Investing in the stock market is one of the most effective ways for everyday people to build life-changing wealth, and you don't need a lot of money or experience to get started.

Exchange-traded funds (ETFs) are a lower-effort way to gain exposure to the market, as they require far less research and up-front investment compared to buying individual stocks. Each ETF may contain dozens or hundreds of stocks, grouped together into a single fund. Just one share of an ETF can provide instant diversification, limiting your risk with next to no effort.

If you're looking for a powerhouse investment that can build long-term wealth over time, the Vanguard Mega Cap Growth ETF (MGK -3.30%) could potentially turn a one-time investment of $1,000 into nearly half a million dollars. Here's how.

Image source: Getty Images.

A powerful investment with a track record of success

The Vanguard Mega Cap Growth ETF contains 69 stocks from companies classified as "megacap" -- which generally refers to organizations with a market capitalization of more than $200 billion. These companies are among the largest in the world, as well as industry leaders with decades-long track records of consistent growth.

Most stocks in this fund are household names, ranging from tech behemoths like Nvidia and Apple to long-standing brands like Mastercard and Costco Wholesale. Because of their sheer size, megacap stocks can sometimes carry less risk than their smaller counterparts. While all stocks are subject to volatility, the biggest players are more likely to survive economic turbulence.

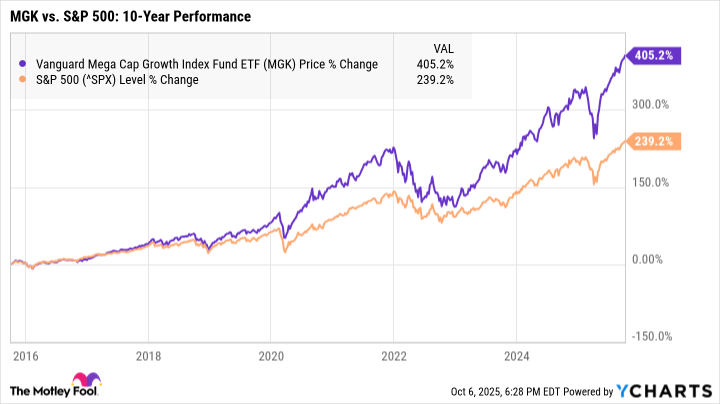

At the same time, though, this particular ETF only contains stocks with growth potential -- meaning you're more likely to see above-average returns over time. In fact, over the last 10 years, the Vanguard Mega Cap Growth ETF has significantly outperformed the S&P 500 (^GSPC -2.71%), with total returns of just over 405% compared to 239%.

Around 65% of this fund is allocated to stocks in the tech sector, an industry famous for its sky-high returns -- and short-term volatility. While megacap stocks are more likely to survive economic downturns, be prepared for more severe fluctuations when you're investing heavily in tech stocks.

Building life-changing wealth with next to no effort

Nobody can say for certain how this ETF or any investment will fare over time, as past performance doesn't predict future returns. However, it can sometimes be helpful to examine historical returns to get an idea of what this fund is capable of achieving.

Over the last 10 years, the Vanguard Mega Cap Growth ETF has earned an average rate of return of 18.87% per year. At that rate, if you were to invest $1,000 right now and simply let it sit, you'd have just over $424,000 after 35 years -- with zero additional contributions.

To really supercharge your wealth, you could invest a small amount each month. Say that instead of investing $1,000 right now, you contribute $50 every month. Here's roughly what you could accumulate, depending on whether you continue earning 18% average annual returns or earn slightly lower returns of 15% or 12% per year, on average:

| Number of Years | Total Portfolio Value: 18% Avg. Annual Return | Total Portfolio Value: 15% Avg. Annual Return | Total Portfolio Value: 12% Avg. Annual Return |

|---|---|---|---|

| 20 | $88,000 | $61,000 | $43,000 |

| 25 | $206,000 | $128,000 | $80,000 |

| 30 | $475,000 | $261,000 | $145,000 |

| 35 | $1,090,000 | $529,000 | $259,000 |

Data source: Author's calculations via investor.gov.

Even if this ETF underperforms compared to its 10-year historical average, you could still earn hundreds of thousands of dollars by investing just $50 per month. If you can afford to invest more than that, you could earn exponentially more in total.

Investing in ETFs can be a simple, straightforward way to invest in the stock market with less hassle than buying individual stocks. With enough time and consistency, you could build a staggering amount of wealth while barely lifting a finger.