSMC's revenue, it also has other sources:

Smartphones (27%): TSMC's semiconductors helped make 5G smartphones function. 5G was one of the biggest developments of the smartphone industry in this decade, allowing customers to access the internet with connections as speedy as a broadband connection. 5G's higher data speeds allow for high-resolution video, real-time gaming, and quick downloading speed.

While the percentage of TSMC's revenue stream involving smartphones fell from 33% to 27% in the last year, this is still a critical space for TSMC. Apple highlighted the company's partnership with the fabricator in August when it announced a $600 billion commitment to manufacturing in the U.S.

Internet of Things (5%): TSMC's revenue from Internet of Things devices fell from 6% to 5% in the last year. This involves a variety of products including smart home devices, smart city devices, and wearable technology. Examples include smartwatches, industrial sensors, medical monitors, lighting, speakers, and robotic vacuums that don't need high-powered 3nm or 5nm chips to function.

Automotive customers (5%): This includes companies like Tesla, which are working to make autonomous driving a reality. This also involves creating chips for electric vehicles, driver assistance systems, and in-car infotainment systems.

The bottom line

TSMC is continuing to advance its technology to create smaller transistors in order to fabricate more powerful chips, and as long as it continues down this path, it will remain the world's top and most significant chip fabricator. That gives it an essential position in today's AI-driven stock market, making Taiwan Semiconductor stock for investors to consider.