The Magnificent Seven stocks earned that name for a good reason -- they've delivered a magnificent performance, helping drive the S&P 500 to double-digit gains over the past two years. These players are Alphabet (GOOG +0.72%) (GOOGL +0.65%), Meta Platforms (META +5.66%), Microsoft, Nvidia, Apple, Amazon, and Tesla. As the artificial intelligence (AI) boom accelerated and the environment for growth stocks strengthened, investors piled into all seven -- they're each well-established and profitable and offer exciting long-term prospects.

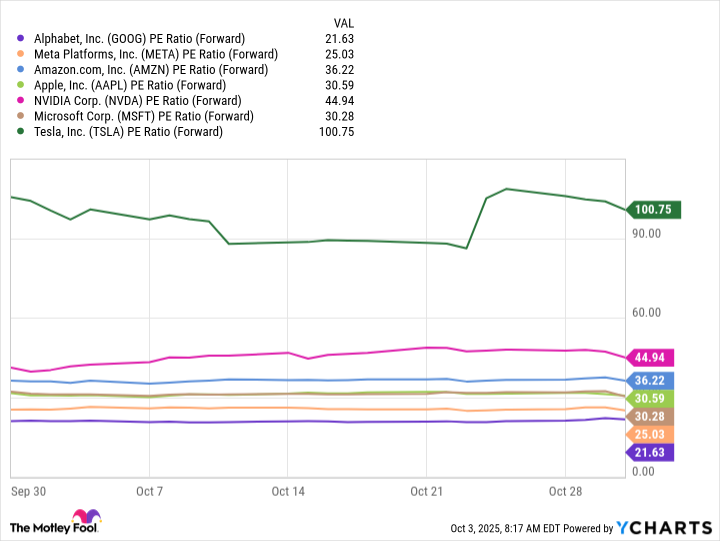

While they all are great stocks to own, though, two in particular stand out right now. That's because, in addition to offering you fantastic businesses and growth, they also are trading at very interesting valuations. In fact, they're the two cheapest of the Magnificent Seven and represent screaming buys today. Let's zoom in for a closer look.

Image source: Getty Images.

1. Alphabet

Alphabet is most known for its Google Search platform, since most of us use it every day. Google Search has dominated the market for years, steadily holding about 90% share, and that's likely to continue thanks to Alphabet's focus on AI. The company is using this technology to make search better than ever -- and improve the advertising experience for advertisers. This is key because advertising makes up most of the company's revenue, so making these customers happy should keep them coming back and spending more.

On top of this, Alphabet also operates another growth business, and that's Google Cloud. This unit has delivered quarter after quarter of double-digit growth, and in the recent period, revenue topped $13 billion. Growth potential is big because Google Cloud is well positioned to benefit from AI demand -- Alphabet has developed its own large language model (LLM) and is using it to power various products and services available through its cloud unit. And Google Cloud also offers access to a variety of other top AI products, such as Nvidia's high-performance AI chips.

NASDAQ: GOOGL

Key Data Points

Another reason to be bullish on Alphabet is a recent court ruling in a U.S. antitrust case against the company eliminated the worst-case scenario -- a possible breakup of Google -- so Alphabet remains on track for growth.

All of this makes the stock look dirt cheap at only 21x forward earnings estimates.

GOOG PE Ratio (Forward) data by YCharts

2. Meta Platforms

Meta Platforms' big business is social media as it owns the world's most recognizable and popular apps -- Facebook, Messenger, WhatsApp, and Instagram. In fact, 3.4 billion people use at least one of those apps on a daily basis.

But Meta isn't just a social media company and is instead building itself into an AI giant. The company has created its own LLM and has kept some of its AI work open source, a move that could help Meta stand out as a leader as AI develops. This tech giant is using its AI strengths to keep users on its apps longer, thanks to its AI assistant, and to help advertisers, its main source of revenue, improve their campaigns. The company also aims to grow through the development and sales of AI devices, such as its AI glasses.

NASDAQ: META

Key Data Points

Meta already has increased earnings into the billions of dollars over time, and in the recent quarter, announced double-digit gains in revenue and net income -- sales reached $47 billion, while net income rose to $18 billion. All of this along with a cash position of $47 billion mean the company has what it takes to pursue this AI investment and potentially win.

Meanwhile, the company also is sharing the wealth with shareholders through and dividends -- Meta paid out $1.33 billion in dividends in the recent quarter.

Today, Meta stock trades for 25x forward earnings estimates, making it the second-cheapest of the Magnificent Seven after Alphabet and a screaming buy, considering its performance so far and its ability to stand out in the AI revolution.