In a banner month for artificial intelligence (AI) stocks, one of the biggest winners in the stock market was small-cap, data-labeling company Innodata (INOD -3.72%).

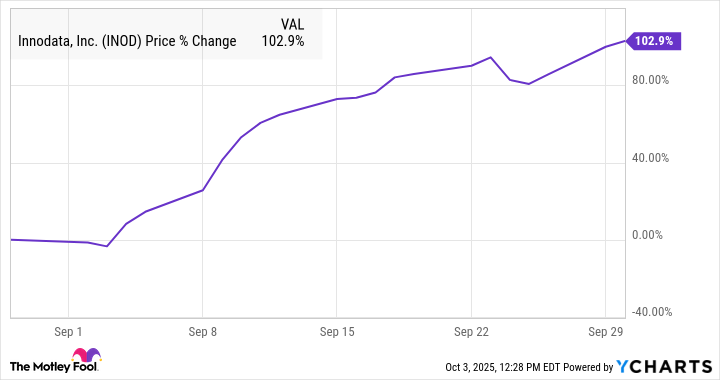

According to S&P Global Market Intelligence, Innodata stock finished the month up 103%. Surprisingly, there was no major news out on the stock last month. Instead, Innodata seemed to benefit from a broader surge of interest in AI stocks, as a number of news items indicated that capital expenditures for AI data centers were soaring.

As you can see from the chart, the stock rose almost steadily over September, with very few losing days, which is rare for a stock that gains so much so fast.

What's happening with Innodata?

One of the biggest days for Innodata last month came on Sept. 10 following Oracle's earnings report. Oracle surged and took much of the AI sector up with it as it gave a bold forecast for AI infrastructure spending. The company said it expected Oracle Cloud Infrastructure revenue to jump 77% to $18 billion this fiscal year, and reach $144 billion by fiscal 2030. The eye-popping growth forecast wowed investors and lifted estimates for AI-related spend across the board.

Oracle stock jumped 36% on Sept. 10, while Innodata gained 8.4% on high-volume trading that session. The news also seemed to fuel extended gains in the stock, as Innodata didn't have a losing session until Sept. 24 after that.

Innodata doesn't work with Oracle directly, but it does host data on Oracle Cloud, as well as other major cloud infrastructure services.

The Oracle announcement also shows that the amount of AI data is expected to grow exponentially, which is a boon for a company that specializes in helping organizations improve their data quality, annotating data at scale. Interest in data labeling, as this industry is known, also jumped after Meta Platforms spent $14 billion for a 49% stake of Scale AI, a data-labeling start-up, in June.

Image source: Getty Images.

What's next for Innodata?

Innodata has been growing rapidly, but it's still one of the smallest AI stocks on the market, making it appealing for investors looking for lesser-known AI picks.

Revenue jumped 79% to $58.4 million in its second quarter, and the company is profitable, with an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) profit of $13.2 million.

While a stock doubling on no news would typically be a reason to be wary of it, Innodata still trades at a price-to-sales ratio of 13, so there's more upside potential in the stock, especially if it can maintain its current growth rate.