Medical device specialist DexCom (DXCM +0.43%) has encountered significant headwinds since last year. The company's financial results in 2024 weren't nearly as strong as the market had expected, and over the past eight months, it has faced the threat of tariffs that could harm its margins and bottom line. DexCom's shares are down by 40% since January 2024.

Even so, the diabetes-focused company has several redeeming qualities that could enable it to deliver excellent returns over the next decade. Here's why DexCom stock is still a buy.

Image source: Getty Images.

What does DexCom do?

DexCom develops and markets medical devices called continuous glucose monitoring (CGM) systems that help people with diabetes track their blood glucose levels. CGMs have advantages over their main competitors, blood glucose meters (BGMs). The latter are manually operated gadgets that require painful fingersticks and are limited to reading a patient's blood glucose level at a specific point in time.

In contrast, CGMs eliminate the need for fingersticks, are automatic, and continuously track patients' glucose levels, measuring them up to once every five minutes. This provides patients with a much more accurate picture of how their sugar levels behave throughout the day and respond to various activities and foods. It enables diabetics to make informed decisions about their health daily. DexCom is a leader in the CGM market.

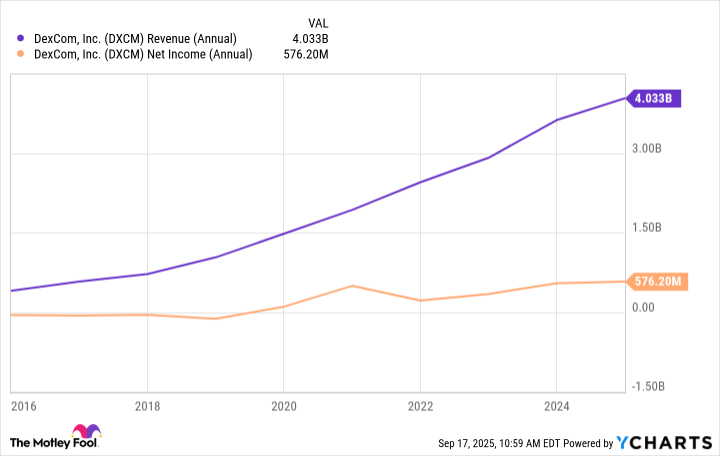

Thanks to the growing adoption of the technology over the past decade, the company has generated steadily increasing revenue and profits.

DXCM Revenue (Annual) data by YCharts.

Plenty of growth potential

DexCom ended 2024 with about 2.8 million to 2.9 million customers worldwide. That may sound like a lot, but it is actually a small fraction of its total addressable market. Despite stiff competition, mostly from medical device giant Abbott Laboratories, DexCom still has plenty of room to grow.

For one, there are some half a billion adults with diabetes worldwide, only about 1% of whom have access to CGM technology. True, many of them are in countries where DexCom does not yet operate. However, even in its more advanced markets, such as several European nations and the U.S., increasing insurance coverage, driven by growing clinical evidence of the benefits of CGM, has given DexCom ample room to grow.

In the U.S., the company estimates that there are more than 4.5 million patients eligible for coverage for CGM who are not yet using the technology. And that's in one of its more advanced markets.

NASDAQ: DXCM

Key Data Points

DexCom's opportunities worldwide remain massive. The company should also launch operations in new regions and increase its total addressable market, as it has historically done. Furthermore, DexCom's innovative qualities should present it with even more opportunities.

Last year, the company launched Stelo in the U.S., an over-the-counter CGM option for diabetes patients not on insulin. CGMs have typically targeted patients using insulin first, who needed a prescription in the U.S. before obtaining the device, until last year. The launch of Stelo expanded DexCom's addressable market. Similar breakthroughs in the future could achieve the same results.

DexCom can overcome the challenges

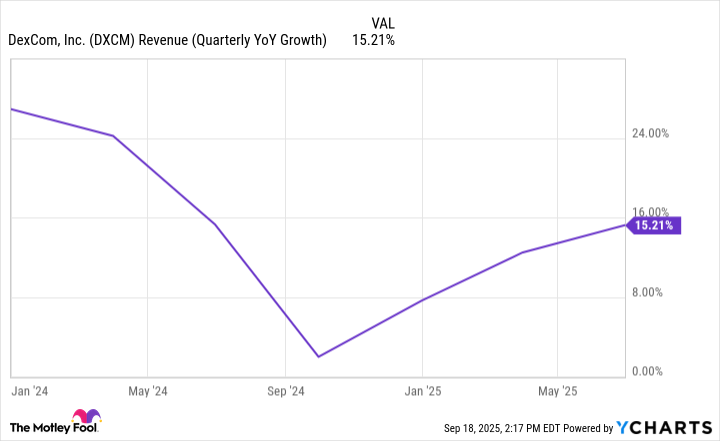

Last year, DexCom's financial results were unimpressive, partly because the launch of its newest device in the U.S., the G7, was marred by some issues. Specifically, more patients than anticipated took advantage of rebates, resulting in lower revenue for the company, especially in the second quarter of that year. DexCom's top-line growth has rebounded since.

DXCM Revenue (Quarterly YoY Growth) data by YCharts.

In Q2, the company's revenue came in at $1.2 billion, 15% higher than the year-ago period, while its non-GAAP (generally accepted accounting principles) per share grew 11.6% year over year to $0.48. The rebate issue is now mostly in the rearview mirror. What about competition, including from GLP-1 medicines, which some believe will disrupt the company's long-term prospects? DexCom has established itself as a leader in the CGM market, despite competing with the larger Abbott Laboratories.

As the company noted, weight loss drugs and CGM devices aren't mutually incompatible. The data show that physicians often prescribe them together to help patients better manage their weight and their diabetes. DexCom's prospects are safe from that threat.

Lastly, even though tariffs pose a potential threat to the company's business, DexCom should be able to manage them. The company expects at most a 50-basis-point (or 0.5%) reduction in its operating profits for the year due to tariffs.

DexCom has a large manufacturing footprint that spans multiple countries, including significant operations in the U.S., which helps mitigate this issue to some extent. This headwind should be a relatively minor one for the medical device specialist. Overall, given its rebounding financial results, long runway for growth, and innovative abilities that have allowed it to be one of the leaders in CGM technology, DexCom's prospects look attractive.

After the beating the company's shares have taken over the past 18 months, now is a great time to buy.