Although "neodymium-praseodymium (NdPr)" may not be a term you use everyday, you most likely depend on its uses everyday.

That's because NdPr is critical for making the super-strong magnets in electric vehicles (EVs), wind turbines, smartphones, robotics, defense systems, and more.

For years the U.S. has depended on foreign sources for rare metals like NdPr. But mining company MP Materials (MP 0.76%) is aiming to change that.

As the owner and operator of the only rare-earth metal mine and processing site in the U.S., the Mountain Pass mine in California, MP Materials is setting itself up to be the country's go-to for certain rare earth metals.

The stock has a lot of momentum -- up almost 350% on the year -- but can it go parabolic in three years?

Image source: Getty Images.

Strategic partnerships, but a cash-bleed problem

MP Materials makes money by selling rare-earth concentrates and oxides, like NdPr oxide, and by producing permanent magnets for a myriad of markets, including electric vehicles.

In July 2025, MP got two huge votes of confidence. One was a multibillion-dollar package from the Department of Defense (DoD), which invested $400 million in MP's stock and agreed to buy NdPr oxide at a price floor of $110 per kilogram over the next decade.

The second was a $500 million partnership with Apple (AAPL 0.28%). A first-of-its-kind deal, MP will supply Apple with magnets for "hundreds of millions" of devices starting in 2027.

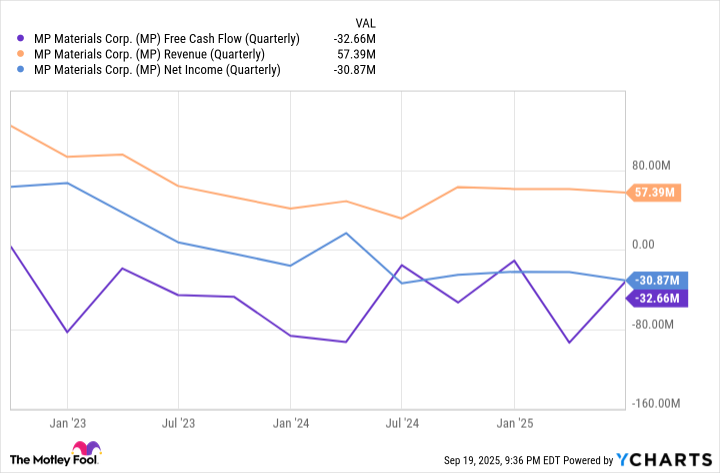

Both of these could set MP up for a strong three years to come. But let's not overlook the risks. MP isn't profitable, and it doesn't have the manufacturing capacity to meet high demand for super-strong magnets.

MP Free Cash Flow (Quarterly) data by YCharts

At its current price, MP trades at almost 83 times forward earnings, a rich valuation that looks more like tech than mining.

With a multiple like that, MP will need something big -- like the completion of its 10X facility -- to go parabolic by 2028. It's possible, but only invest if you can stomach losses, as volatility should be expected.