Shares of Earth observation leader and public benefit corporation Planet Labs (PL +3.14%) soared 27% higher this week as of noon ET on Friday, according to data provided by S&P Global Market Intelligence.

The reason for this fanfare stems from an announcement on Wednesday that Planet Labs had shipped two Pelican satellites and 36 SuperDoves for launch.

CEO and cofounder Will Marshall explained, "We're continuing to see incredible demand for our high-resolution data ... we're not just putting more satellites in orbit, we're providing our customers with the consistent and timely information they need to deliver results."

Now six Pelican satellites strong -- and with intentions to grow its constellation to 30 -- Planet Labs aims to reduce resolution imagery down to 30 centimeters, while cutting latency down to minutes for its customers.

This week's news shows the company continues marching forward to meet these goals, prompting the share price to pop.

NYSE: PL

Key Data Points

Planet Labs' expansion comes with positive cash flows

What makes this shipment particularly promising -- especially paired with the fact that it launched two Pelican satellites last quarter, also -- is Planet Labs' cash from operations (CFO) turning positive.

This development shows that the scalable, one-to-many nature of Planet Labs' business model may be starting to take hold -- even with its spending on new satellites.

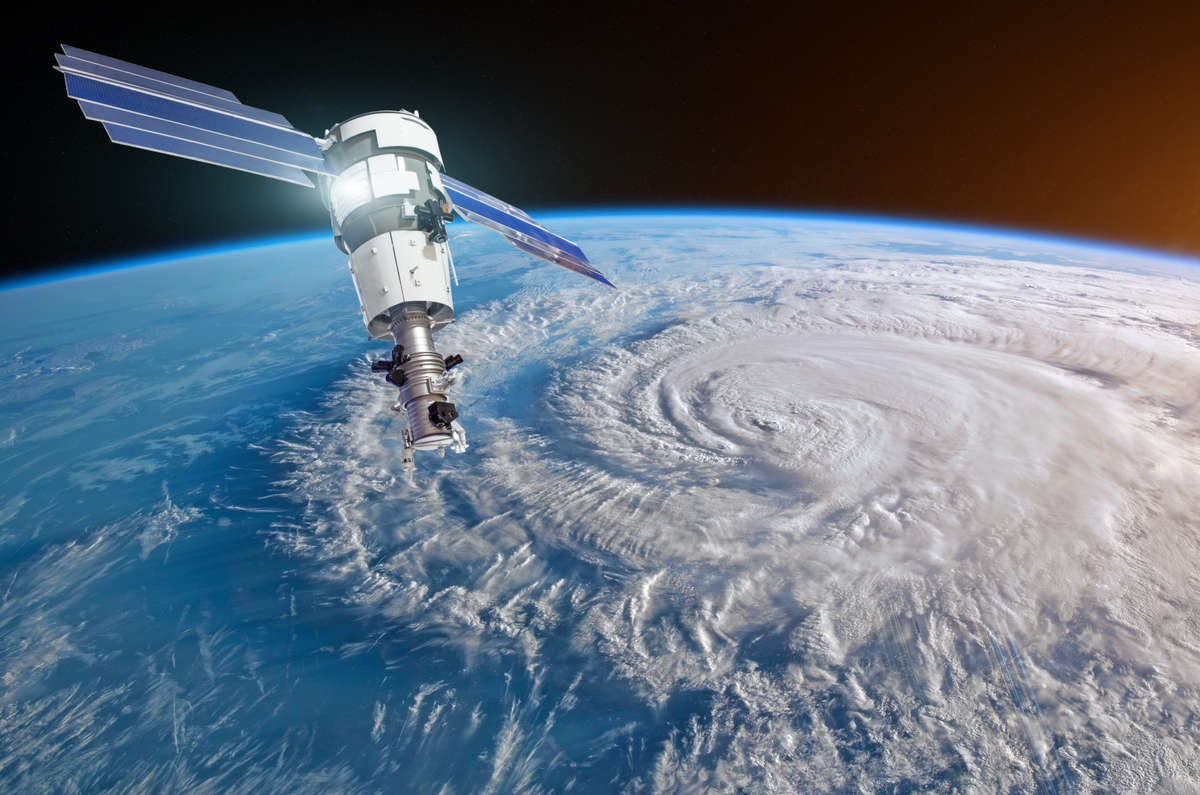

Image source: Getty Images.

Serving customers in numerous industries, ranging from civil government and defense to agriculture and insurance, the company saw its backlog skyrocket by 245% in its last quarter.

Now equipping its Pelican satellites with Nvidia's Jetson AI platform, Planet Labs can provide these customers with faster insights, unlocking even more value.

So is Planet Labs a buy?

However, while intrigued, I would only consider buying Planet Labs stock in segments over time, after its share price ballooned nearly 600% in just the last year.