United Parcel Service (UPS 1.21%) is one of the largest shipping and logistics companies in the world. The company went public in 1999, raising a record-breaking nearly $5.5 billion at the time, which is still among the largest initial public offerings today.

However, UPS has not fared well in recent years. The company struggled as shipping volume declined following the COVID-19 surge. Then, the sector went through what many experts believed to be a freight recession. At the beginning of the year, UPS surprised many on Wall Street when it announced that it would scale back its partnership with Amazon by about 50%.

Image source: Getty Images.

Management described the decision as strategic, due to slim margins on the business. But Amazon was UPS' largest customer, so investors did not receive the news well. UPS has also been dealing with the effect of tariffs this year. In the second quarter of the year, UPS continued to see revenue decline. Management did not provide guidance for revenue or operating profits due to "current macro-economic uncertainty."

If you'd invested $1,000 in UPS five years ago

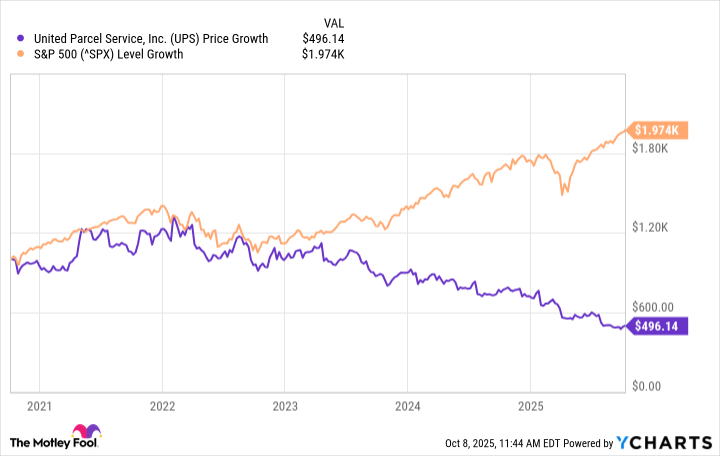

Due to these challenges, UPS' stock has been hammered. It's trading down about 30% this year and over 50% in the past five years, which is a tough outcome considering the strength of the broader market.

Data by YCharts.

As you can see above, a $1,000 investment in UPS would only be worth $496 now, while investing in the broader benchmark S&P 500 index would have nearly doubled the $1,000 investment. UPS does have an ultra-high-yielding dividend yield of over 7.5%, but the company clearly has work to do to win back the confidence of investors.