Exchange-traded funds (ETF) have become a major element of many long-term investing portfolios. There are many benefits to owning ETFs, but ETFs are not all the same. There are actively managed funds, like popular investor Cathie Wood's Ark Invest ETFs, and passively managed ETFs, like Vanguard's.

Vanguard offers 98 options that cover every stripe of investor, from high-risk tech-focused ETFs to high-dividend yield ETFs, and they all track indexes. They offer different benefits for investors, and if you're looking for two options that could help set you up for life, I recommend the Vanguard S&P 500 Growth ETF (VOOG 1.62%) and the Vanguard Information Technology ETF (VGT 2.21%).

Image source: Getty Images.

The best of the S&P 500

As its name implies, the S&P 500 Growth ETF owns the growth-oriented stocks in the S&P 500. It owns 213 stocks as of this writing, and they lean toward the largest stocks in the index, since these are predominantly the higher-growing ones. Its largest positions are Nvidia, Microsoft, Meta, and Apple, but it also owns dividend stocks like Moody's and Sherwin-Williams, which help mitigate some of the risk.

Owning 200 stocks is wide diversification, even if it's not as diversified as the total S&P 500. That also minimizes some of the risk of investing in high-growth stocks.

And because it tracks an index rather than being actively managed, stocks that aren't doing as well will get automatically traded out of the index and out of the ETF, while new stocks making it into the index will end up in your portfolio.

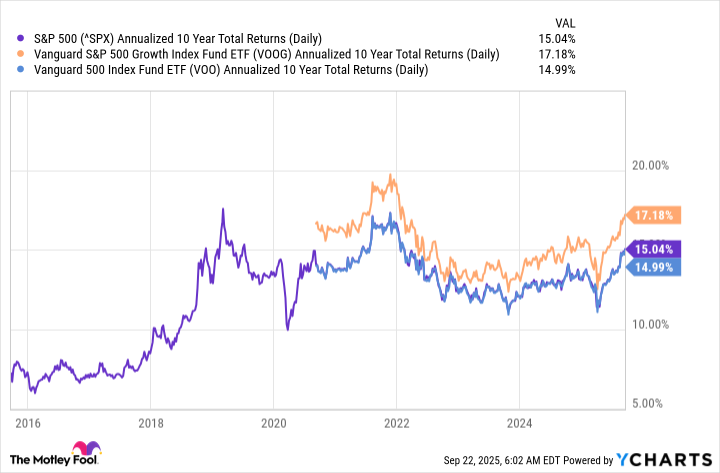

These features give it an edge over the standard Vanguard S&P 500 ETF, and it has outperformed the index over time. In fact, it's the fifth-highest-gaining Vanguard ETF over the past 10 years.

It also has a low expense ratio of 0.07%, which compares favorably with the industry average of 0.93%.

It has Vanguard's second-highest risk level, so it's not for the most risk-averse investor. But it is for investors looking to help get set for life.

High in tech, high in gains

Of all the Vanguard ETFs that have been in operation for at least 10 years, the highest-gaining one is the Information Technology (IT) ETF. This is Vanguard's tech ETF, and its three largest components are the same as the growth ETF, but they make up a higher percentage of the total -- around 45% -- and after those, things start to change. This one includes artificial intelligence (AI) stocks like Palantir Technologies and Advanced Micro Devices in its top 10. It also includes many new upstarts that most investors haven't even heard of, although they account for minuscule percentages of the whole. However, it has more total components than the growth ETF, 316 today, which gives investors exposure to many new stocks that could explode into the next important tech stocks, and also helps minimize overall risk.

The IT ETF has Vanguard's highest risk status, and one of its highest expense ratios at 0.09%. However, it says the industry average is 0.93%.

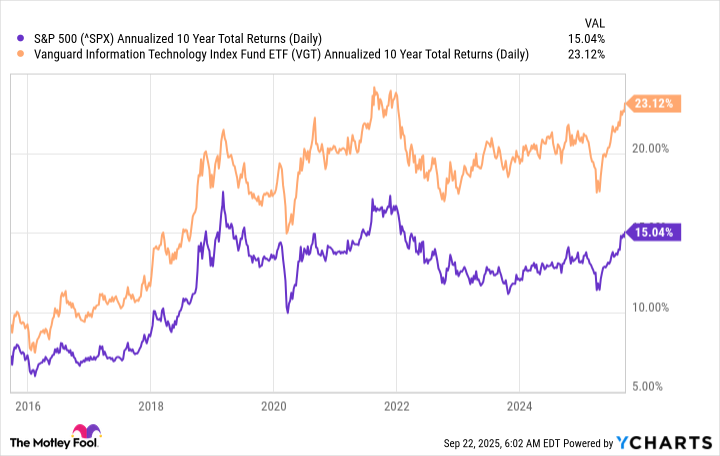

It also has the highest gain among all of Vanguard's 98 ETFs over the past decade.

This ETF isn't for investors who don't have an appetite for risk, but over time, these stocks have outperformed the market. Growth stocks tend to lead the market in either direction, outperforming when the market is soaring and doing worse than the market when it's plunging. This ETF can potentially outperform other investments and build wealth for investors, and it can be a significant asset in your portfolio due to the market's typical strong performance over many years.