Nvidia (NVDA -0.77%) has been a top-performing stock each of the last three years. With that kind of run behind it, investors would be forgiven if they thought Nvidia didn't have enough steam to continue higher. However, if the market opportunity is as large as its management projects, Nvidia clearly has a ton of room to run.

During its Q2 conference call, Nvidia's CEO and founder, Jensen Huang, stated that he expects global data center capital expenditures to reach $3 trillion to $4 trillion by 2030. Considering that figure is about $600 billion in 2025, that's a massive increase in just five years.

If this prediction pans out, Nvidia is a screaming buy right now, and investors should be loading up on shares even after its remarkable run.

Image source: Nvidia.

Nvidia's GPU demand is predictable a few years in advance

Nvidia makes graphics processing units (GPUs), which are computing units that can process multiple calculations in parallel. This makes them ideal for intense workloads, like training artificial intelligence models, mining cryptocurrency, and processing engineering simulations.

Nvidia's GPUs and the software that supports them are best-in-class, which has led Nvidia to capture about a 90% market share in the data center GPU realm. That level of dominance is rare in the tech space, and it speaks to how much better Nvidia is than the competition.

As a result of being the top brand, investors should pay attention when management makes a bold prediction, like they did during the conference call. Demand for Nvidia GPUs is high and currently outstrips supply. As a result, many of the AI hyperscalers are likely in contact with Nvidia about future demand well before they actually purchase the GPUs. That way, they can ensure that the GPUs are available when they need them.

Additionally, data centers don't pop up overnight. When you hear an AI hyperscaler announce a new data center project, those companies have to acquire the land, design the facility, build the facility, and then install the GPUs. This is a multiyear process, making it even more important for companies to work with Nvidia to let them know their demand far in advance, for when they actually need the GPUs.

So, when Nvidia's management speaks about massive demand still coming, investors should consider what that could do for Nvidia's stock.

Nvidia would be a must-own stock if this projection comes true

Wall Street analysts project Nvidia will generate $206 billion in revenue this year, so it's safe to say that Nvidia captures about a third of all data center capital expenditures. If Nvidia keeps this market share through 2030 and data center capital expenditures reach $3.5 trillion, that indicates that Nvidia could generate around $1.17 trillion in revenue.

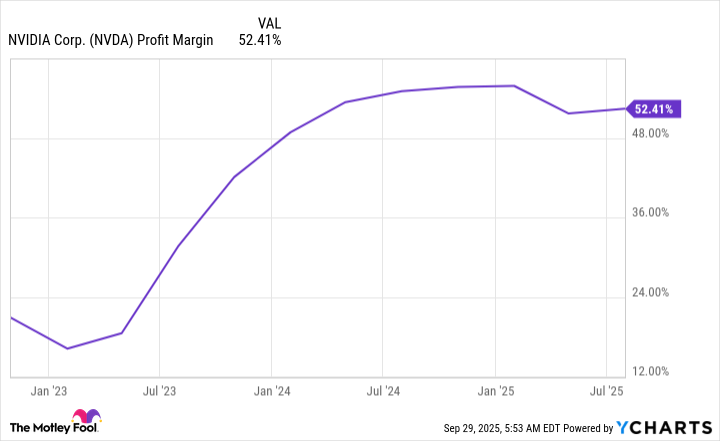

Nvidia's profit margin stayed fairly steady over the past few quarters, above 50%. If it can maintain that strong margin profile, it would generate $583 billion in net income.

NVDA Profit Margin data by YCharts

That would easily make Nvidia the most profitable company on earth, but it would also have huge ramifications for its stock price. If we assign Nvidia a relatively cheap 25 times earnings multiple, that would give Nvidia a market cap of $14.6 trillion. Currently, Nvidia sports a $4.6 trillion market cap, so this would represent an increase of 217%.

While a 217% return over the next five years isn't as strong as Nvidia's stock has been over the past few years, it would still be an incredible run and make Nvidia a must-own stock. For this to come true, Nvidia's market projection, market share, and profit margins need to pan out, but even if Nvidia slightly misses the mark on all three of these projections, the general trend is toward more data center capital expenditures, and Nvidia is one of the best-positioned companies to take advantage of it.