Shares of the rare metal miner MP Materials (MP +1.77%) have slipped about 15% since peaking above $80 a share last Thursday, Sept. 25.

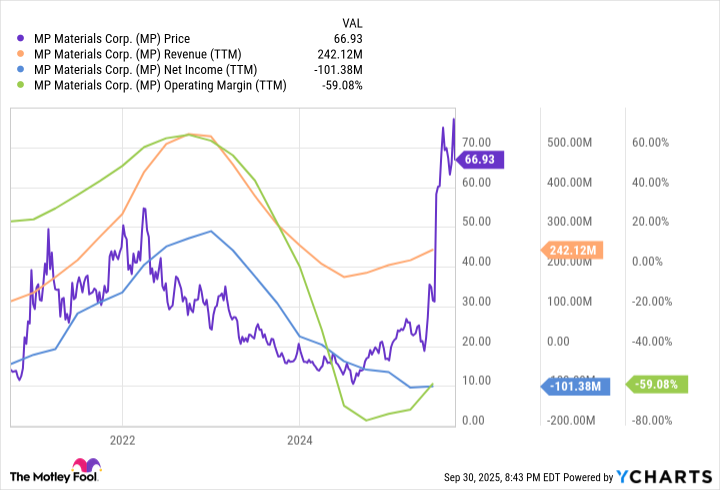

The mining stock has been on a tear in 2025, with a 309% gain year to date, but concerns over valuation and slowing revenue growth may have started weighing down on this explosive performance.

Supply chain independence remains MP's key tailwind

MP Materials' second-quarter earnings report wasn't all good news. Although total revenue spiked 84% year over year, it also fell about 5.6% quarter to quarter. Operating expenses were also higher on a quarterly basis, and its earnings per share deteriorated by $0.05 per share.

The revenue declines and widening losses stand out, but there were bright spots worth highlighting. The company produced a record of 597 metric tons of neodymium-praseodymium (NdPr) -- its flagship rare metal. It also inked a huge deal with Apple (AAPL 0.07%) in mid-July, then got a hefty investment by the U.S. Department of Defense (DoD).

Both deals have helped bolster MP's cash position, which was about $263 million at the end of June, a roughly 32% increase from the first quarter.

Image source: Getty Images.

A vote of confidence from the DoD highlights MP's strategic advantage. For years, it's been building up its facility in Mountain Pass, California, one of the only rare earth mines of any significance in the U.S. And although its facilities don't have quite enough manufacturing power to meet demands, the investments can fund expansion efforts that will increase production.

On that note, an investment in MP Materials is a bet that its rare earth metals, which are used to make super-strong magnets found in countless modern-day technologies, will continue to be in high demand in the future.

Like other mining stocks, MP Materials will be volatile, especially as it aims to ramp up production. But with policy tailwinds and a mining asset that no other company has, MP has what it takes to bounce back from the slide.