Although Wall Street knew it was coming, Warren Buffett's 2025 announcement that he was going to retire was still a huge deal. Having been the chief executive officer of Berkshire Hathaway (BRK.A -1.36%) (BRK.B -1.42%) for decades, and racking up a hugely successful track record along the way, nobody wanted to see the legendary investor go. But his retirement was inevitable and his successor, Greg Abel, had already been announced.

Is the stock worth buying now that the news is out? A nearly $10 billion investment just announced by the company suggests the new CEO is going to get off on the right foot.

The big change that's taking place at the end of 2025

When a company makes a nearly $10 billion acquisition you normally expect that to be the most important news. But in the case of Berkshire Hathaway it actually isn't. Even more important is the fact that longtime CEO Buffett is set to hand over the reins to Abel at the end of 2025. This marks a huge shift for Berkshire Hathaway and for all of Wall Street.

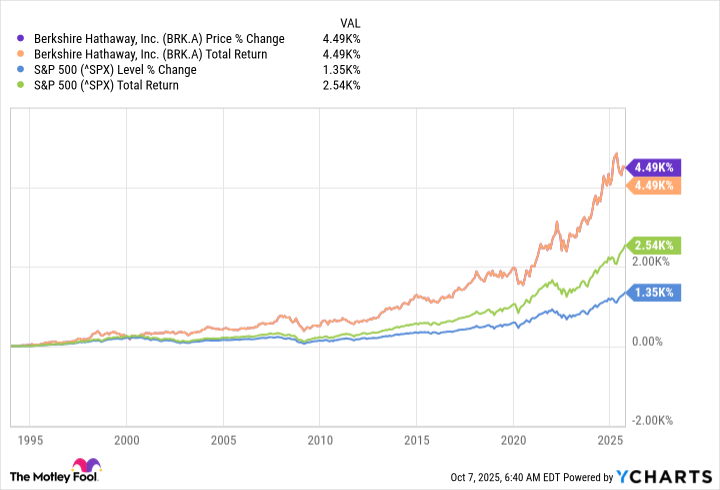

As the chart above shows, the performance of Berkshire Hathaway's stock has been nothing short of incredible under Buffett's leadership. Buffett's investment approach is widely tracked on Wall Street, noting that his success has earned him the nickname "the Oracle of Omaha." Abel has huge shoes to fill.

Abel has been working with Buffett for decades and is likely steeped in the Oracle's ways. Moreover, Buffett isn't leaving entirely, he is going to remain the chairman of the board of directors. In other words, he will still be Abel's boss and, more importantly, he's still going to be around to offer advice to the new CEO. Abel will manage the company differently from Buffett because he isn't Buffett, but the change probably won't be as big as some fear.

Image source: The Motley Fool.

Buffett is leaving Abel with a parting gift

One of the biggest issues facing Berkshire Hathaway today is the enormous cash hoard it has amassed on its balance sheet. At the end of the second quarter the sum totaled just over $344 billion. That cash actually is a drag on financial performance, and investing it would likely generate higher returns than letting it sit in a bank account (or in U.S. Treasury Bills, which is where most of it actually sits).

A key question is what will Abel do with all of that cash once he takes over? The answer has likely been provided by Buffett just months before he's set to leave. Abel will, like Buffett, attempt to find attractive investment opportunities into which he can place large sums of money. That big deal that just got inked was Berkshire Hathaway acquiring Occidental Petroleum's (OXY -5.32%) chemicals business for almost $10 billion.

Oxy, as the energy company is widely known, and Berkshire Hathaway have a long history, so this deal isn't shocking. But it says two things to investors. First, Berkshire Hathaway can still find big deals. Second, Abel will enter as CEO with a new business to help boost financial results. And, if the Oxy deal fails miserably, Abel gets to blame Buffett for the decision. In other words, it's all wins for Abel and, at the same time, the deal is an important signal to Wall Street that the cash pile will eventually be well used.

Bigger than the dollars that are getting spent

To be fair, when a company has $344 billion to spend and it only uses $10 billion, well, there's still a lot of cash to deal with. So while the $10 billion Oxy deal is material, the real impact is likely to be more on the emotional level on Wall Street. If you were fretting about what happens when Buffett retires, this is a sign that you probably don't have to worry all that much. This could even be the sign you needed to justify buying the iconic company just months ahead of the biggest change to the business in decades.