Nvidia (NVDA +1.68%), the largest company in the world, endured a topsy-turvy ride on the stock market in 2025. Shares of the company dipped in the first four months of the year owing to restrictions on sales of its chips to Chinese customers, as well as concerns about the health of AI infrastructure spending.

However, it has made a remarkable recovery in the past five months. In all, Nvidia stock is up 32% in 2025 despite a poor start to the year. Investors will now be wondering if Nvidia stock can sustain its momentum in 2026.

We will take a closer look at Nvidia's catalysts and check how much upside this high-flying technology stock is likely to deliver by the end of next year.

Image source: Getty Images.

These data points suggest that Nvidia could keep growing at a nice pace next year

Nvidia became the largest company in the world thanks to its dominance in the artificial intelligence (AI) chip market. The company controls an estimated 80% of the AI accelerator market. That's precisely the reason why it is on track to deliver healthy growth in 2026, as companies and governments are likely to spend more money to build enough cloud infrastructure to meet the booming AI demand.

NASDAQ: NVDA

Key Data Points

Market research firm Gartner estimates that companies will spend $267 billion on AI accelerators such as graphics processing units (GPUs) and custom processors that are deployed in cloud servers, up from $140 billion last year. In 2026, that number is expected to swell to almost $330 billion.

That's not surprising considering the pace at which the revenue backlogs of cloud computing giants such as Microsoft, Oracle, Alphabet's Google, and Amazon are growing. Apart from these hyperscalers, neocloud companies such as CoreWeave and Nebius that rent out GPUs to customers for running AI workloads have also been landing huge contracts and have significant contractual backlogs.

Nvidia sold $102 billion worth of AI compute chips in 2024, suggesting that it was controlling around 73% of this market last year. Assuming that the spending on AI accelerators indeed hits $330 billion in 2026 thanks to the catalysts pointed out above, and Nvidia controls 70% of this space at that time, its data center compute revenue could land at $231 billion in 2026.

Nvidia, therefore, is on track to more than triple its AI accelerator revenue in the space of just two years. On the other hand, investors should note that the company's other segments are in fine form as well, and they could complement the robust growth of the data center business.

These additional catalysts can set the stock up for more gains

Nvidia generated $28 billion in revenue in the previous fiscal year (which ended in January this year and coincided with 11 months of 2024) from sources that exclude its AI data center GPU business.

These other segments include its networking business, along with gaming, automotive, and professional visualization. The combined fiscal 2025 revenue from these non-AI data center chip businesses grew by almost 29% from the prior fiscal year. Nvidia has the ability to keep clocking healthy growth rates in these segments thanks to the secular growth opportunity presented by AI-enabled personal computers (PCs), smarter cars, and digital twins.

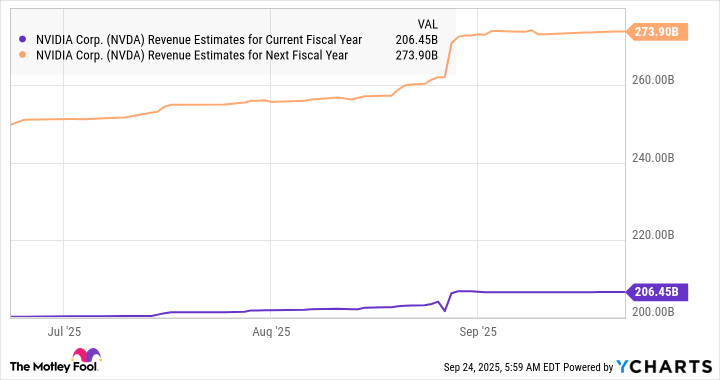

Assuming that its non-AI accelerator businesses see 20% growth in 2025 and 2026, they could contribute $40 billion to its top line in the next fiscal year. So, Nvidia has the potential to generate north of $270 billion in fiscal 2026 (including the $231 billion revenue potential of the data center compute business), and this is precisely what consensus estimates are projecting.

However, what's worth noting here is that the estimate for next year has been bumped up significantly. It won't be surprising to see that estimate head higher as companies reliant on Nvidia's GPUs to run AI applications in the cloud decide to spend more.

Assuming Nvidia can hit $280 billion in revenue next year and trades at 20 times sales at that time (a discount to its current price-to-sales ratio of 26), its market cap could jump to $5.6 trillion. That points toward a potential upside of 30% in its stock price, suggesting that this AI stock still has room for more upside and could eventually go on to hit a $6 trillion valuation.