Any investor would love to follow in Warren Buffett's footsteps, choosing stocks that over time will create a billion-dollar portfolio. The storied investor manages more than $257 billion in securities at the helm of Berkshire Hathaway and has generated market-beating returns over almost 60 years.

While our portfolios may not hit the $1 billion mark, I have good news for you: Following some of Buffett's moves could help lift the value of your portfolio and shepherd you along the path to wealth. This means adding some of Buffett's investing principles to your own strategy -- for example, a focus on long-term investing -- and including a couple of his favorite stocks in your portfolio.

So, let's get started by considering two players the billionaire has owned for decades: Coca-Cola (KO 0.40%) and American Express (AXP -0.41%). In Buffett's 2023 shareholder letter, he wrote: "During 2023, we did not buy or sell a share of either AMEX or Coke -- extending our own Rip Van Winkle slumber that has now lasted well over two decades. Both companies again rewarded our inaction last year by increasing their earnings and dividends."

These have been players Buffett has relied on over time. Now the question is, if you could buy only one today, which one should you choose? Let's find out.

Image source: Getty Images.

The case for Coca-Cola

Buffett is known to drink Coca-Cola's eponymous beverage every day, and he isn't the only one. The company is the world's biggest maker of nonalcoholic beverages and has a fantastic moat, or competitive advantage -- this is its brand strength as well as its global distribution network. Buffett loves moats, as these may ensure a company's market position and therefore earnings strength over time.

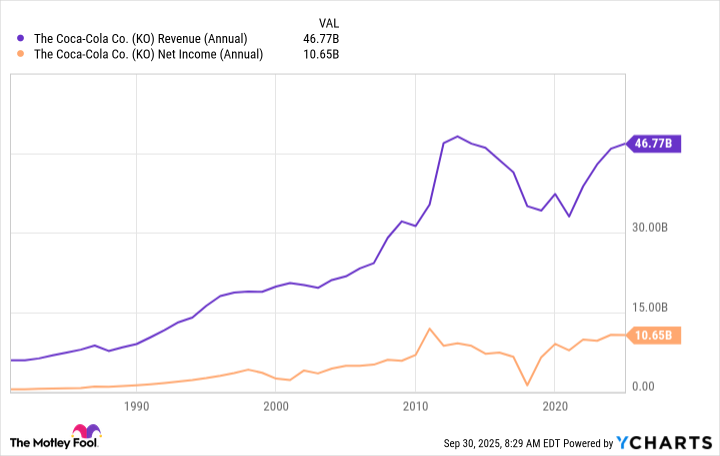

Coca-Cola isn't a high-growth player, with revenue climbing only 1% in the recent quarter, but over a period of years, the company has been reliable, progressively increasing revenue and net income.

KO Revenue (Annual) data by YCharts

And though Coca-Cola is most known for Coca-Cola and variations such as Diet Coke, the company owns a variety of popular drinks, from Fuze Tea to Minute Maid juices. Meanwhile, the beverage giant also innovates according to the tastes of different countries to drive growth and uses data to offer drink sizes and formats that appeal to specific markets too. This should keep the company on the right path as the overall market evolves.

Finally, what Buffett may like best about Coca-Cola is the company's dividend growth. As a Dividend King, it's lifted the payout for more than 50 consecutive years -- a sign that rewarding investors is important to the company and that it's likely to continue along this path. Today, Coca-Cola pays a dividend of $2.04, representing a yield of 3% -- that surpasses the S&P 500 (^GSPC 0.40%) dividend yield of 1.2%.

The case for American Express

You may think that American Express, as a credit card giant, would be a risky bet as any economic downturn may weigh on the company. But that actually isn't the case, and here's why: American Express, as a premium card company, generally attracts members in higher income categories, and these users are less likely to suffer in difficult economies. In fact, in many instances, American Express has noted that this cohort keeps on spending.

Why do high-income consumers like American Express so much? For two major reasons. First, the company acts quickly to help customers when problems arise -- like potential fraudulent use of a card, for example. And second, American Express offers customers many perks, such as discounts at restaurants and upgrades at hotels.

All this has helped the company increase earnings over time, and in the recent quarter, revenue reached a record of nearly $18 billion. Importantly, American Express is generating significant growth from younger customers -- a sign that its revenue momentum may continue over the years to come. In the recent quarter, 63% of global new accounts were for millennial and Gen-Z consumers.

Finally, Buffett clearly likes American Express for its dividend too, as the company pays shareholders $3.16 per share for a yield of 0.9%.

Drinks or credit cards?

So, which Buffett favorite makes the better buy -- the beverage giant or the credit card powerhouse?

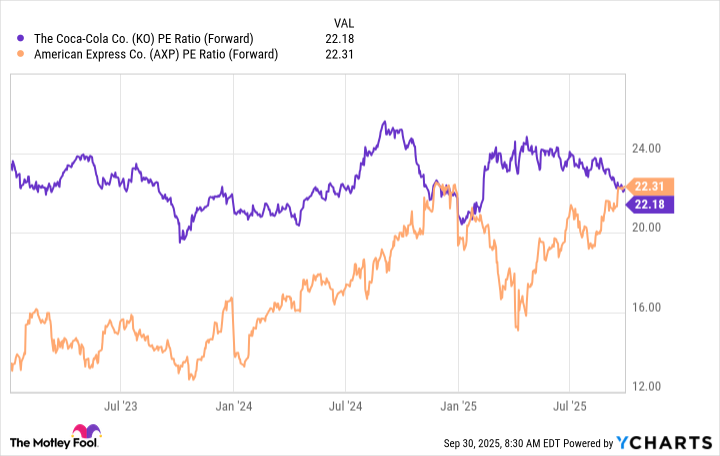

Both stocks actually trade at almost exactly the same valuation right now, as you can see in the chart, though Coca-Cola's valuation has declined a bit, while American Express' has advanced to reach this level.

KO PE Ratio (Forward) data by YCharts

I would say the answer to this question, though, depends on your strategy. If you're a cautious investor looking for dividend income over time, Coca-Cola makes a great buy today, on this small dip in valuation. Coca-Cola is the ultimate Buffett dividend stock, in my opinion.

But if you're a growth-oriented investor, it's worth picking up American Express, as it's still reasonably priced -- and earnings and the stock price may deliver stronger gains over time.