Marijuana stocks are getting some attention this week following new interest from President Donald Trump.

Trump on Sunday posted a video on his Truth Social account that promoted the health benefits of hemp-derived CBD for seniors, suggesting it could be included under Medicare. The video suggests CBD can help seniors manage pain, reduce stress, and get more sleep.

Image source: Getty Images.

Trump hints toward federal action on marijuana

The video comes just a few weeks after Trump said he was considering reclassifying marijuana on the federal level as a less dangerous drug. Several states already allow marijuana for recreational purposes, but it remains a Schedule 1 substance under the Controlled Substance Act, and there's been no action on the federal level to change it, despite advocates pushing for it for years.

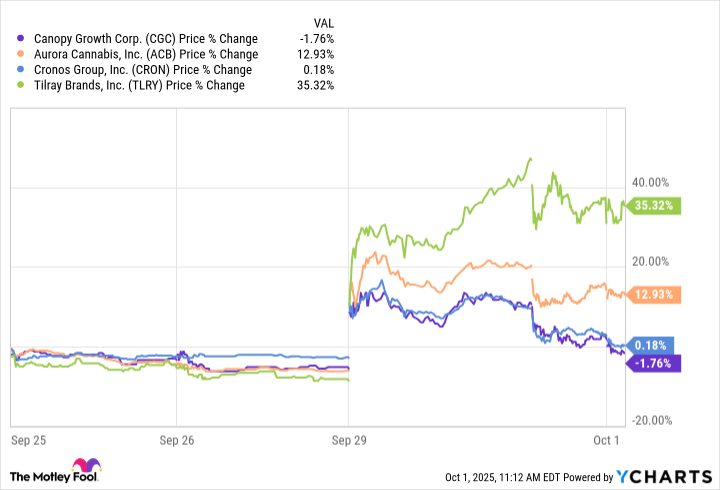

However, the twin tailwinds gave a sharp boost to marijuana stocks, including an 18% jump for Canopy Growth (CGC -5.48%), a 25% upward move by Aurora Cannabis (ACB -3.94%) and a 15% increase for Cronos Group (CRON -4.14%). One of the biggest gains was for Tilray Brands (TLRY -4.62%), which rose 42% on the news.

While Cronos and Canopy Growth have already given back their gains, Tilray and Aurora continued to show positive momentum this week.

What's the outlook for cannabis stocks?

Before Trump posted the video on his Truth Social feed, Grand View Research estimated that the U.S. market size for cannabis would grow from $38.5 billion in 2024 to $74 billion by 2030, for a compound annual growth rate of 11.51%. That's not a huge market, and investing can be challenging because the market capitalizations of some companies are exceptionally low. For instance, Aurora Cannabis has a market cap of only $329 million.

For investors who have a strong risk tolerance, a marijuana-themed exchange-traded fund could be a better option than individual stocks. The top-performing names this week include the following:

- The Amplify Seymour Cannabis ETF (CNBS 2.84%) and the Amplify Alternative Harvest ETF (MJ -1.69%): These are operated by the same company. Alternative Harvest's biggest holding is Seymour Cannabis, which accounts for 48% of the fund. The largest individual company Alternative Harvest holds is Tilray Brands, which makes up 18% of the fund and is one of the best-performing cannabis stocks this week. That's how Alternative Harvest, with a 17.2% gain over the last week, managed to outgain Seymour Cannabis, whose biggest holding is U.S. Treasury bills. Seymour Cannabis is up 12.2% this week.

- AdvisorShares Pure US Cannabis ETF (MSOS 5.64%): This is marketed as the first actively managed U.S.-listed ETF with cannabis exposure from U.S. companies, but much of this ETF is made up total return swaps. That means it pays a fee to a third party, such as a bank, to invest in a company and also pays a fee to receive the gains or absorb the losses. The fund is up 11.9% this week.

- AdvisorShares Pure Cannabis ETF (YOLO -1.42%): This ETF includes what you would expect when you think about cannabis stocks, but its biggest holding (nearly 40%) is AdvisorShares Pure US Cannabis. This fund is up 11% in the last week.