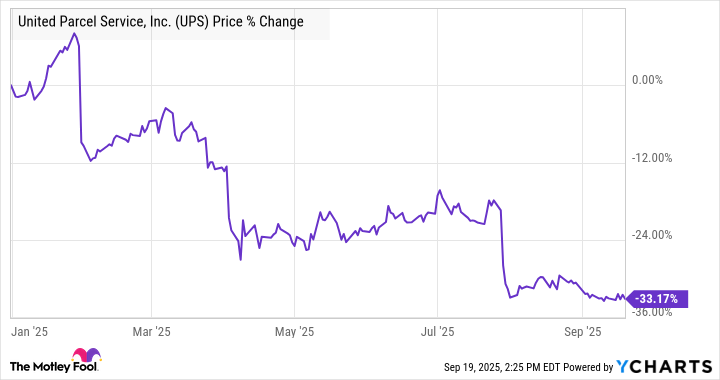

United Parcel Service (UPS 1.43%) stock is undoubtedly one of the most intriguing investment propositions on the market today. It's a blue-chip stock trading on less than 13 times the Wall Street analyst consensus earnings estimate for 2025, and sporting a whopping 7.7% dividend yield.

Moreover, management recently confirmed its commitment to a "stable and growing dividend." Does it all add up to make the stock a buy despite its difficulties in 2025?

Image source: Getty Images.

Three considerations for investors

Before deciding on buying the stock, there are three factors investors need to be comfortable with first:

- Is management's current capital allocation strategy making sense in the light of challenging near-term trading conditions?

- Are the deteriorating trading conditions significant enough to negatively impact fundamentals over more than the near term?

- UPS is having a noisy operational year as it scales back Amazon delivery volumes and assumes final-mile delivery from the USPS for SurePost packages in 2025.

UPS' capital allocation strategy

Investors have a right to question this for a few reasons. At the start of the year, management told investors it planned for $5.7 billion in free cash flow (FCF), and make $5.5 billion in dividend payments, with $1 billion in share buybacks.

Wall Street analysts questioned management over the prudence of the plan on an earnings call earlier in the year. CEO Carol Tomé said UPS had "plenty of liquidity to pay the dividend" and even referred to internal discussions over taking on debt to finance share buybacks as the cost of the debt was lower than the dividend yield at the time.

UPS investors will be happy that no debt was taken on board, as management spent $1 billion on share buybacks in the first half, and as the chart below shows, it was at significantly higher prices than where the stock trades now.

Moreover, the deteriorating market conditions resulted in FCF of just $742 million in the first half, compared to $3.4 billion in the first half of 2024.

Simply put, while UPS tends to generate heavy earnings in its fourth quarter (about $2.3 billion in FCF in the fourth quarter of 2024), it's extremely unlikely to generate the $5 billion in free cash flow in the second half, necessary to meet its full-year target of $5.7 billion.

At which point, investors are entitled to be critical of the $1 billion spent on share buybacks and $5.5 billion commitment to the dividend.

Deteriorating fundamentals

There are four things to focus on here.

First, the ongoing trade dispute is damaging international trade, as noted by Tomé on the last earnings call: "Our China to U.S. trade lane is our most profitable trade lane, and the volume decline here pressured our international operating margin."

Second, delivery volumes in management's key target market of small and medium-sized enterprises (SMEs) fell short of expectations in the first half, and the current trade environment is creating unique challenges for them. Third, according to BMO Capital analyst Fadi Chamoun, UPS' higher-margin business-to-business market continues to struggle.

Finally, the weakness in small package delivery volumes this year suggests that the supply surplus in the industry (created by the boom in capacity expansion during the COVID-19 lockdowns) remains in place.

Image source: Getty Images.

A noisy year

The challenging trading conditions discouraged management from updating guidance on the second-quarter earnings presentations in late July.

However, this year contains numerous operational adjustments. Not only did UPS embark on a plan to reduce Amazon delivery volumes by 50% from the start of 2025 to the end of the first half of 2026, but it also took back last-mile deliveries for its SurePost service from the USPS. It's hard to separate the impact of these adjustments on its underlying earnings.

A stock to buy?

The noise around operational changes is making the optics difficult in a year full of challenges to its trading environment, and it doesn't help that management's capital allocation strategy (which is under its control) probably needs adjusting.

As such, while UPS has excellent long-term prospects, it makes sense to wait for more clarity on its medium-term outlook and see how management is addressing its current challenges before making an investment.