SoundHound AI (SOUN 4.24%) is a fairly popular artificial intelligence (AI) stock. A few of the factors contributing to its popularity are its small size and rapid growth rate. Both of these attributes often combine to produce explosive returns, which makes SoundHound AI a popular stock pick.

It has been a huge success so far, with the stock up nearly 1,000% since the AI arms race began in 2023. But what matters is where SoundHound AI is heading over the next few years, as that will determine your returns from today's levels.

So, where will SoundHound AI be in three years? Let's find out.

Image source: Getty Images.

SoundHound AI is blending audio recognition with AI

SoundHound AI combines leading audio recognition technology with artificial intelligence. This isn't a new concept, and has been around for quite a while (think about Siri or Alexa). However, SoundHound AI's product has far superior performance to these dated models, and can sometimes be indistinguishable from its human counterparts.

If SoundHound AI can blend in and take the role of one party during an interaction, it could provide substantial cost savings to its users. A few areas where SoundHound AI's technology has been deployed are restaurant drive-thrus, financial institutions, and digital assistants in vehicles. As this technology advances and becomes closer and closer to replicating a real human, I'd expect it to grow in popularity, leading to impressive returns.

NASDAQ: SOUN

Key Data Points

Even now, SoundHound AI is growing rapidly, with revenue rising 217% year over year to $43 million. However, investors can't take that figure at face value because SoundHound AI has made multiple acquisitions. This skews results, as it adds a revenue stream that wasn't a part of the company during the previous year, which affects the year-over-year comparison.

Instead, investors should be focused on organic growth, which measures how existing businesses grow year over year. Unfortunately, management didn't break out this figure for investors during the quarter, but it did give us a hint as to what the future holds. Management told investors during the conference call that the company has historically produced 50% or greater organic growth, and that growth rate is something they "anticipate for the foreseeable future."

The "foreseeable future" is a vague time measure, so we'll just assume that it is at least three years to guide us in projection, where SoundHound AI will be by 2028.

SoundHound AI is a great buy now if management's growth projection is correct

Should SoundHound AI deliver 50% organic growth between now and 2028, it would generate $570 million in revenue by the end of 2028 if we use management's $169 million full-year 2025 outlook as the starting point. That's substantial growth, but what does it mean for the stock?

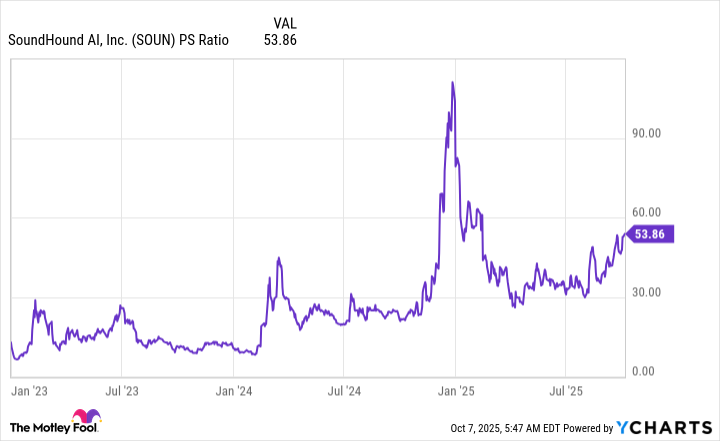

SoundHound AI currently has an expensive price-to-sales (P/S) valuation of more than 50 times sales.

SOUN PS Ratio data by YCharts

Considering that most software stocks trade between 10 and 20 times sales, this is an immediate hurdle SoundHound AI must overcome, as a lot of future growth is baked into the stock already. Should SoundHound AI generate $570 million in revenue and its market cap doesn't change from today's $7.44 billion level, that would value the stock at 13 times sales. Considering how rapidly the company is projected to grow, the odds of investors being able to buy the stock for that price are fairly slim, so it will likely be worth much more than that.

If SoundHound AI can maintain a 50% growth rate or better, I'd say 25 times sales is a fair price to pay for the stock. If SoundHound AI achieves $570 million at a 25 times sales valuation, that would price the company at $14.3 billion, or a 92% upside from today's level.

That's nearly double in three years, making SoundHound AI a smart investment if the company can deliver on management's promises. Time will tell if they're correct in their projection, but if it comes true, SoundHound AI is a no-brainer buy right now.