Alphabet (GOOG 0.80%) (GOOGL 0.80%) had an incredible run during September. Its stock rose 14% throughout the month, which is a huge move considering that Alphabet is around a $3 trillion company. Although last month was a strong run for Alphabet, I think there's plenty of room for more upside due to the catalysts of why its stock moved higher.

I think Alphabet remains at the top of the list of stocks to buy right now, as the stock could experience even more strength throughout October and into the end of the year.

Image source: Getty Images.

Alphabet had a legal ruling go its way during September

Alphabet is the parent company of Google, among many other brands. Since its inception, this has been a great business to be in, except for recently. A few months ago, the future of the Google Search engine was in question.

There were two major factors contributing to this uncertainty: Government intervention and generative artificial intelligence (AI). Many investors assumed that generative AI-powered search engines would disrupt Google's business, causing advertisers to go elsewhere. However, that hasn't surfaced yet, and Google continues to post strong results quarter after quarter. In Q2, Google Search's revenue rose 12% year over year. That doesn't sound like a struggling business, and underscores that Google is still a top place to advertise.

NASDAQ: GOOGL

Key Data Points

One factor that's helping it out is the integration of AI search overviews. This provides a generative AI-powered search summary at the top of each Google Search, essentially merging the two technologies into one platform. AI search overviews have become an incredibly popular feature, and will likely bridge the gap between the two technologies. As a result, it seems like Google Search is here to stay.

Another fear quelled during September was the concern about a government breakup. Alphabet was accused of operating an illegal monopoly in the search engine space, and the Department of Justice sought to split Google Chrome off as a remedy. The judge presiding over the case thought this was too far of a reach, and instead forced Alphabet to make some changes, but essentially allowed it to operate as is. The ruling was perceived as a major win for Alphabet, and eased investors' fears about Alphabet looking far different than its current state a few years down the road.

Both items contributed to Alphabet's stock price rising over the past month, but I think it has plenty of room to grow.

The stock is reasonably priced compared to its peers

With the easing of both fears, investors can now appreciate Alphabet's stock for the company dominance it shows. During its last quarter, Alphabet's revenue rose 14% year over year and its diluted earnings per share increased by 22%. That places Alphabet in solid growth stock territory and growing at a quicker pace than many of its big tech peers.

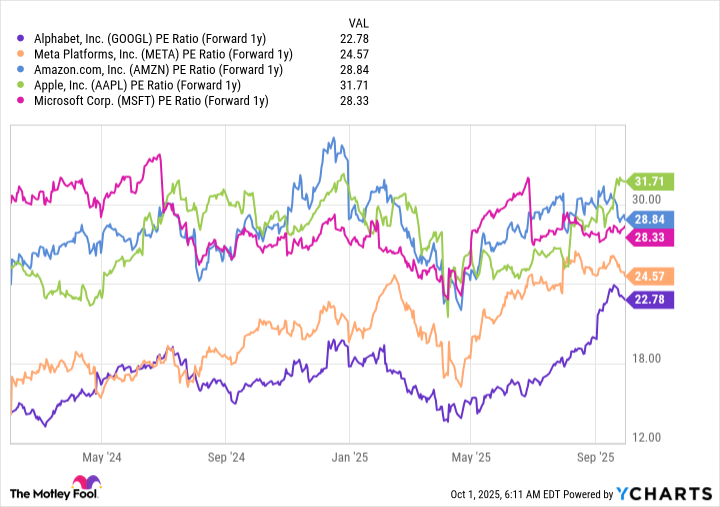

Despite Alphabet's strength, it is still priced at the bottom end of its peers.

GOOGL PE Ratio (Forward 1y) data by YCharts

I think the combination of Alphabet's relatively low valuation (at least compared to its peers) and strong growth makes it one of the top big tech stocks to buy right now. It could see a sustained rally to end the year and be a strong stock pick for 2026.

Alphabet also has a lot of momentum going with its own generative AI platform, Gemini. Gemini consistently ranks as one of the top-performing generative AI models, and with its integration into the Google Search engine, it is the most used. With Alphabet having a solid model to base future products on, it creates momentum that could lead to further growth during 2026.

The future is incredibly bright for Alphabet, and I think investors would be smart to scoop up shares during October.