A stock market bubble happens when the value of stocks grows faster than the value of the businesses they represent. And there's good reason to believe investors are in one right now.

Years ago, famed investor Warren Buffett proposed a metric to measure stock valuations generally -- take the entire value of the U.S. stock market and divide it by U.S. GDP. Today, investors call this metric the Warren Buffett indicator. That number is at an all-time high and far beyond the level that Buffett described as "playing with fire."

If there is a bubble right now, it's undoubtedly been inflated by artificial intelligence (AI) stocks. Top AI stocks such as Nvidia, Oracle, and Palantir have all surged in 2025 and are large enough to account for a material portion of total market gains.

Image source: Getty Images.

While fears of an AI-fueled stock market bubble may be rising, there are still AI stocks that represent bargains right now. Three such names are worth a look.

1. Can Micron push past cyclicality?

Shares of Micron Technology (MU -1.97%) are hitting all-time highs in 2025. The maker of memory products is enjoying a surge in revenue and a fattening profit margin, but the stock trades at less than 12 times forward earnings estimates. What's not to like? Well, investors have been burned here before.

When it comes to memory products, demand regularly surges every few years, pushing Micron's revenue and profit margin higher. But then demand tapers back off, having the opposite effect on the business. So investors don't question whether or not Micron can make a ton of money right now -- AI needs memory and it's a great tailwind. They understandably question how long this bullish run will last.

It's risky for investors to say, "It's different this time," but maybe it is indeed different this time for Micron. The company's high-bandwidth memory (HBM) products are fueling impressive growth because of how important they are for data-center buildouts. Management even says its HBM capacity is almost completely sold out for 2026.

Will demand for data centers drop off after 2026? I personally doubt it. OpenAI is one of the leading names in artificial intelligence, and it's reportedly hoping to secure 250 gigawatts of electricity to power data centers by 2033. That amount is roughly the electricity generating capacity of Germany, and that's the energy demand from a single AI company. Keep in mind the competition will be building as well.

My point is that OpenAI and its competitors want to scale data centers by a seemingly impossible amount in coming years, as evidenced by how much power they need. And even if they don't hit their goals, this clearly indicates that AI data center demand will extend far beyond 2026, which should allow Micron to enjoy steady growth, making the stock an absolute bargain today.

2. Duolingo's AI strategy is working

Language learning company Duolingo (DUOL -3.18%) isn't at the forefront of AI infrastructure, but it's using AI to provide new products and features. The strategy is working.

Only about 8% of Duolingo's 128 million monthly active users are paying subscribers, but subscriptions accounted for 84% of total revenue in the second quarter of 2025. The implication is clear: If the company can get more users to pay for a subscription, the benefit to its financial results will be substantial.

This is where AI comes in. Duolingo's highest subscription tier has AI features, such as live conversation, which is quite important for language learners seeking to up their communication skills. These new features are proving popular as Q2 subscription revenue was up 46% year over year. This is on top of the 50% subscription revenue growth the company reported in 2024.

Trading at about 18 times sales, Duolingo stock may not look like a bargain to some. However, the stock is down 40% from the all-time high it reached earlier this year. If the company can continue to put up such strong growth numbers, then its current valuation will end up looking like a bargain in hindsight.

3. Can Super Micro Computer execute?

When trying to find a good investment, I start by looking for the seemingly impossible: A high-growth business with expanding profit margins that trades at a below-average valuation. It's a tall order, but Super Micro Computer (SMCI -0.80%) can be that stock -- if it can execute.

Supermicro's growth comes with the same caveat as Micron's: How long will the AI data center boom last before the clock strikes midnight? That said, its role in the data center ecosystem should help the company to sustain its top-line growth for some time yet. The company's fiscal 2026 started in July, and management expects net sales growth of at least 50% compared to fiscal 2025.

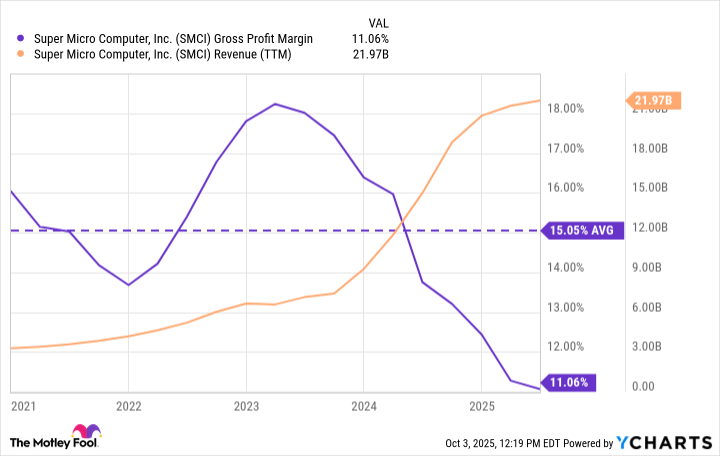

According to YCharts, Super Micro Computer stock trades at about 22 times its forward earnings estimates. For a company growing at least 50%, that looks quite cheap. But there's a small issue: The company's profit margin has trended lower with scale, a trend investors are wary will continue.

Data by YCharts.

Supermicro's management believes its gross profit margin is bottoming out now, and the company is optimistic it can improve again long-term. Central to this optimism is the company's growing importance in data centers.

That's no sure thing, however. Fortunately, Supermicro's incredible revenue growth and ongoing profitability -- even at a lower margin -- could still make this stock a winner. And if margins improve, the stock could prove to be a very exciting investment.

While soaring AI stocks and high valuations make headlines, there are still reasonable bargains to be found in the AI space, including Micron, Duolingo, and Supermicro.