Some stocks are such good companies that it really does pay to keep things simple. In other words, some stocks are almost always worth buying when the share price dips and holding those shares indefinitely. Great companies tend to generate results that lead to long-term wealth creation for their shareholders.

Take The Coca-Cola Company (KO -0.85%) for example. Not only is Coca-Cola one of Warren Buffett's favorite companies, but it also has a decades-long track record of raising its annual dividend to its investors. Holding Coca-Cola stock and reinvesting the dividends it pays has worked out quite well for investors.

Today, the stock is down about 10% from its high. Here is why Coca-Cola is likely to continue rewarding those who buy and hold this legendary dividend stock.

Image source: Getty Images

Dominance in a fragmented market

You are probably familiar with Coca-Cola. The soda is world-famous, as is the company named after it. The Coca-Cola Company is a global beverage juggernaut. It sells over 2.2 billion beverage servings daily in more than 200 countries and territories, offering an extensive portfolio of over 200 brands of soda, juice, water, tea, coffee, and more.

The global beverage market is colossal, but it's also highly fragmented. Despite Coca-Cola's massive size, the company estimates that it holds only 14% of the market share in developed countries and 7% in emerging markets.

Coca-Cola enjoys significant competitive advantages in such a highly fragmented market, including unmatched prowess in distribution, economies of scale, and brand recognition.

It's unlikely that stores would displace Coca-Cola products with competing brands, and the company can leverage its prominent shelf positioning to introduce and grow new products. Coca-Cola can drive growth in multiple ways, including through pricing, new product development, or by steadily increasing its market share.

Coca-Cola's growth may not excite every investor, as analysts anticipate mid-single-digit annualized earnings growth over the long term. Yet, consistent results add up to significant returns if you give it enough time.

The magic of Coca-Cola's dividend

Coca-Cola is a highly profitable business. In a typical year, nearly $0.20 of every sales dollar ends up as free cash flow, or cash profits that the company can use as it pleases. Much of that goes to the company's dividend, which it pays quarterly to shareholders.

The magic of Coca-Cola stock lies in its annual dividend increases. The company has raised its dividend for 62 consecutive years and by an average of almost 5% per year over the past decade. That means investors have gotten a bit more each year, despite recessions, wars, and even a global pandemic. It's a testament to Coca-Cola's business model, to put it mildly.

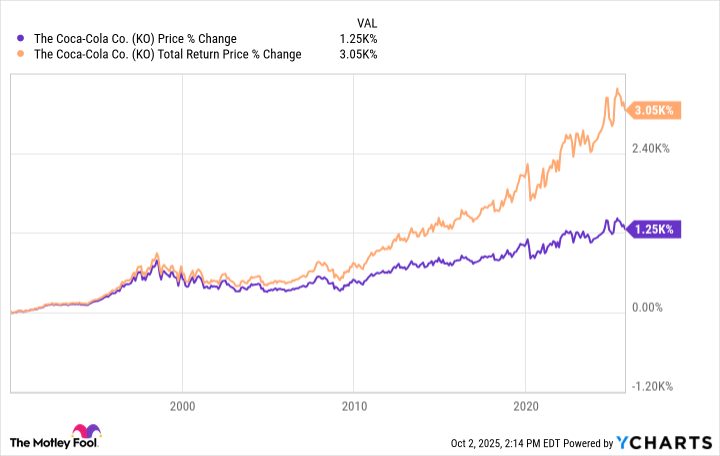

It has also been a game-changer for the stock's performance over the span of decades. You can see the difference in the stock's price appreciation versus its total returns, which include all of those dividends.

Straightforward, steady results make Coca-Cola a no-brainer

Historically speaking, owning Coca-Cola stock can be immensely rewarding if you're willing to wait long enough for compounding to perform its magic.

Fortunately, it still has a promising future ahead of it. The company still holds just a fraction of the global beverages market, and one could reasonably expect the company to continue growing steadily for the foreseeable future as more people around the world drink Coca-Cola products.

Dividend investors sometimes use a stock's historical dividend yield as a method to gauge the stock's valuation. At its current dividend yield of approximately 3%, Coca-Cola is trading at its historical average. A discount to historical norms would be even better, but Coca-Cola is a world-class stock that investors can confidently buy at a fair price.

Analysts anticipate the company growing its earnings by an average of 6.5% annually over the next three to five years. Assuming the stock price increases at the same pace as earnings grow moving forward, investors could expect annualized total returns -- that's capital gains plus dividends -- of about 9% to 10% over time.

Doing the math on that, your investment would double every seven to eight years. That's why holding Coca-Cola for 20 to 30 years can be so lucrative for your portfolio, and why the stock continues to be a no-brainer when it dips to a fair price or better.