Artificial intelligence is starting to change the world for everyday people, not to mention for the businesses that use it. Nvidia is one of the biggest companies in the space, providing what amounts to the "brains" of AI with its high-performance computer chips.

But that's only one way to play the picks-and-shovels angle of AI, with two other great options being data centers and utilities.

Image source: Getty Images.

What AI needs to live

For most, the power of artificial intelligence will be in its application. Essentially, that means the output of really complex programs that analyze large amounts of data very quickly to provide usable outputs.

The problem for investors is figuring out which company is going to be the long-term winner in the AI space. Even Nvidia isn't a sure thing, given that another company could leapfrog it with new chip technology. Just look at the way Yahoo! was usurped by Google in the internet search wars for proof that being an early leader isn't a guarantee of long-term success when it comes to technology investing.

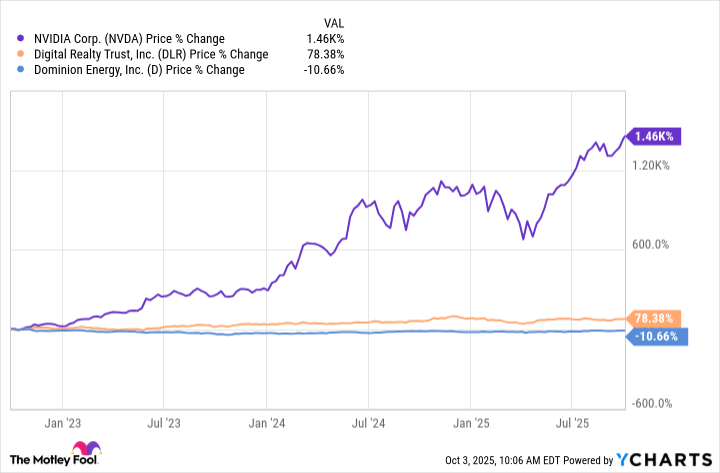

That said, there are two things that are very certain when it comes to AI. It will have to "live" somewhere and it will need to be "fed." AI's home will be data centers and its food will be electricity. Sure, you can buy Nvidia to get exposure to AI, but given the stock's rise of more than 1,400% over the past three years, a lot of investors are already pricing in great results for the stock.

Different ways to invest in AI "picks and shovels"

If you want to own a business that hasn't had quite the same price advance, consider a data center real estate investment trust (REIT) like Digital Realty Trust (DLR 0.78%). This REIT is one of the largest data center landlords in the world, with exposure to North America, South America, Europe, Asia, and Africa. It has 2.8 gigawatts of capacity and another 750 million megawatts in development. The dividend yield is 2.8%, for those who are in search of income.

But if you don't want to pick one winner, you might want to consider the WisdomTree New Economy Real Estate Fund (WTRE 0.94%). This is an exchange-traded fund (ETF) that is focused on owning the infrastructure that supports AI and other new technologies. Data center landlord Digital Realty is one of its largest holdings, but it also owns competitors like Equinix and companies that are starting to dip their toes into the space, like Prologis. If you believe in diversification, the WisdomTree New Economy Real Estate Fund could be the AI "housing" choice for you.

Electricity is another support without which AI wouldn't be possible. One interesting option in the utility space is Dominion Energy (D -0.20%). Its regulated utility in Virginia basically has a monopoly on providing power to one of the largest and most important data center markets in the world. To be fair, the company is in the middle of a fairly low-risk turnaround and the stock has been a lackluster performer for a bit. And at the same time, it has an attractive 4.3% yield, which is well above the utility average of 2.7%.

But once again, this speaks to the risk of trying to pick specific winners and losers. If you'd rather not do that, you might want to look at the Utilities Select Sector SPDR ETF (XLU 0.68%). This ETF's yield is just average, or 2.7%, but it gives you a diversified portfolio of utility stocks with one simple investment. And since the entire utility sector is likely to benefit from the electricity demand that AI generates, it could be the better choice for more conservative investors.

The big takeaway for AI investing

When Wall Street gets a story in its teeth, it tends to run with that story for longer than it should. That means that the last ones in on the story often get hurt. You don't have to follow the crowd with the obvious investment choices. You can, instead, look for businesses that will directly benefit from AI while rewarding investors along the way.

Dividend paying REITs like Digital Realty are clear options. But so is an industrial landlord like Prologis, which is turning warehouses into data centers. And then there are utilities like Dominion Energy, which has a high yield and an advantaged position in a key data center market. But don't get stuck on picking stocks -- you can also punt and buy ETFs like the WisdomTree New Economy Real Estate Fund and Utilities Select Sector SPDR ETF, to get diversification along with your AI exposure.