Quantum computing is starting to gain attention. It's a fast-growing market that McKinsey & Co expects to be worth $100 billion in 10 years. And one no-brainer quantum computing stock worth taking a bet on just hit new all-time highs.

IonQ (IONQ -8.53%) stock is up 75% year to date. While dozens of analysts cover each of the Magnificent Seven, only five analysts cover this leading quantum computing company. The stock's outperformance on top of IonQ's steady growth as it works to commercialize its technology makes it a compelling investment opportunity before Wall Street catches on.

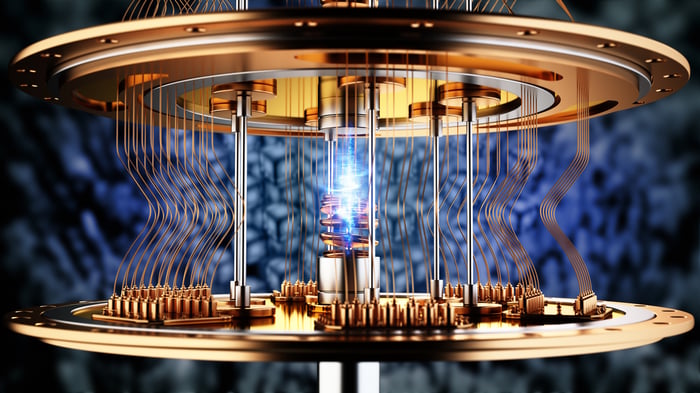

Image source: Getty Images.

Why IonQ is positioned to win

The power of quantum computing over traditional computing will lead to breakthroughs in the coming decades that are unimaginable today. IonQ has an advantage over its competitors with its trapped-ion process.

One of the drawbacks of quantum computing is that some methods of implementing the technology require near-absolute-zero temperatures for the qubits -- the units of information used in quantum computing -- to function. But IonQ's trapped-ion method can operate near room temperature, and therefore speed up the company's ability to commercialize and scale its service.

IonQ has been working on this technology for 25 years, giving it a first-mover advantage in this burgeoning industry. It sells quantum computing hardware and other support services, in addition to its quantum-as-a-service platform. It offers its hardware through leading cloud service platforms, including Amazon Web Services, Microsoft Azure, and Alphabet's Google Cloud. Its revenue surged 67% year over year on a trailing 12-month basis to $52 million.

The company's early lead in commercializing quantum computing is a major advantage that could pay huge dividends for early investors.