Lululemon Athletica (LULU +1.35%) has historically been a big winner on the stock market.

The company pioneered a new category of apparel -- athleisure -- and it made yoga pants a mainstream, everyday item. It's also succeeded in maintaining its pricing power and its high-end or even luxury branding, even as it's faced a wide range of lower-priced competition.

However, this year, Lululemon has run into trouble, and the stock has swooned. It's facing challenges on multiple fronts.

Comparable sales in the U.S., its biggest market, are now declining due to weak consumer discretionary spending in categories like apparel, a trend away from yoga pants to baggier fits as workout clothes, and the company's own errors, as management admitted it had not done enough to keep its styles in lounge and social fresh. It also sold out of popular styles in other categories.

In its second-quarter earnings report earlier this month, Lululemon also cut its earnings guidance due in large part to the ending of the de minimis exemption, which had allowed importers like Lululemon to avoid paying tariffs on shipments that were $800 or less. The company had relied on that carve-out to ship e-commerce orders from Canada to the U.S. It now will rearrange its supply chain to avoid having to pay the tax.

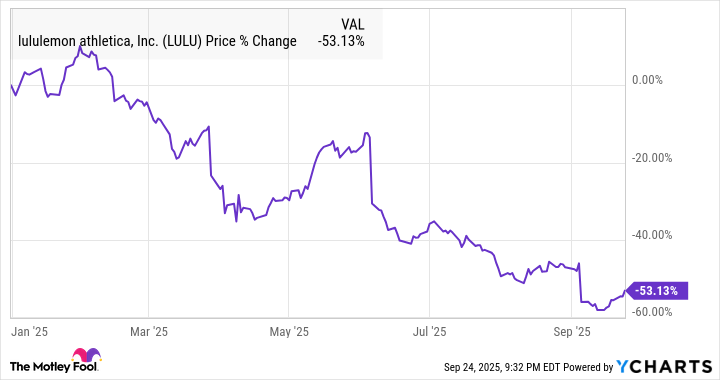

As you can see from the chart below, the stock is down 53% year to date, making it one of the worst-performing stocks on the S&P 500.

Going back to its peak in late 2023, the stock is down 65%. However, the sell-off looks like a good buying opportunity for long-term investors. Keep reading to see why.

1. Most of its challenges seem temporary

The problems facing Lululemon don't seem insurmountable. For example, the macroeconomic challenges seem related to the sluggish job market, fears about tariffs, and generally stubborn inflation. Discretionary spending has been weak for categories like restaurants and apparel this year, but that will eventually change whenever consumer confidence improves.

The impact of the removal of the de minimis exemption is also a one-time hit. While it was a setback for the company, it is now clearly priced in. On the earnings call, management said that the increased tariffs and the end of the de minimis exemption "played a large part in our guidance reduction for the year." That problem won't repeat.

The adjustments Lululemon has to make with its inventory are trickier, but the company has a plan. It's introducing more new styles, raising the percentage of newness in its overall assortment from 23% to 35% by next spring, and it's making its go-to-market process faster so that it can more quickly respond to customer demand trends and be sure that a popular item is in stock.

Image source: Getty Images.

2. International markets are still strong

While the company may be losing business in the U.S., sales in China, its second-biggest market, are soaring. Comparable sales jumped 17% in China, driving overall revenue up 25%.

Lululemon is clearly following in the footsteps of other American brands like Nike and Starbucks that have had success in a market known for conspicuous consumption, and it still sees a long runway for new stores there. It opened five stores in China in the quarter, and plans to open at least 15 in that market next year.

While success in China won't make up for the weakness in the U.S. on its own, it does show that the Lululemon growth story is not dead.

NASDAQ: LULU

Key Data Points

3. The stock is cheap

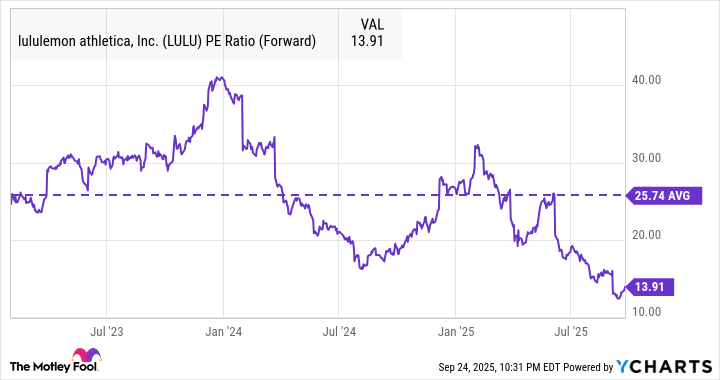

The company lowered its EPS guidance to between $12.77 and $12.97. Based on that forecast, the stock currently trades at a forward P/E of 14, which is roughly half the P/E of the S&P 500.

That valuation seems to assume that Lululemon is basically a no-growth stock from this point on. If the company can get back to its earlier winning ways, there's a lot of upside potential for the stock, as it has historically traded at a much higher price.

As you can see from the chart below, the valuation has been twice what it is now in recent years.

LULU PE Ratio (Forward) data by YCharts

Overall, a recovery in the stock could take time, but Lululemon looks oversold at current levels. Over the next few years, the stock is a good bet to be a winner.