Shares of semiconductor chip leader Nvidia (NVDA 0.29%) have been riding a rocket ship, particularly after the astounding announcements of investments in Intel and ChatGPT creator OpenAI. The stock is up about 40% this year.

The deals demonstrate Nvidia's expansion beyond merely selling AI products. The company is taking a larger role in driving changes to the cloud computing market, where artificial intelligence systems are housed.

These partnerships mark a new chapter in the company's storied history. Does this mean now is the time to scoop up Nvidia shares? Let's dive into the implications of these deals to find out.

Image source: Nvidia.

Nvidia's team-up with Intel

In September, Nvidia announced a $5 billion investment in Intel. The AI leader's decision to partner with the ailing semiconductor giant was an interesting choice.

The once-dominant Intel has struggled for years as it missed the boat on mobile device technology and, more recently, AI. These issues are reflected in its stock's price-to-book (P/B) ratio, which plunged to a multi-year low last year. But Nvidia stands to gain in more far-reaching ways beyond capitalizing on Intel's low valuation.

As a fabless semiconductor company, Nvidia outsources the manufacturing of its cutting-edge AI chips. It plans to leverage Intel's manufacturing facilities to build AI products for data centers and PCs, but that's just one benefit of the deal.

In describing the partnership, Nvidia CEO Jensen Huang said, "Together, we will expand our ecosystems and lay the foundation for the next era of computing." That era involves AI factories.

NASDAQ: NVDA

Key Data Points

AI factories and Nvidia's OpenAI partnership

For some time, Huang predicted the arrival of a new industrial revolution, one requiring AI factories where the output is intelligence. These factories are data centers designed to support the level of computing power needed for AI.

But many of today's data centers are not up to the task. This is where Nvidia's deals with Intel and OpenAI come in. The trio will work together to fill this gap.

One example of AI factories coming to pass is the British government's goal to expand the country's AI computing infrastructure by 20 times over the next five years. To that end, the U.K. partnered with OpenAI, and in turn, OpenAI enlisted Nvidia to provide as much as 31,000 AI chips.

On top of that, Nvidia announced a separate deal with OpenAI that's much larger and far reaching. The semiconductor titan will invest $100 billion in OpenAI. In return, OpenAI commits to using Nvidia products to build out the massive AI infrastructure needed to advance its artificial intelligence models. This requires a staggering number of Nvidia's AI chips, estimated to stretch into the millions.

The collaborations with OpenAI and Intel suggest spectacular sales growth ahead for Nvidia, even though it faces geopolitical hurdles to selling AI chips to China, one of the largest AI markets in the world. In April, the Trump administration implemented requirements that hurt Nvidia's China sales. Then in September, Chinese businesses were banned from buying Nvidia products by their government.

Weighing whether to pick up Nvidia stock

Despite the challenges, Nvidia's revenue continues to climb. In its fiscal second quarter, ended July 27, sales increased 56% year over year to $46.7 billion. In fiscal Q3, the company forecasted revenue to accelerate to $54 billion, and that's accounting for a lack of sales to China.

Nvidia's outsized success, combined with news of its Intel and OpenAI collaborations, helped to propel its stock to an all-time high of $191.05 on Oct. 2. The achievement raises the question whether now is the time to buy shares.

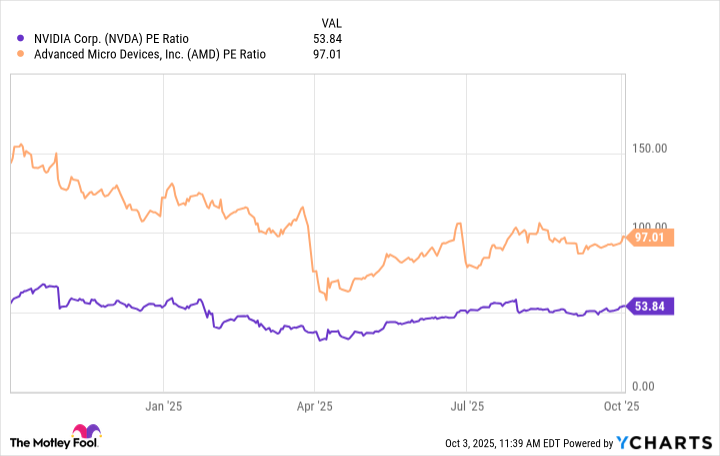

To evaluate its share price valuation, here's a comparison of Nvidia stock's price-to-earnings (P/E) ratio against that of longtime semiconductor chip rival Advanced Micro Devices.

Data by YCharts.

Although AMD's P/E ratio is lower than it was a year ago, Nvidia's remains lower. This indicates Nvidia stock is the better value. That said, an earnings multiple hovering around 54 is not cheap.

An argument can be made that Nvidia stock is worth the premium. The company holds a commanding position in the AI chip industry, controlling an estimated 94% market share.

This dominance, combined with strategic partnerships with Intel and OpenAI to meet the increasing demand for AI computing power, make Nvidia a worthwhile investment for the long term. But after the stock hit an all-time high, it's ideal to wait for shares to pull back a bit before deciding to buy.