Semiconductor leader Nvidia (NVDA 1.72%) rewrote the rules for computer processors when it introduced its graphics processing units (GPUs) in 1999, and they have since become the heart of artificial intelligence (AI) systems.

Now, the company is rewriting the rules once again. In September, it announced a huge partnership with OpenAI that entails Nvidia investing up to $100 billion in the ChatGPT creator.

This deal contains far-reaching consequences. By dissecting the implications of the OpenAI partnership, it's possible to determine if now may be the time to buy Nvidia shares.

Image source: Nvidia.

Nvidia's OpenAI collaborations on the path to "superintelligence"

The chipmaker's deal with OpenAI is the latest in a long history between the two. In 2016, Nvidia CEO Jensen Huang recognized GPUs would be ideal for AI, and to make his case, he hand-delivered the world's first supercomputer designed for artificial intelligence to OpenAI.

The two companies are also partnering with other businesses on the Stargate project, an initiative to build $500 billion worth of AI infrastructure in the U.S. by 2029. And they're also working together on a sister project, Stargate U.K., which plans to use as many as 31,000 Nvidia GPUs as OpenAI helps the British government expand AI computing capacity.

These projects illustrate a major shift in the data center industry, which Huang describes as AI factories. These are data centers specifically designed to support the rigorous computing demands of AI systems.

This industry shift led to the latest collaboration between Nvidia and OpenAI. In exchange for Nvidia's $100 billion investment, OpenAI will use the chipmaker's products to construct huge AI factories required "to train and run its next generation of models on the path to deploying superintelligence," according to Nvidia.

This "superintelligence" entails OpenAI striving to achieve artificial general intelligence (AGI), a theoretical form of AI considered to be equivalent to human intellectual capabilities, such as creativity and original thoughts.

How the OpenAI deal affected Nvidia's stock

If OpenAI can achieve AGI, it would represent a breakthrough potentially greater than the ChatGPT launch that kicked off the current AI frenzy. To attain AGI, OpenAI needs tremendous computing power, hence its historic partnership with Nvidia.

The undertaking will require a total of Nvidia GPUs estimated to extend into the millions. This project adds to the demand it already enjoys from customers, holding the potential to supercharge its sales. As a result, the company's shares soared to an all-time high of $191.05 on Oct. 2.

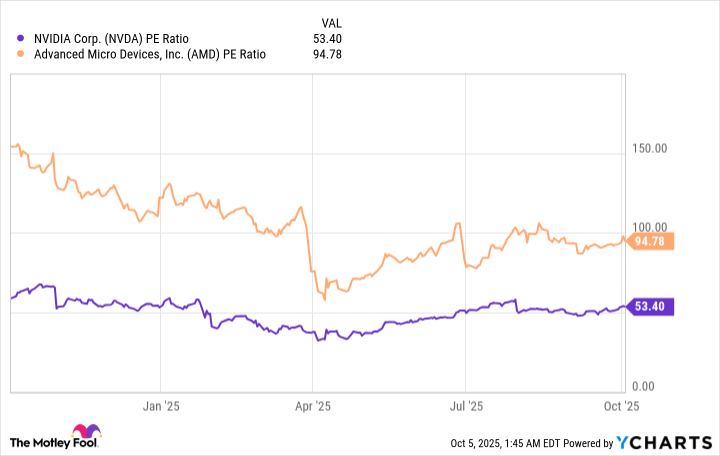

With the rise in Nvidia stock, it's reasonable to wonder if now is the time to buy it. To evaluate this, let's examine its price-to-earnings ratio (P/E) and compare it to Nvidia's major competitor, Advanced Micro Devices.

Data by YCharts.

AMD's P/E multiple has dropped from a year ago, but it's still well above Nvidia's. This suggests the latter company's shares are the superior value.

Evaluating whether to buy Nvidia stock

Although its stock valuation is better than AMD's, Nvidia's earnings multiple is not cheap. Arguably, the premium is warranted given its blockbuster deal with OpenAI and its outstanding financial results to date.

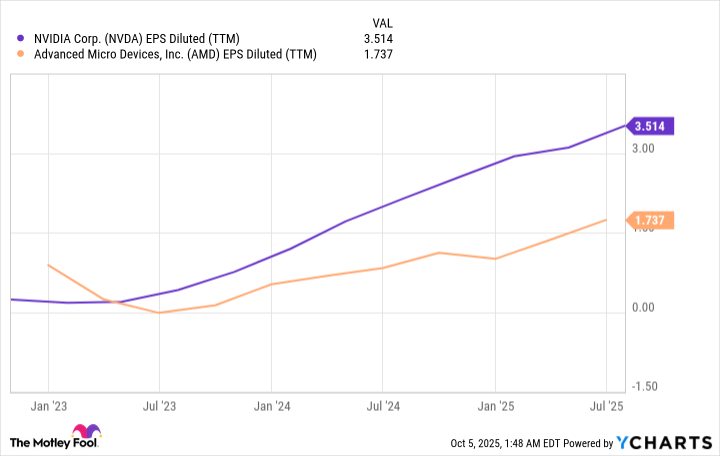

For instance, Nvidia's diluted earnings per share (EPS) have seen excellent growth over the past few years, since AI demand has supercharged sales.

Data by YCharts. TTM = trailing 12 months.

AMD's diluted EPS has also edged up, but not as substantially as Nvidia's. Another consideration is Nvidia's strong revenue growth in the face of challenges, such as being barred from China, one of the largest AI markets in the world.

Due to geopolitical tensions between China and the U.S., Beijing prohibited Chinese companies from purchasing Nvidia products. Despite losing China sales, Nvidia's revenue in its fiscal second quarter (ended July 27) hit $46.7 billion, a 56% year-over-year increase.

The company expects sales to keep growing as a sign it can shrug off China's loss. It forecast fiscal third-quarter revenue of $54 billion, a significant increase from the prior year's record sales of $35.1 billion.

Moreover, in August, the company added $60 billion to its share repurchase authorization. The decision to expand buying back its stock indicates management's confidence in the company's future, which makes sense considering the magnitude of its projects with OpenAI and Stargate.

Given its strong financial results despite being locked out of China and its potentially game-changing deal with OpenAI, Nvidia is a worthwhile investment to buy and hold over the long term. That said, because its share price recently hit a record high, it might be wise to wait for the stock to dip a bit before deciding to buy.