Cybersecurity specialist Fortinet (FTNT 1.17%) started the year on a solid note, but a closer look at its stock price chart tells us that it didn't take long for investors to press the panic button. The stock has witnessed a lot of volatility in 2025 due to its tepid quarterly reports in the past couple of quarters.

That's the reason why Fortinet stock is down 26% from the 52-week high it reached in February this year. The stock's expensive valuation and underwhelming numbers have weighed on its performance so far this year. Its latest set of results for the second quarter of 2025 (released in early August) further dented investor confidence.

However, it may be a good idea to start accumulating Fortinet stock following its pullback. Let's look at the reasons why.

Image source: Getty Images.

The market may have been too harsh on Fortinet stock

Wall Street analysts point out that Fortinet's growth isn't as strong as expected. The company was expected to benefit from a $450 million revenue opportunity arising out of the upgrade of older firewalls to next-generation firewalls in 2025 and 2026.

However, Fortinet management's comment on the latest earnings call that it was "approximately 40% to 50% of the way through the 2026 upgrade cycle at the end of the second quarter, based on the remaining active units and service contracts, and we expect continued upgrade activity for the remaining devices over the next 6 quarters" has turned out to be a negative for the company.

Analysts are now questioning why the upgrade cycle hasn't translated into stronger product revenue growth for the company. On top of that, there are concerns that Fortinet's growth could trail off once the upgrade cycle is complete in the next year and a half. That's the reason why several Wall Street companies have downgraded Fortinet stock lately.

Only 27% of the 45 analysts covering Fortinet rate it as a buy. However, what's worth noting is that Fortinet's growth is indeed accelerating. Its revenue in Q2 2025 jumped by 14% from the year-ago period to $1.63 billion, edging past the consensus estimate. That was better than the 11% growth it recorded in the same period last year. It raised its full-year billings guidance as well.

The company's remaining performance obligations (RPO) increased by 12% to $6.64 billion. This metric refers to the total value of a company's contracts that are yet to be fulfilled at the end of a period, and its size indicates that Fortinet has the ability to keep growing at healthy double-digit rates in the future.

NASDAQ: FTNT

Key Data Points

Importantly, Fortinet's growth in fast-growing cybersecurity niches such as unified secure access service edge (SASE) and security operations (SecOps) is exceeding its overall growth. For instance, its annual recurring revenue (ARR) for the unified SASE solution (which is a cloud-based framework that integrates networking and cybersecurity operations into a single platform) increased by 22% from the year-ago period.

Meanwhile, its SecOps ARR increased at a much faster pace of 35%. Unified SASE and SecOps now account for $1.6 billion in ARR. Looking ahead, these two end markets could move the needle in a bigger way for Fortinet. The unified SASE space is expected to grow at an annual rate of 18% through 2029, opening an addressable opportunity worth $78 billion. Meanwhile, the artificial intelligence (AI)-focused SecOps market is expected to present a $165 billion opportunity in 2029.

These markets are enabling Fortinet to land bigger deals and enhance its revenue pipeline. For example, there was a 51% year-over-year jump in the value of deals worth more than $1 million last quarter for Fortinet. All this indicates that analysts may be underestimating the company's long-term growth potential.

The valuation suggests that it may be a good idea to buy this cybersecurity specialist

Fortinet's slide in 2025 has brought its price-to-earnings ratio to 33, in line with the tech-laden Nasdaq-100 index's earnings multiple. If the stock continues to slide in the near term and becomes available at a relatively cheaper valuation, it may be a good idea to start buying it considering the potential acceleration in its bottom-line growth.

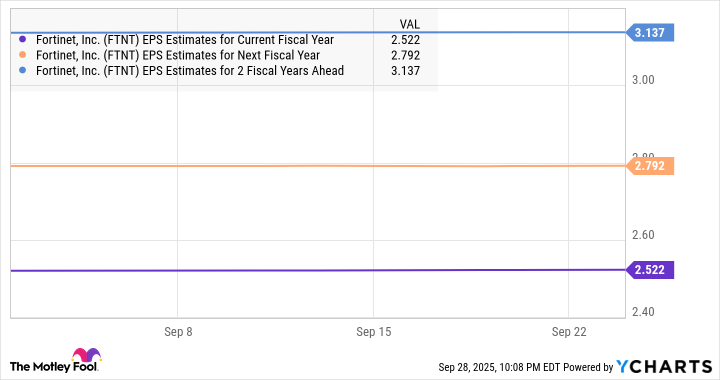

Analysts are expecting a single-digit jump in its earnings in 2025 to $2.52 per share. However, the forecast for the next two years points toward an improvement in that growth rate.

FTNT EPS Estimates for Current Fiscal Year data by YCharts.

The rapid growth of Fortinet's unified SASE and SecOps businesses could help it land bigger deals and contribute toward a faster jump in its earnings. That could set this cybersecurity stock up for a rally in the future. Savvy investors can consider accumulating Fortinet stock, as it has the potential to regain its mojo.