Everyone knows United Parcel Service (UPS 0.35%) for its brown trucks. Fewer may have noticed, however, that the company's stock has been tanking in 2025.

The stock has fallen sharply since its early pandemic-era highs. A slew of not-so-great news -- from the intent to cut Amazon deliveries to narrowing margins -- has left this stock underperforming the S&P 500 in 2025.

NYSE: UPS

Key Data Points

Down about 30% on the year, is UPS stock a bargain, or a hard pass?

The case for optimism

Despite recent troubles, UPS remains one of the most efficient logistics networks in the world. Indeed, one of the reasons to stay optimistic is that UPS is aiming to get even more efficient.

Part of the reason for that is its cost reduction plan. Dubbed "better, not bigger," this plan aims to cut jobs and close warehouses, which could save the transportation giant about $3.5 billion in 2025. In a similar vein, the company is shedding low-margin business like consumer packages in favor of more profitable deliveries like those for healthcare companies and small businesses, which could improve margins over the long run.

Image source: UPS.

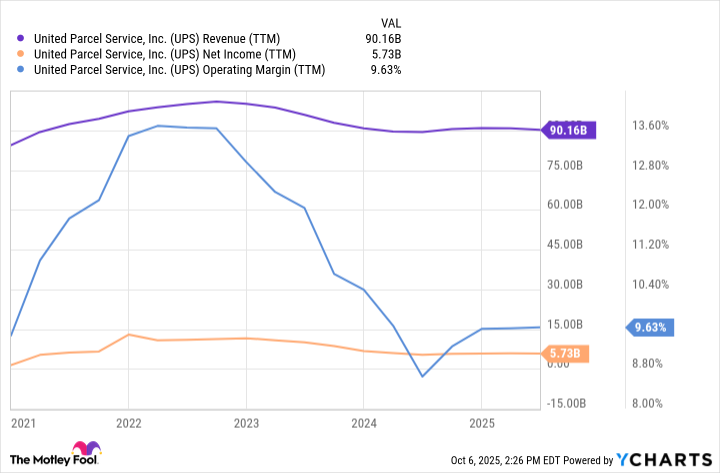

Meanwhile, UPS is also investing in automation and data analytics to help it reduce delivery times and costs. Although operating margin has slipped significantly since 2022, these efforts could help it become more profitable over time.

UPS Revenue (TTM) data by YCharts

Risks to consider

Although UPS is executing a plan, the near-term picture still looks cloudy.

Average daily package volume in the U.S. has trended downward this year, along with a tighter operating margin. Tariffs have also applied pressure, causing the company to withhold giving guidance about what it expects for all of 2025.

My call

With shares trading around 14 times forward earnings estimates, the stock isn't screaming cheap, but it could be undervalued if its cost reduction plan is successful. Investors looking for growth off a rebound (and a solid dividend; the stock yields over 7% right now) might find it appealing, but those who want stability may want to wait for clearer signs of a turnaround.