Dividend stocks can be an excellent source of passive income and also stability for investors. However, not all dividend stocks are created equally. Some companies have modest payout ratios that they look to grow steadily over time. Others may focus on delivering a high dividend yield that could be in the double digits, but it may be less reliable over time.

Two companies that offer appealing dividend yields are Annaly Capital (NLY +2.42%) and Realty Income (O +1.65%). Annally boasts a high yield of 13.3%, which could be more volatile over time. Meanwhile, Realty Income's yield is 5.7%, but it has a history of consistently raising its dividend payout. If you're weighing which stock is a better buy today, consider the following.

Image source: Getty Images.

Real estate investment trusts are good for dividends

Annaly Capital and Realty Income are both real estate investment trusts (REITs). As REITs, these companies trade like stocks, but tax rules require them to distribute at least 90% of taxable income to shareholders as dividends.

This REIT structure makes them attractive for dividend investors seeking steady cash flow. REITs offer exposure to real estate without direct ownership, and their yields often exceed those of traditional equities. These stocks can be suitable for investors seeking steady income, as they distribute payments quarterly and sometimes even monthly, which Realty Income does.

The two REITs focus on different aspects of real estate

While Annaly and Realty Income are REITs, they operate in very different segments of the real estate sector.

Drilling down further, Annaly is known as a mortgage real estate investment trust (mREIT). As an mREIT, Annaly invests in mortgage-backed securities (MBS) rather than physical properties. The company earns income by buying or originating MBS, and profits from the interest spread between its borrowing costs and lending yields. To juice returns and support its double-digit dividend, Annaly utilizes leverage to achieve higher returns.

NYSE: NLY

Key Data Points

Realty Income, on the other hand, owns and invests in commercial properties, mainly single-tenant buildings leased under long-term net lease agreements. Its portfolio spans the retail, industrial, and office sectors, and tenants include recognized names such as Walgreens, 7-Eleven, Dollar General, and FedEx. Realty Income's earnings are primarily tied to its rental income. This is how the company supports its dividend payment, which it has raised every year for an impressive 31 years.

Annaly and Realty Income come with different types of risk

One thing to bear in mind when investing in these stocks is the risk they present. Annaly utilizes leverage to enhance the returns on its MBS portfolio. This leverage helps the company to generate the income needed to support its ultra-high dividend yield. However, it also exposes investors to interest rate risk that may not be immediately apparent.

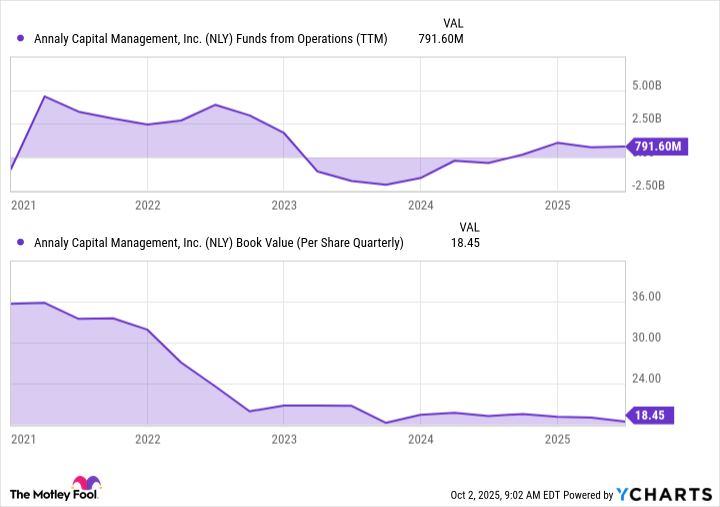

Annaly's performance is sensitive to Federal Reserve policy, interest rate fluctuations, and the shape of the yield curve. When short-term rates rise faster than long-term yields, Annaly's net interest margin compresses, which in turn puts pressure on its earnings. Rising interest rates can also impact the value of its investments, creating a drag on its balance sheet and driving down the book value of the stock.

NLY Funds from Operations (TTM) data by YCharts

Conversely, in easing cycles or stable rate environments, Annaly can benefit from wider spreads as short-term rates fall faster than long-term ones. The company actively manages its portfolio using hedging strategies to mitigate some of this, but its reliance on repurchase agreements (which are short-term in nature) for funding introduces this risk.

Realty Income faces some risks as well. While it is also vulnerable to fluctuations in interest rates, its risk lies more in its tenants. Tenant defaults are a primary concern, especially during economic downturns or sector-specific disruptions.

Although it boasts investment-grade tenants, it wouldn't be immune from a wave of bankruptcies or lease renegotiations. Realty Income aims to mitigate some of these risks through geographic and sector diversification, as well as a more conservative use of leverage.

NYSE: O

Key Data Points

Which one is a better buy?

Annaly's dividend payout can be very appealing to income-driven investors. However, its payout could fluctuate more over time and is affected by the Federal Reserve -- more specifically, short- and long-term interest rates -- and overall housing market conditions.

Meanwhile, Realty Income offers a blend of income stability and long-term growth. Still, you'll want to monitor interest rate trends, as well as tenant health and the health of the overall economy.

I believe Annaly is well-positioned in the next year or two, especially if the Federal Reserve continues to reduce its benchmark interest rate, as such a move could be a tailwind for it. That said, Realty Income has a longer track record of raising its dividend payout, and I prefer it as a stock to hold on to for the long haul.