Whether it's the U.S. government shutdown, the broader market hitting all-time highs, or perhaps too much exuberance around artificial intelligence (AI), there's plenty of reason to question the elevated valuations of U.S. stocks. U.S. markets are the envy of the world, but every asset has an appropriate value, which is why it can be beneficial for investors to broaden their horizons and look at stocks internationally.

Not an expert? Then you may want to look at exchange-traded funds (ETFs), which trade like stocks but give investors broad exposure to a theme or type of investment. Here are two international ETFs your portfolio might be missing out on.

Image source: Getty Images.

Select STOXX Europe Aerospace & Defense ETF

The Select STOXX® Europe Aerospace & Defense ETF (EUAD 0.73%) invests at least 80% of its net assets in European companies that obtain at least half of their revenue from manufacturing, service, supply, and distribution of aeronautical equipment, systems, and other components that directly support European civil and military defense initiatives.

NYSEMKT: EUAD

Key Data Points

Up until this year, investors were not bullish on European stocks, and their valuations showed it, significantly trailing those of American stocks. But President Donald Trump's tariff and trade war and promotion of deglobalization have pushed European countries to realize they may need to bulk up. In March, the European Commission announced the ReArm Europe plan, in which it intends to put 800 billion euros into military and defense spending in order to push military spending in the EU to 3.5% of gross domestic product (GDP) by 2030. Investors likely didn't anticipate this kind of spending, which led to a run-up in European defense and aerospace stocks.

Airbus, a multinational space company that builds aircraft, defense systems, and tech for space exploration, is the largest stock in the ETF, with over 23% of the fund's assets invested in the company. Rheinmetall, the German military and weapons manufacturer, is the next-largest holding, followed by the British defense and aerospace company BAE Systems.

Due to this unexpected surge in military funding, the European Aerospace & Defense ETF has blasted over 93% higher this year. But we are still in the early innings of this expected massive spend, and Trump's approach to global affairs isn't expected to change over the next few years, so it's a good idea to have some exposure to European defense and aerospace stocks.

iShares MSCI China Multisector Tech ETF

The iShares MSCI China Multisector Tech ETF (TCHI +0.98%) follows Chinese equities in technology and technology-related industries. One of the largest economies in the world, it should come as no surprise that China has birthed large and innovative tech conglomerates that rival those in the U.S. Now, investing in China comes with more risk than countries like the U.S. and Europe for several reasons.

NASDAQ: TCHI

Key Data Points

First, the Chinese government can be unpredictable. There are times when they promote the tech sector and times when they crack down. It can be tough to see these regulatory hurdles coming, which is why many of these stocks don't trade at the same multiples as those in the U.S. Additionally, the Chinese economy has been dealing with a downturn over the past few years that it has struggled to shake. This includes soft demand, a bad housing market, and high unemployment among its younger population.

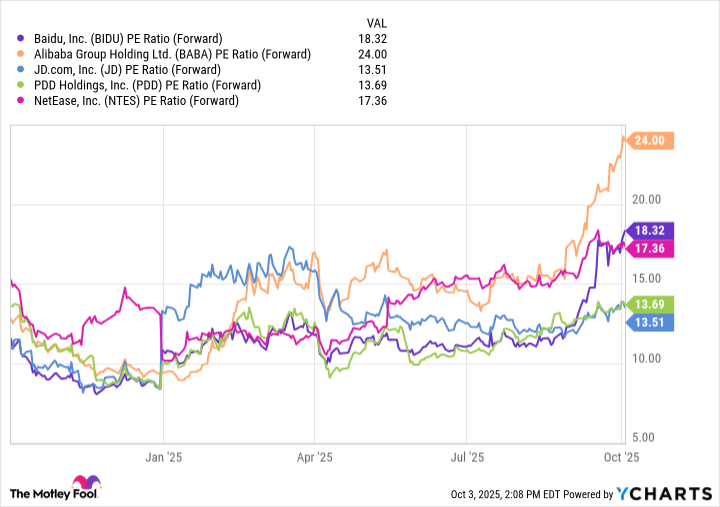

But many companies in this China Multisector Tech ETF have demonstrated strong growth and built innovative technologies like Alibaba, JD.com, and Baidu. And while many of these stocks have actually enjoyed nice runs this year, they still trade at relatively tame multiples when compared to artificial intelligence stocks in the U.S.

Data by YCharts.

Now, this doesn't mean they will ever catch their U.S. counterparts, but they could eventually close the gap, especially as Chinese officials grow more interested in bringing more foreign capital into their markets. Plus, with U.S. AI stocks trading at meteoric multiples, this could be one area to add exposure to if you still want exposure to tech and AI. I wouldn't necessarily go overweight on this group, due to some of the variables mentioned above, but I do think investors will want some exposure.