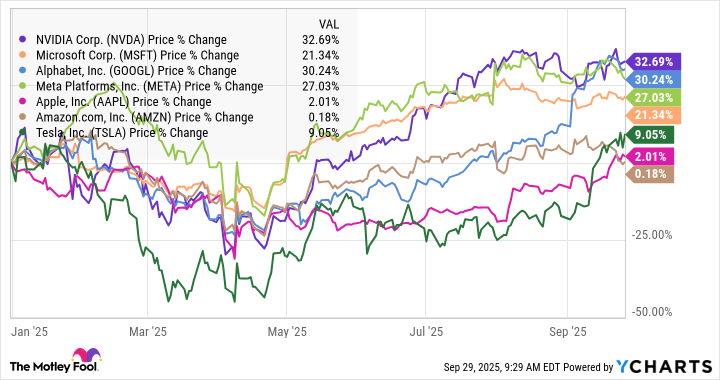

The "Magnificent Seven" has been driving the AI boom ever since its earliest days.

The group of seven stocks, which includes seven of the most valuable stocks on the market -- Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta Platforms, and Tesla -- all have some exposure to AI and are seen as the leading technological companies.

Image source: Getty Images.

However, after driving the stock market rally through 2023 and 2024, the Magnificent Seven's performance has been more pedestrian this year. In fact, three of the seven have underperformed the S&P 500 so far.

A basket of all seven of those stocks would have gained 17.5% so far this year, outperforming the S&P 500 through Sept. 26, which was up 13%. That's a solid return, and investors can get exposure to the Magnificent Seven through exchange-traded funds (ETFs) like Roundhill Magnificent Seven ETF.

However, there's one ETF that has not only nearly doubled the return of the Magnificent Seven this year, it's beaten every stock in the elite group through Sept. 26. That's the VanEck Semiconductor ETF (SMH 2.52%), which is up 33.2% year to date, and has a long track record of outperforming the S&P 500.

Meet the VanEck Semiconductor ETF

The VanEck Semiconductor ETF aims to replicate the MVIS U.S.-listed Semiconductor 25 Index, and like the Magnificent Seven, its biggest holdings have significant exposure to AI. These are the top 10 stocks in the ETF.

| Stock | % of ETF |

|---|---|

| Nvidia | 21.8% |

| Taiwan Semiconductor Manufacturing (TSM 1.68%) | 10.6% |

| Broadcom (AVGO 3.21%) | 9.5% |

| Advanced Micro Devices (AMD 1.75%) | 6% |

| Lam Research | 4.4% |

| Analog Devices | 4.4% |

| ASML | 4.2% |

| Micron Technology | 4.1% |

| Texas Instruments | 4.1% |

| Qualcomm | 4.1% |

Nearly 40% of the value of the ETF comes from Nvidia, TSMC, and Broadcom, three stocks that have been top performers in the AI boom. Notably, the VanEck Semiconductor ETF has also outperformed the iShares Semiconductor ETF because the SMH's holdings are more concentrated in those three leading stocks.

While the Magnificent Seven might hold better-known stocks like Apple and Tesla, semiconductor companies have seen their business soar during the AI boom as they are providing the core computing power to make AI applications work. They form the building blocks of the AI revolution, and should as long as the data center buildout phase continues, with companies like Oracle pledging to spend hundreds of billions of dollars on AI infrastructure.

Is the VanEck Semiconductor ETF still a buy?

The VanEck SMH ETF is not only outperforming the S&P 500 this year, but it has a long track record of delivering superior returns. Since its inception in 2011, the fund has gained more than 2,000%, turning a $10,000 investment into more than $200,000 and trouncing the S&P 500 along the way, which is up by less than 600% during that time.

NASDAQ: SMH

Key Data Points

Looking at its valuation, the SMH ETF isn't cheap, but it's not as expensive as you might think. It currently trades at a price-to-earnings ratio of 39, which is much cheaper than popular AI stocks like Tesla or Palantir Technologies, and is only moderately more expensive than the S&P 500 at a P/E of 28. Meanwhile, some of the VanEck Semiconductor ETF's top holdings, like Taiwan Semiconductor, still look cheap considering its growth rate.

Given its exposure to the top chip and AI stocks and its diversification across the industry, the SMH ETF still looks like a strong buy. Over the long term, the fund looks like a good bet to continue to outperform the S&P 500, and given the massive capex spending in AI, it has an edge over the Magnificent Seven group as well.