Alibaba (BABA +1.73%) was among the winners last night as the Chinese tech giant continued to benefit from investments in artificial intelligence, as investors increasingly see it as a winner in AI.

Additionally, Founder Jack Ma has returned to the company's headquarters, showing relations between him and Beijing have improved.

Overall, last month's gains were part of a broader momentum shift as investors seem to be moving back into Alibaba, after it was off-limits for several years due to the tech crackdown from Beijing and weak economic growth in China.

Image source: Alibaba.

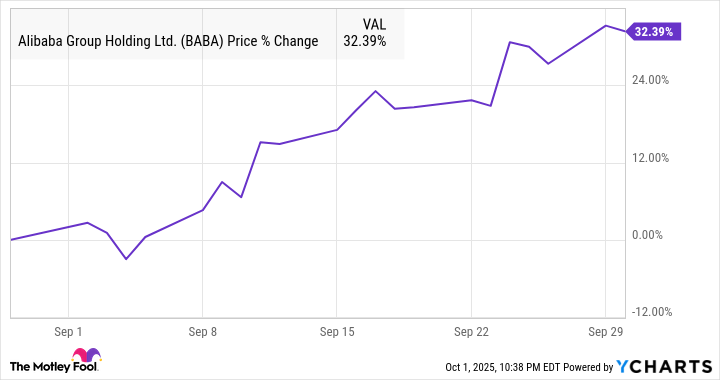

According to data from S&P Global Market Intelligence, the stock finished the month up 32%. As you can see from the chart below, the stock climbed steadily over the course of the month.

Alibaba rides the AI wave

September was a good month for AI stocks in general, as several companies, including Oracle, gave bullish forecasts and projected tens of billions in capex spending. However, Alibaba also had some good news of its own to report.

First, momentum from its June quarter earnings report at the end of August seemed to carry over to the beginning of September as Alibaba received several price target hikes and bullish analyst notes, observing that Taobao grew daily active users by 20%.

NYSE: BABA

Key Data Points

A report from The Information later in the month said that Alibaba was developing its own AI chips as export restrictions have made it difficult to get Nvidia chips.

A Bloomberg report also said that Ma had returned to the company and is now more involved than he's been in five years. Ma had provoked the crackdown from Beijing after he insulted some finance ministers at a conference.

Later in the month, Alibaba received an order for its AI chips from China's second biggest telecom, China Unicom, giving the stock a boost. Then, the biggest news came on Sept. 24 when it announced a new partnership with Nvidia, unveiled a new AI model, said it was expanding new data centers around the world, and said it would increase AI spending beyond an earlier goal of $53 billion over the next three years.

What's next for Alibaba?

The AI boom is moving ahead full steam, and Alibaba looks well-positioned to take advantage of it. Not only is the company a diversified leader in China's tech industry, but the stock also looks affordable, especially compared to its U.S. counterparts, as it trades for a price-to-earnings ratio of just 21.

If the AI boom remains healthy, expect Alibaba to keep gaining.